Existing-Home Sales Rose in December But Inventory Remains Tight

Sales of existing homes rose 3.6 percent in December to a 5.54 million seasonally adjusted annual rate. Sales are up a robust 10.8 percent from a year ago but remain essentially in a flat trend, about equal to 2017 levels. Sales are well below the all-time peak of 7.25 million in 2005 and well above the low of 3.45 million in July 2010.

Sales rose in three of the four regions tallied: they rose 5.7 percent in the Northeast, putting sales 8.8 percent above year-ago levels; sales gained 5.4 percent for the month in the South and are 12.4 percent above the December 2018 rate; and sales increased 4.6 percent in the West, putting that region’s sales rate 10.7 percent above the year-ago pace. Sales were down 1.5 percent for the month in the Midwest but are 9.2 percent above the year-ago level.

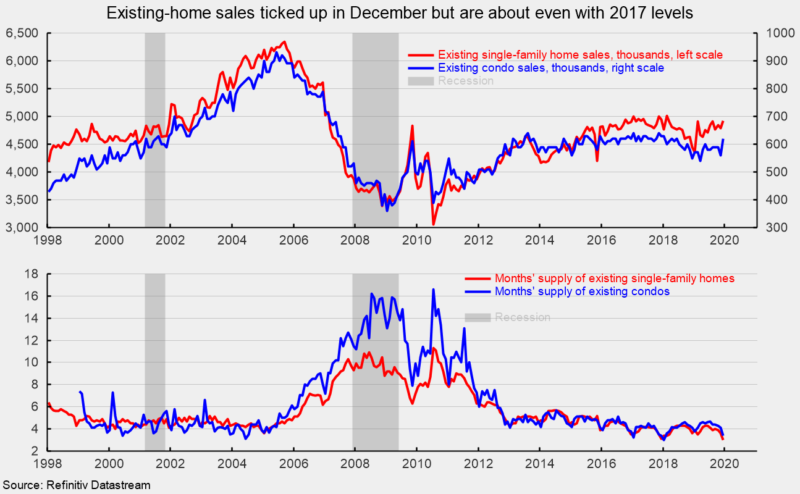

Sales in the market for existing single-family homes, which account for just under 90 percent of total existing-home sales, rose 2.7 percent in December, coming in at a 4.92 million seasonally adjusted annual rate (see top chart). From a year ago, sales are up 10.6 percent. Sales were up across three of the four regions: the Northeast saw a 5.1 percent gain, putting sales 8.8 percent above year-ago levels; sales rose 4.5 percent for the month in the South and are up 11.9 percent versus a year ago; and sales increased 4.1 percent in the West, putting sales 11.0 percent above the year-ago pace. Sales were down 2.4 percent for the month in the Midwest but are 8.9 percent above the year-ago level. Single-family sales have recovered from a dip in selling that occurred from early 2018 through early 2019 but remain about on par with the selling pace for much of 2017.

Total inventory of existing single-family homes for sale declined 15.9 percent to 1.22 million in December, the smallest inventory available in 40 years. That puts the months’ supply (inventory times 12 divided by the annual selling rate) at 3.0 versus 3.6 in the prior month. The drop in months’ supply has brought the figure back to ultra-low levels of late 2017 and the range that prevailed during the early 2000s (see bottom chart).

The lack of available inventory may be weighing on housing activity. Furthermore, elevated prices partially offset low mortgage rates, suggesting sales are unlikely to move significantly higher in the coming months, and new-home construction is unlikely to contribute significantly and persistently to growth in gross domestic product in coming quarters. Still, the economy overall continues to grow, albeit slowly, supported by a tight labor market, rising incomes, and strong consumer balance sheets. The main risks on the horizon are increased uncertainty from erratic trade policies, ongoing trade wars, political events including impeachment and upcoming elections, and ballooning federal deficits. Extreme uncertainty can impact business and consumer confidence, and could begin to restrain economic growth.