Consumers Restrain Spending in September

Retail sales and food services spending fell 0.3 percent in September following a 0.6 percent gain in August. Over the past year, total retail sales and food services were up 4.1 percent through September. For the third quarter, total retail sales were up at 1.5 from the second quarter and 4.0 percent from the third quarter of 2018.

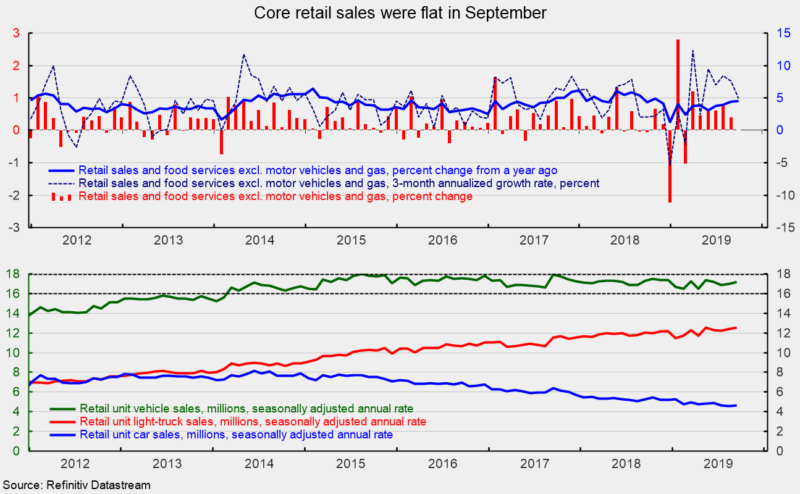

Excluding the volatile auto and energy categories, core retail sales and food services were unchanged in September after a gain of 0.4 percent in August. Core retail sales had posted six straight monthly gains through August, helping drive a year-over-year gain of 4.5 percent. For the third quarter, core retail sales rose 1.7 percent versus the second quarter and were up 4.3 percent from 2018 (see top chart).

Details of the September retail sales report were mixed with declines in seven retail-spending categories, while five categories posted gains and one was essentially unchanged. Declines were led by a 1.0 percent drop in building-material, garden-equipment, and garden-supplies dealers and a 0.9 percent drop in motor vehicles. Despite the drop in the dollar measure of motor vehicle and parts sales, unit-auto sales rose to 17.2 million at an annual rate in September versus 17.0 in August (see bottom chart). The gain in unit sales was driven by increases in both light-truck sales (12.54 million in September versus 12.42 million in August) and car sales (4.65 million versus 4.59 million). However, over the past six and a half years, car sales have sharply trailed light truck sales. For September, light trucks accounted for 73 percent of vehicle sales, a record high, while cars were just 27 percent.

Gasoline station sales fell 0.7 percent. The drop in gas station sales station sales reflects a 0.8 percent drop in average retail prices of gasoline.

Posting gains were clothing and accessories stores, up 1.3 percent for the month, furniture stores, up 0.6 percent, and health and personal care stores, also up 0.6 percent. Over the past year, those categories have gains of 1.5 percent, 1.1 percent, and 2.9 percent, respectively.

Surprisingly, nonstore retailers, predominantly on line shopping, had a 0.3 percent decline for the month. This category has been growing very robustly for years, posting a gain of 12.9 percent over the last 12 months. It’s highly likely this category will continue to post strong gains in the future.

The weak data for September adds to the uncertainty about future economic growth. Turmoil in policy, including trade policy and monetary policy, is starting to impact business and consumer confidence. If the softening in confidence translates into significant restraint in hiring, business investment and consumer spending, the probability of recession increases dramatically. For now, economic expansion is the most likely path, but caution is warranted.