Delinquency Rates Rise For Student Loans, Credit Cards, and Auto Loans

A new report on debt and credit shows that in the first quarter of 2017, household debt just surpassed the previous peak of $12.7 trillion, seen during the Great Recession. Rising debt levels may become a problem.

From the first quarter of 2009 to mid-2013, consumers paid down debt. Since mid-2013, households have taken on more debt. The composition of household debt has changed since the recession. During the housing bubble, mortgage debt made up the largest share of household debt. In 2006 and 2007, mortgage debt was over 73 percent of household debt. Today, mortgages make up 67 percent of household debt.

As the share of mortgage debt has declined, the shares of auto loans and student loans have been rising. Since the early 2000s, auto loans have averaged 7.4 percent of consumer debt. Today, they average 9.2 percent. In 2003, student loans made up a little more than 3 percent of debt. In the first quarter of this year, student loans made up over 10 percent.

AIER recently published an in-depth analysis of private debt. Private debt tends to become a problem after an economic shock such as a recession. Private debt could also become a problem if delinquency rates unexpectedly rise. If delinquency rates rise and creditors mispriced default risk, financial conditions might worsen.

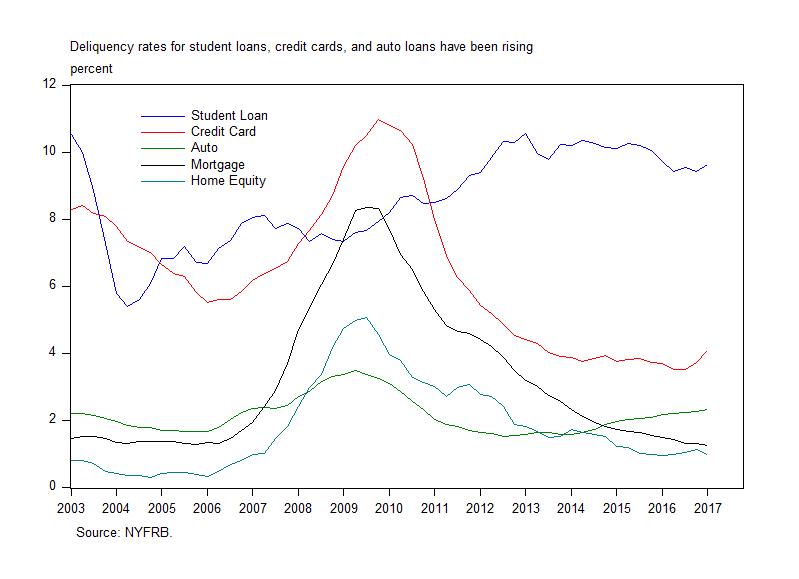

This quarter saw a notable uptick in credit card debt transitioning into delinquencies and in auto loans transitioning into serious delinquencies, while student loan transitions into serious delinquencies remained high.

At the end of 2016, the 30-day delinquency rate on credit cards was 5.1 percent. In the first quarter of this year, the delinquency rate rose to 5.9 percent. The severely delinquent rate (90+ days) on credit cards increased from 3.5 percent to 4.1 percent.

At the beginning of 2017, the delinquency rate on student loans was nearly 10 percent. Prior to the Great Recession, the percentage of borrowers who were behind on their student loan payments was closer to 7 percent. The true delinquency rate for student loans is likely higher because many student loans are in grace periods.

Some consumers are also having trouble with their auto loans. The current delinquency rate for auto loans is 2.3 percent, elevated compared with recent years. Relatively lower auto-lending standards have contributed to borrowers falling behind.

If delinquencies continue to rise, household access to credit will tighten. On the investor side, creditors might take losses if they did not properly price default risk.