Housing Outlook Remains Cautious

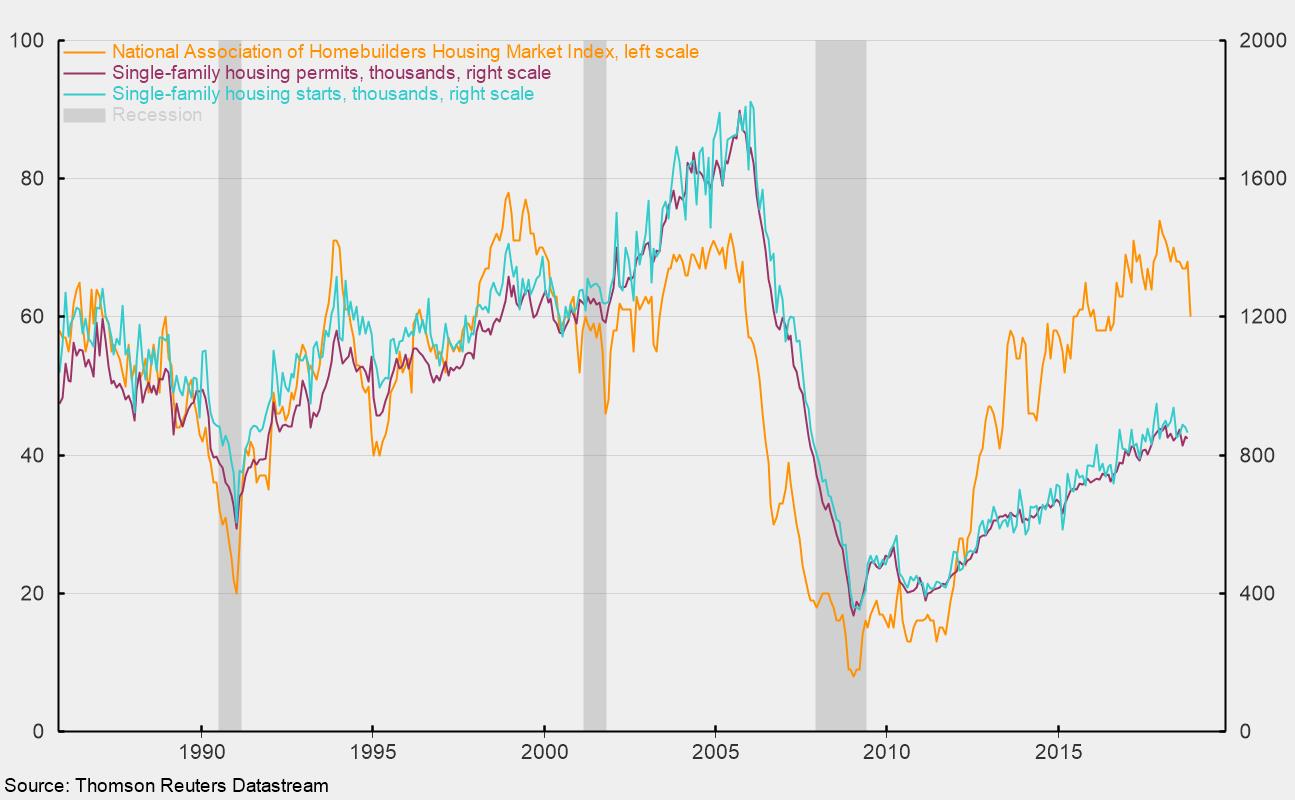

Housing activity remained weak in October as single-family housing starts fell by 1.8 percent and permits fell by 0.6 percent. Single-family housing construction and permits are weakening after rebounding from the housing boom-bust cycle in the early to mid-2000s (see chart). The combination of rising interest rates and falling affordability is likely to provide resistance to a prolonged reacceleration in activity.

Total housing starts rose 1.5 percent in October to a 1.228 million annual rate. The dominant single-family segment, which accounts for about three-fourths of new home construction, fell 1.8 percent for the month to a rate of 865,000 units. Starts of multifamily structures with five or more units jumped 6.2 percent to 343,000.

Among the four regions in the report, total starts fell in two regions, the West (−4.6 percent) and the Northeast (−34.1 percent), but rose in the Midwest (32.9 percent) and the South (4.7 percent). For the single-family segment, starts fell in three regions, the West (−2.0 percent), the South (−4.0 percent), and the Midwest (−1.6 percent), but rose in the Northeast (14.8 percent).

For housing permits, total permits fell 0.6 percent to 1.263 million from 1.270 million in September and are off 6.0 percent from October 2017. Single-family permits also fell 0.6 percent, to 849,000, while permits for two- to four-family units were down 5.0 percent, and permits for five or more units were unchanged at 376,000. From a year ago, single-family permits are down 0.6 percent while two- to four-family units are up 8.6 percent and permits for five or more units are off 17.2 percent.

Along with the weakness in housing permits, home builder sentiment from the National Association of Home Builders plunged in the latest survey. The index came in at 60 in November, down from 68 in October (see chart). That is down from a recent peak of 74 in December. Among the three components of the overall index, the current single-family sales index fell 7 points to 67 while the expected-sales component lost 10 points, to a reading of 65. Both indexes had been as high as 80 over the past year. The traffic-of-prospective-buyers component came in at 45 in November, down from 53 in the prior month and well below the 58 reading in December.

Housing permits is one of the AIER leading indicators. The permits indicator remained in a downtrend in October after turning neutral in June and downward in August. As discussed over the last few months, the housing market appears to be struggling with a combination of elevated home prices and rising interest rates. While affordability overall remains favorable, it has become significantly less favorable over the past few years. With interest rates likely to drift even higher over coming months and quarters, the outlook for housing remains cautious.