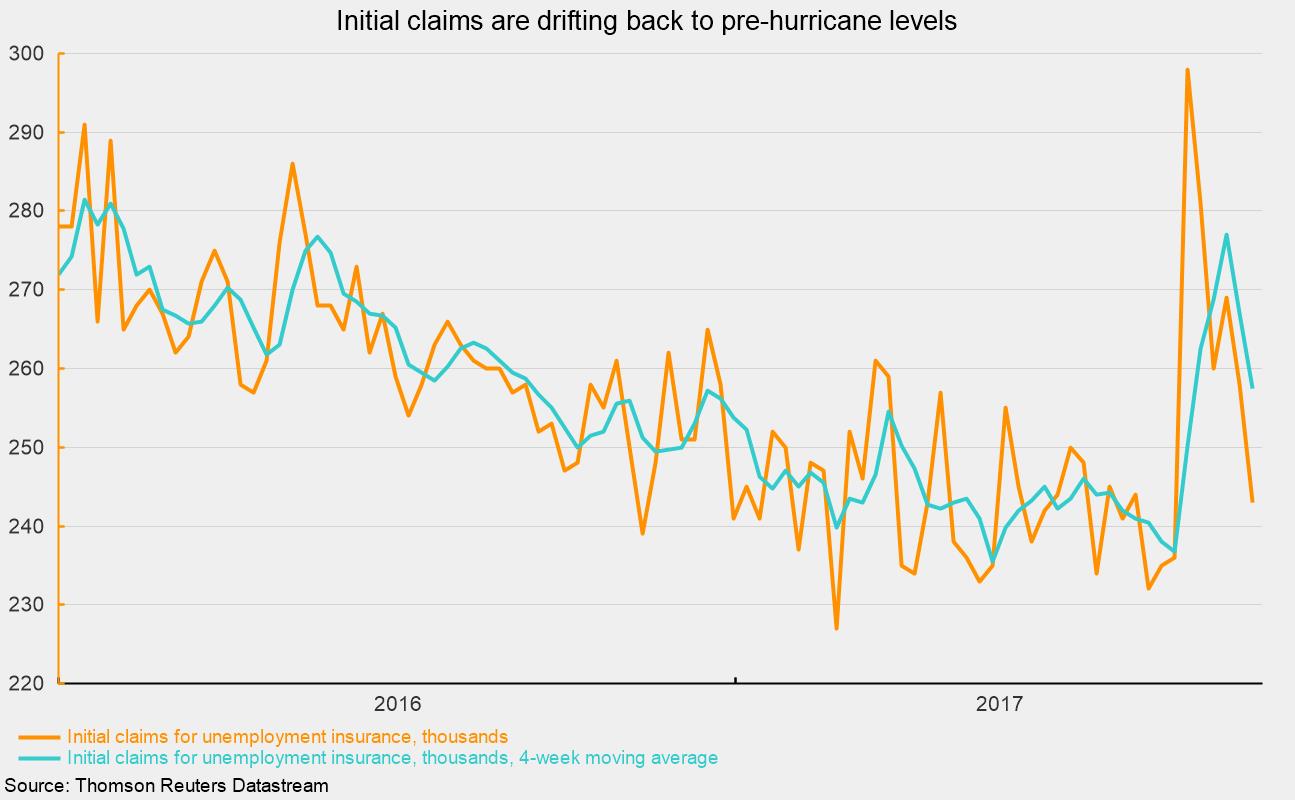

Initial Claims Drift Back Down Toward Pre-Hurricane Levels While Producer Prices Rise in September

Initial claims for unemployment insurance fell 15,000 to 243,000 for the week ending October 7. The four-week average fell 9,500 to 257,500. The Department of Labor reported that the data continue to be affected by Hurricanes Harvey, Irma, and Maria. Before the storms, claims had been averaging around 230,000 to 240,000 per week, or about 0.16 percent of payroll employment. For the week ending September 2, claims surged to 298,000, but since then they have been steadily drifting lower. Given the many positive signs for the labor market, it seems likely that claims will continue to drift back to their pre-storm levels, assuming no additional distortions due to natural disaster.

The producer price index from the Bureau of Labor Statistics rose 0.4 percent for September, the fourth increase in the last five months and the ninth rise since August 2016. Since hitting a low last August, , the PPI rose from 0.0 percent to 2.6 percent.

The PPI for final demand for energy has been one significant source of price pressure, posting a 12-month change of 10.6 percent. Excluding energy, the PPI for final demand is up 2.1 percent over the past year.

For consumer demand, the overall PPI rose 0.4 percent in September and is up 2.3 percent from a year ago. The PPI equivalent for core consumer prices (the PPI for personal consumption excluding food and energy) rose just 0.1 percent in September and is up a mild 1.7 percent from a year ago.

On the business side, the PPI for private capital equipment was flat in September and up 1.0 percent over the last 12 months while the PPI for private capital construction rose 0.1 percent in September and rose 3.4 percent over the prior year.

Overall, producer prices are rising a bit more briskly over the past several months though the year-over-year gains are still moderate by historical comparison. Producer prices tend to be more volatile than consumer prices, and some of the most recent increases may be results of distortions related to natural disasters. However, close monitoring is warranted given the dangers of accelerating prices.