Labor-Market Strength Continues

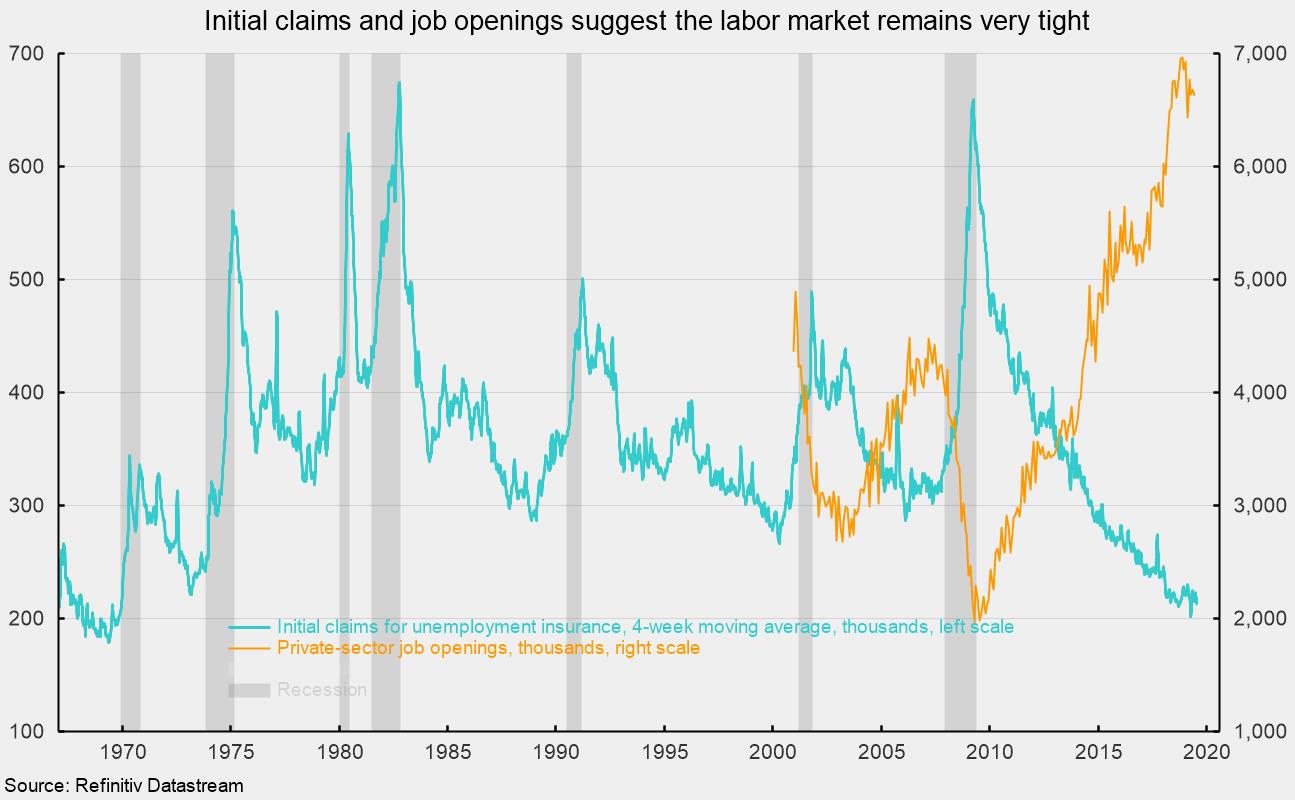

Initial claims for unemployment insurance fell to 209,000 for the week ended August 3, a drop of 8,000 from the prior week. The four-week average, used to smooth out volatility, is 212,250, up slightly from 212,000 (see chart). Claims have been below 300,000, a level typically associated with a strong economy and tight labor market, since 2014, and are holding around levels not seen since the late 1960s.

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the number of open positions in the economy was down slightly in June to 7.348 million, just below the record-high 7.626 million in November 2018. Private job openings in the United States totaled 6.629 million in June versus 6.68 million in May and just below the record 6.962 million in November (see chart).

The industries with the largest number of openings were professional and business services (1.329 million), health care (1.217 million), leisure and hospitality (934,000), and retail (888,000).

The job-openings rate, openings divided by the sum of jobs and openings, fell to 4.6 percent from 4.7 percent while the openings rate for the private sector held steady at 4.9 percent. The private sector rate is just 0.3 percentage points below the all-time high of 5.2 percent reached in October and November 2018. The highest openings rates were in professional and business services (5.8 percent), health care (5.6 percent), retail (5.3 percent), and leisure and hospitality (5.3 percent).

A further sign of labor-market strength may be seen in the number of quits, which likely reflects confidence in the labor market. Quits totaled 3.251 million for the private sector in June versus 3.277 million in May. The number of quits has been above 3.2 million for five consecutive months, a very strong performance. The private sector quits rate held at 2.5 percent in June, just below the cycle high of 2.6 percent but 0.3 percentage points below the all-time peak of 2.8 percent in January 2001.

The layoffs rate, another key indicator for the labor market, fell to 1.2 percent for private employers, just above the all-time low and consistent with the historically low initial claims as a percentage of employment. Combined, the high number of openings, the high openings rate, the high quits rate, and the low layoffs rate all suggest the labor market remains very tight.

Overall, the data relating to the labor market show renewed strength. A strong labor market should support personal incomes and consumer confidence, which should support future consumer spending.