Macroeconomic Highlights of 2018: A Retrospective

In 2018, all major institutions that provided the basis for the international order since the second half of the past century have come under fire, from NATO and the United Nations, to the role of the World Bank and the International Monetary Fund, to the World Trade Organization and the European Union. China flexes its muscles and challenges the role of the United States while the US president promotes protectionism and isolationism. A national economy exists within the framework of the nation’s politics, and a nation operates within the framework of its international relations and its strategic global position. When the international framework is changing, the national macroeconomic situation remains not untouched.

First Quarter

U.S. Government Shutdown

On January 20, 2018, at the first anniversary of the inauguration of Donald Trump, the U.S. government had to confront a partial shutdown because Congress did not lift the debt ceiling. The dispute between the Democrats and the president’s Republican party concerned immigration policy and the status of the children of illegal immigrants. For both parties, these disputes have remained high-stakes issues throughout the year along with the conflict about building a wall between the United States and Mexico to stop immigration.

Stock Market Boom

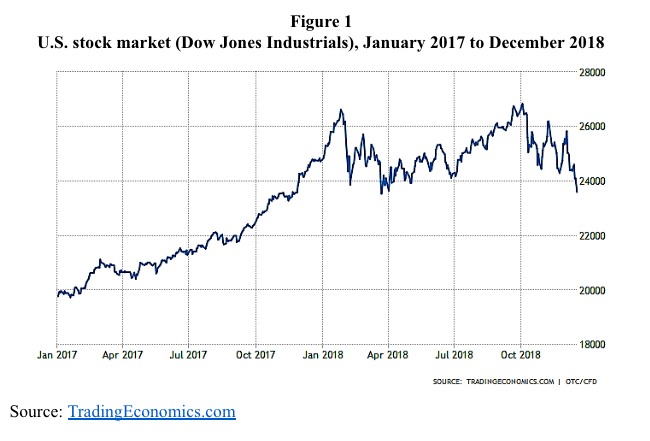

The U.S. stock market boomed after the presidential election in November 2016 and particularly after the inauguration of Trump in January 2017. In the first quarter of 2018, the U.S. stock market grew to over $30 trillion. After the strong increases from 2017 until January 2018, there was a sideward movement. Since October 2018, stocks have been falling, a slide that accelerated in December (figure 1).

Europeans Face Brexit

The imminent exit of the United Kingdom from the European Union throws a dark shadow on the future of the EU. As it becomes clear that Brexit cannot be stopped, businesses have strategically reoriented as the United Kingdom will no longer enjoy the trade privileges that come with EU membership when it leaves the European Union. Most observers expect a costly divorce.

Second Quarter

The U.S Starts a Trade War

On March 1, the US government fired the starting gun on a series of protectionist measures. As soon as he announced a plan to slap an import tariff of 10 percent on imported aluminum and of 25 percent on imported steel, America’s major trading partners, including the European Union, declared that they would not accept such a policy and were ready to retaliate. Trump, in return, threatened to widen his protectionist policy and expand his tariffs to the import of automobiles.

President Trump blamed “unfair” trade practices. The day after his announcement to impose the initial tariffs, he tweeted:

Our Steel and Aluminum industries (and many others) have been decimated by decades of unfair trade and bad policy with countries from around the world. We must not let our country, companies and workers be taken advantage of any longer. We want free, fair and SMART TRADE!

Protectionism would mean the end of a policy that has been in place among the industrialized countries and for a large part of the developing world since the end of World War II. The spread of protectionism would not only be a shift but a major change.

U.S. Trade Deficits

The United States has had trade deficits since the early 1980s. In the broader category of the current account, the balance has been in the negative since 1982. In 2006, the current-account deficit reached 6 percent of GDP; it fell to 2.6 percent in the second quarter of 2018. Current-account deficits require corresponding capital imports. In this way, the overall foreign debt of the United States has risen to around $8 trillion.

Institutional Change

Changing institutions is a common feature of human history. The problem is that sometimes, the old institutional framework crumbles before a new system has come into place. Along with that comes the problem that while the leading power is waning, the next one has not yet attained taken hold. While the president announced the retreat of his country from major global institutions, few countries would accept a Chinese global leadership.

There was a time when expectations were high that the European Union could work in tandem with the United States to provide an almost-perfect mixture of hard and soft power to reach global economic and financial dominance. With the retreat of the United Kingdom from the European Union, this option is off the table.

The United Nations, the International Monetary Fund, and the World Bank along with the World Trade Organization could not live up to their expectations. Now, even their financing is in doubt. When the United States challenges the authority of the WTO, other countries will follow suit.

Third Quarter

Free Trade Under Attack

The decision of the American government to impose tariffs on goods not only from China but also from Canada, Mexico, and the European Union has caused an uproar and led America’s closest allies to plan retaliation. In the third quarter of 2018, the world entered a trade war reminiscent of when the United States imposed the Smoot-Hawley tariffs on thousands of goods.

Around the world, consternation grows about the U.S. trade policy. Analysts try to make sense of the paradox that the U.S. economy has the highest degree of international competitiveness but resorts to protectionism, a policy that is usually reserved for countries that are economically weak and internationally uncompetitive.

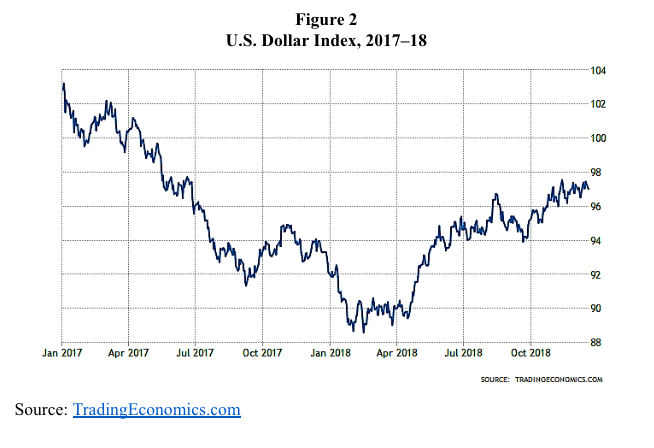

New Strength of the Dollar

The U.S. Dollar Index fell from 103 in January 2017 to 89 by the end of that year. Beginning in June 2018, the dollar made a strong comeback. Over the year, the American currency strengthened from below 90 to 97 in December 2018 (figure 2).

The Dollar’s Double-Edged Privilege

Why does the United States have trade deficits when its economy is one of the most competitive economies of the world? The answer is that, measured in purchasing power parity, the dollar is overvalued against almost any other currency. This overvaluation is the immediate result of the use of the dollar as a global means of payment and consequently as an international reserve currency.

The monetary equivalent of the resource curse that harms many of the commodity-exporting countries is the dollar curse. On the one hand, the United States suffers from persistently high trade deficits, while, on the other hand, it need not worry about its ability to make international payments because its foreign debt is denominated in dollars.

Fourth Quarter

Interest Rates

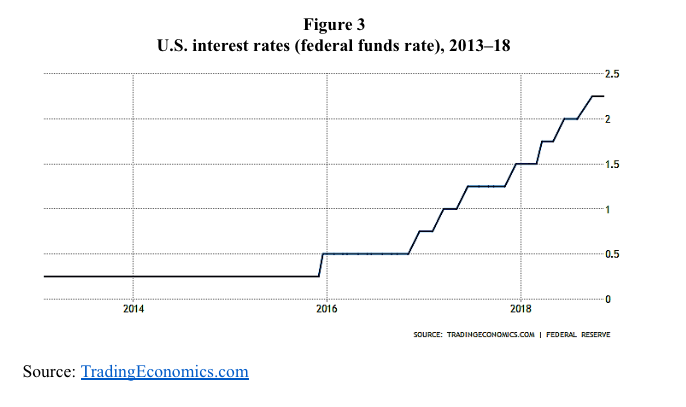

With the Federal Reserve System having raised its key interest rate from 0.5 percent in 2016 to 2.25 percent in 2018 (figure 3), the president has expressed his concern about further increases. Given that the real interest rate is still below the historical norm, more severe conflicts between the presidency and the American central bank loom on the horizon. A clash will become even more likely when the stock market keeps falling.

Government Shutdown

The year 2018 may end as it began with the threat of a government shutdown. As President Trump and Congress clash about the $5 billion bill to build a border wall with Mexico, government agencies are preparing for a partial government shutdown in December. So-called essential services would be maintained, while about 20 percent of regular government spending would lack funding.

Conclusion

In 2018, the post–World War II world order has come under attack — not by foreign enemies, but from within. At the forefront of the attack are those countries that were most instrumental in establishing this order, the United States and the United Kingdom. With its vote for leaving the European Union, the United Kingdom abandoned its support for one of the main institutions that came into existence after World War II. Global uncertainties are on the rise and undermine the prospects for solid economic growth. The global economy may contract before it fully recovers from the last recession.