MMT Is a Recipe for Revolution

Historian Stephen Mihm recently argued that based on his reading of the monetary system of colonial Massachusetts, modern monetary theory (MMT), which he cheekily referred to as PMT (Puritan monetary theory), “worked — up to a point.”

One can forgive him for misunderstanding America’s colonial monetary system, which was so much more complex than our current arrangements that scholars are still fighting over some basic details.

Clearly, though, America’s colonial monetary experience exposes the fallacy at the heart of MMT (which might be better called postmodern monetary theory): the best monetary policy for the government is not necessarily the best monetary policy for the economy. As Samuel Sewall noted in his diary, “I was at the making of the first Bills of Credit in the year 1690: they were not Made for want of Money, but for want of Money in the Treasury.”

While true that colonial governments controlled the money supply by directly issuing (or lending) and then retiring pieces of paper, their macroeconomic track record was abysmal, except when they carefully obeyed the market signals created by sterling exchange rates and the price of gold and silver in terms of paper money.

MMT in the colonial period often led to periods of ruinous inflation and, less well-understood, revolution-inducing deflation.

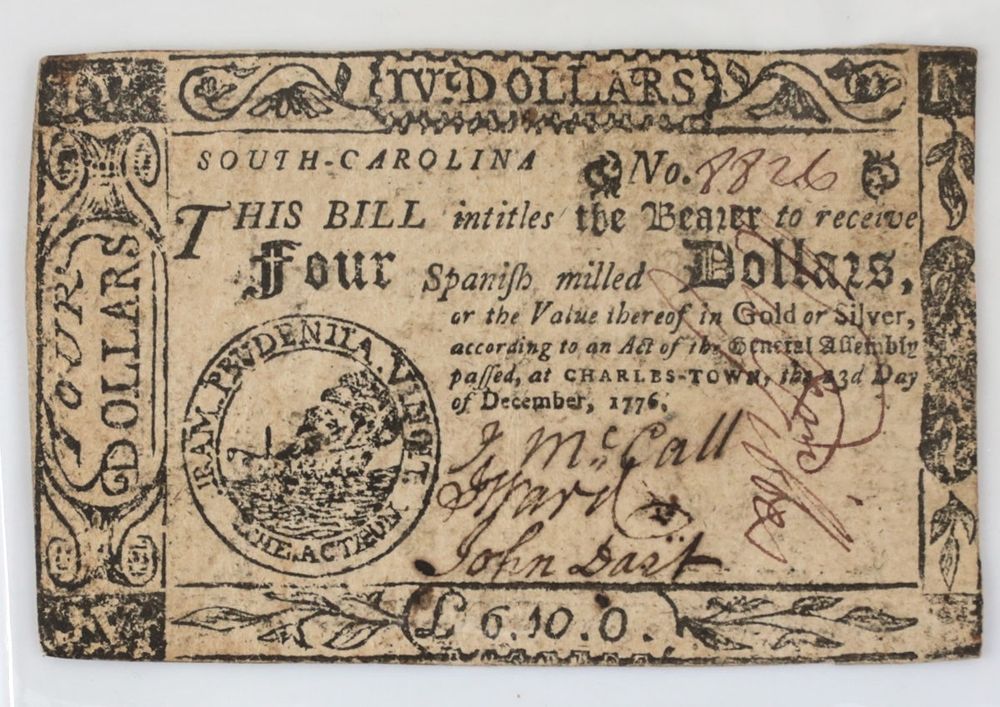

South Carolina and New England were the poster colonies for inflation, in part because they bore the brunt of colonial wars against their rival Spanish and French empires. Relative peace and following market signals eventually stabilized prices in South Carolina.

In New England, however, Rhode Island for decades was able to act as a “money pump” that forced inflation on other New England colonies until they abandoned MMT entirely in the early 1750s.

In New York, New Jersey, and Pennsylvania, by contrast, legislatures followed market signals and were never pressed as hard militarily as the buffers to their north and south were. They therefore did not inflate away the value of their paper moneys by issuing too much.

After the French and Indian War, however, the Middle Colonies suffered from a large deflation rooted in wartime excesses, structural economic changes, and new imperial regulations. Real estate prices plummeted and debtors’ prisons overflowed. The direct result was colonial unrest over the Stamp Act, which quickly escalated into a pamphlet war, a trade war, and then a shooting war.

About the only time the colonial monetary system functioned effectively was when paper money circulated in tandem with full-bodied gold or silver coins (specie). When the government found itself in dire straits, as it did during the American Revolution, the value of paper money vis-a-vis specie slipped.

This was the market’s way of signaling that too much paper money was in circulation at the current price level and that further emissions would spark inflation. This is precisely what happened. Yes, America eventually won the war, but only after returning to a monetary system anchored by the precious metals.

While the prospect of returning to a more solid monetary anchor after the inevitable failure of MMT may intrigue some, the socioeconomic costs of hyperinflation would be enormous. With everyone’s savings destroyed, as in Germany in the 1920s and Venezuela today, the end result is impossible to predict, but undoubtedly thornier than rosier.