Revenge of the Zombies, Part 2

I recently defended the natural-rate hypothesis from a resurgence of interest in the Phillips curve. Critics of the natural-rate hypothesis, I argue, have gotten the causation among monetary policy, inflation, and unemployment entirely wrong. Unexpectedly high inflation can temporarily lower unemployment until workers update their inflation expectations by reducing their real wages, but low unemployment doesn’t causeinflation. Rather, overly expansionary monetary policy causes total spending to rise. This in turn causes the labor market to overheat as firms seek to hire workers to accommodate the higher demand for their products. It is this monetary-induced outward shift in the economy’s aggregate-demand curve that ultimately causes prices to rise, not the tightness in the labor market that results from it. As Friedman put it, “Inflation is always and everywhere a monetary phenomenon.”

The preceding analysis is consistent with many of the leading works in the monetary disequilibrium tradition, which I’ve discussed in greater detail. But even if we assume for a moment that the direction of causation can be drawn from labor markets to prices, there’s a much simpler and more plausible explanation for why the historically low unemployment rate isn’t pushing inflation higher or causing the economy to overheat: our historically low labor force participation rate.

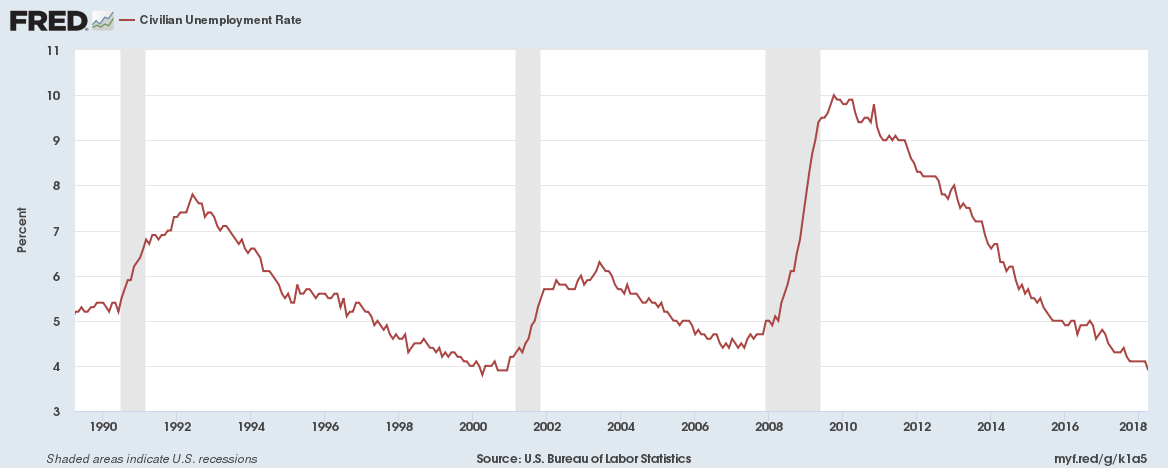

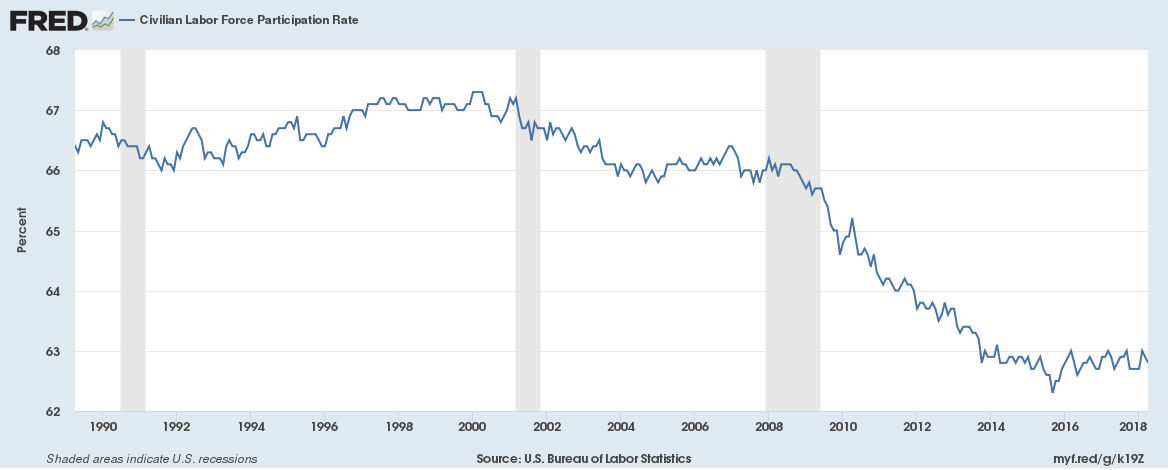

In introductory macro, we teach students that the unemployment rate is calculated as the ratio of unemployed workers (workers actively seeking a job but unable to find one) to the total labor force (the total of employed and unemployed workers in the economy, excluding retirees and individuals not actively searching for jobs). During the Great Recession, the labor force participation rate fell from about 66 percent to 62 percent. It has remained around 62 percent ever since. It’s not surprising that the number of job seekers fell in the depths of the greatest downturn since the Great Depression. What is surprising, perhaps even disturbing, is that it has remained at this low level throughout the entire decade, even as the unemployment rate has dipped below its historical trend.

Employment has accelerated over the past few years. However, this job growth comes on the heels of one of the weakest labor-market recoveries from a recession in U.S. history. The labor-market recovery was so weak that many economists argue that millions of workers, frustrated by their inability to find a job, decided to leave the labor market altogether.

What does the low labor force participation rate tell us about the current state of the labor market? Measured unemployment might be low today, but two things are entirely consistent with the natural-rate hypothesis: (1) the measure has only fallen below the 5 percent threshold over the past 18 months, and (2) a major reason why it has fallen so low is precisely because labor markets have been unusuallyweakover the past decade, not because they are unusually strong. In other words, measured unemployment today is not low simply because the numerator (the number of unemployed workers) is shrinking rapidly as more jobs are filled. It is low, in large part, because of low labor force participation.

It’s worth pointing out that the more recent surge in hiring that has finally pushed unemployment below the 4–5 percent threshold economists often associate with the natural rate of unemployment has coincided with a rise in inflation projections: inflation is projected to exceed the Fed’s 2 percent benchmark in the coming years according to the University Michigan survey of consumer inflation expectations and the Fed’s own forecasts. That said, none of these forecasts anticipate that inflation will spiral out of control or even break the 3 percent threshold.

Nor does the natural-rate hypothesis imply that it should. The unemployment rate is one measure of the strength of the labor market. But it is by no means the onlymeasure. It alone doesn’t tell us whether the labor market, and the economy in general, is overheated.

As I noted in my last post, a better indicator of whether the labor market is overheated is the level of total nominal spending in the economy, or nominal GDP. According to that metric, the economy doesn’t appear to be overheating, at least not yet. Nevertheless, it is still fruitful to use the flawed Phillips-curve framework as Devil’s advocates to show that the evidence is weak that unemployment is below its natural rate and that, accordingly, we should discard the natural-rate hypothesis.

This doesn’t mean the economy is necessarily on a healthy and sustainable trajectory or that the Fed’s unorthodox policies over the past decade haven’t systematically distorted asset prices and fueled malinvestments that might eventually rear their ugly heads. But it does cast some doubt on the claim that today’s rare combination of low inflation and unemployment somehow discredits five decades’ worth of evidence against the Phillips curve and in favor of the natural-rate hypothesis. Our low labor force participation rate might be unnatural. But the natural-rate hypothesis is still alive and as strong as ever.