The Big Fib about the Rich and Taxes

Last week, several prominent journalism outlets publicized a bombastic claim about tax policy in the United States. According to analysis by Berkeley economists Gabriel Zucman and Emmanuel Saez, the bottom 50 percent of earners in the United States now pay a higher overall tax rate than multimillionaires. The New York Times and Washington Post trumpeted this claim as if it was settled fact, even though the study it was based upon has yet to go through scholarly peer review.

Yet as we also saw, Saez and Zucman’s numbers immediately came under intense scrutiny — including from high quarters in the economics profession. Their overall depicted trend in tax rates conflicted with better-established estimates from the Congressional Budget Office (for federal rates) and the Institute on Taxation and Policy (for state and local rates) — which, when combined, reveal an unambiguously progressive distribution of the tax burden.

Saez and Zucman’s supporters nonetheless insisted that their alternative estimates would be vindicated with the release of their new book, The Triumph of Injustice. After an unconventional rollout that included providing selected journalists with privileged access to unvetted stats, the Saez-Zucman data files are finally available. Far from demonstrating the superiority of their new estimates, the statistical release has only cast further doubt upon their methods.

The Scholarship of Adjusting Data

To see how, we must first examine Saez and Zucman’s own earlier published work with their frequent collaborator Thomas Piketty. Last year, the trio published a paper in the top-ranked Quarterly Journal of Economics (hereafter referred to as PSZ-2018) attempting to estimate not only the top 1 percent’s tax rate but an even smaller group of ultra-wealthy. If one accepts the validity of their methods, they present rates for a much finer-grained slice at the top 0.001 percent.

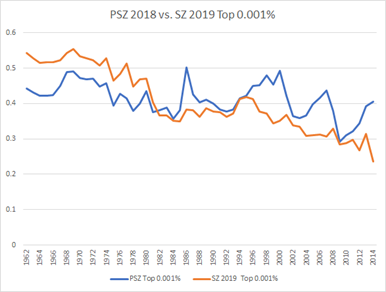

Saez and Zucman’s new book is reportedly based on the PSZ-2018 paper, yet as their data release this week revealed, they have substantially altered their calculations and the assumptions behind them. The chart below depicts the estimated average tax rate (federal, state, and local) for the top 0.001 percent in the two publications, stopping at 2014 (the latest year of direct comparison in both series). The blue line is the published and peer-reviewed estimate from PSZ-2018. The red line shows the new numbers from their book. Remember when comparing each that two of the three authors overlap between the different results, and PSZ-2018 figures were only one year old before what appears to be a drastic revision in the trend.

As can be seen, the entire trend line pivots in a downward direction. The new series also flattens what appear to be yearly fluctuations in top tax rates that — expectedly — occur amid business cycle events, such as the 2007–8 recession or that coincide with major tax code changes, such as the Tax Reform Act of 1986.

Outside of these fluctuations, it would have been difficult to maintain that the tax burden on the ultra-wealthy was declining under the PSZ-2018 series. Indeed, the top tax rate only changed from 44 percent in 1962 to 41 percent in 2014. The new Saez-Zucman numbers, by contrast, show a massive drop from 54 percent to 34 percent in the same years.

Economists often revise their calculations after publication to improve accuracy and incorporate better data, and Saez and Zucman claim to be doing as much here. But as the comparison shows, these are no small tweaks — they’ve actually transformed a tiny 3-percentage-point rate change into a massive 20-percentage-point drop, while suggesting through imputed figures to 2018 that the drop continued even further.

Seeing as the new numbers contain such a drastic change, the normal scholarly process for presenting and vetting them should have entailed an addendum submitted to the same journal where they would be subjected to similar scrutiny. Instead, Saez and Zucman opted to bypass peer review and released their revisions to the New York Times as part of a book-publicity campaign.

The accompanying data release, though a week late, does include an attempt to justify the changes to the series. Some of the adjustments are more transparent than others, and the reasoning behind a few of the changes is not readily apparent even with the new documentation. Zucman to his credit has acknowledged the sharp break from the existing literature, as well as the Congressional Budget Office’s standard practices, by indicating that he “hope[s] to convince the world” of his new approach. It is nonetheless extremely unconventional to propose a major revision to existing scholarly practices by eschewing peer review, and pitching it instead to a group of friendly journalists. It is even more irresponsible for those journalists to engage in credulous repetition of the new results as if they were established facts, when they remain well outside of empirical conventions and yield a clear outlier result when compared to other studies.

We may nonetheless disentangle the new Saez-Zucman adjustments to examine how and where they break from the existing literature. Columbia University’s Wojtek Kopczuk, editor of a top economics journal, posted a helpful thread that deconstructs what appears to be happening, and is able to account for most of the changes between PSZ-2018 and the new Saez-Zucman book.

The new data release has prompted a vibrant debate among economists, with much of it taking place on Twitter. Yet that debate has also revealed that the new Saez-Zucman adjustments are dependent upon some extremely heterodox and unconventional assumptions for handling tax data.

Curiously, the edits to the newly released data skew in a non-random direction. Almost all of Saez and Zucman’s new adjustments appear to work in favor of their political narrative, which claims that tax burdens on the ultra-wealthy have dramatically fallen over time.

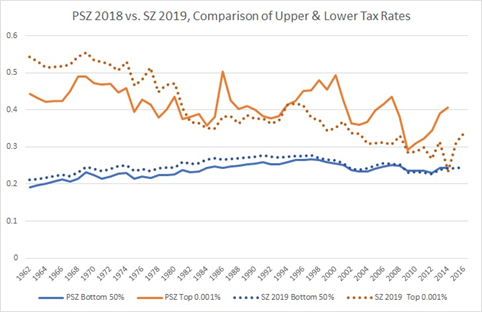

The cumulative changes to the upper and lower average tax rates are shown side-by-side in the chart below, with the dashed lines representing the new numbers.

So what changed?

First, Saez and Zucman drastically altered their assumptions about the incidence of corporate taxes. While these taxes are paid by corporations and thus, ultimately, the shareholders, the actual incidence of corporate taxation is much more complicated. Some of it falls on the shareholders, but part is also passed through to other forms of capital, including disbursement in the noncorporate sector as a result of the effects of changing the rate of corporate taxation (Kopczuk discusses this literature here). As a result, most economic treatments of corporate tax rates build basic assumptions into their models that distribute the associated tax incidence. In fact, PSZ-2018 followed this standard practice.

The new Saez-Zucman numbers, by contrast, jettison this basic statistical convention. Instead, their “revised treatment allocates all the corporate tax” directly to corporate shareholders alone. This new development entails an extremely heterodox assumption that blurs the lines between statutory tax payment and tax incidence. Further, these assumptions are unlikely to pass muster at a scholarly economics journal let alone a top-ranked one.

They do, however, achieve the effect of pivoting the depicted tax-rate trend line to a clear downward slope. This is mostly achieved by adding about 15 percentage points to the corporate tax rate in 1962 while slightly reducing it in 2014 from their previously published numbers.

There are also several smaller adjustments that further accentuate the downward pivot of the new series. They slightly tweak the numbers for sales, personal-income, and estate taxes (which would be more consistent with a data update, as opposed to dramatically changing their assumptions on corporate tax incidence). But they also appear to distribute capital gains taxation differently by smoothing it on an ad hoc basis for certain specified years. This accounts for the disappearance of the yearly fluctuations in the previous series, but it is also a questionable assumption if our goal is to accurately measure year-to-year tax rates. Those fluctuations reveal the sensitivity of yields from certain forms of taxation to business cycles among other things.

The cumulative effect of these adjustments is a nearly complete transformation of the depicted series. Saez and Zucman migrate from a very slight 50-year decline in rates at the top to a clear and sharp downward trend, aligning with their political arguments for Elizabeth Warren’s wealth tax proposal.

They do document these changes in their new data release (and somewhat begrudgingly, it would appear, given the criticism of their initial release to favorable media outlets), but documentation is not the same as undergoing rigorous peer review — as a major alteration in their corporate-tax-incidence assumptions would appear to warrant.

Indeed, the change remains highly unconventional relative to the established economic literature, including their own previous peer-reviewed work. It is also at direct odds with an alternative estimate just released by David Splinter, an economist for the Joint Tax Committee. Splinter follows the mainstream literature on distributing corporate tax incidence. He also finds clear evidence of progressivity at the upper rates (top 0.01 percent) in both released statistics through 2014 and in his forecast model for 2018.

The Politics of Presenting Data

In addition to the contested adjustments to the PSZ-2018 academic article, Saez and Zucman have explicitly tied their new work to political and electoral objectives involving the Elizabeth Warren campaign and the ongoing Democratic primary. The pair unveiled a flashy new website, www.taxjusticenow.org, to promote their book. The website presents an interactive data simulator to calculate the rates associated with several Democratic-candidate tax proposals, using their own new estimation methods as a base.

Academics often weigh in to politics, including advisory roles in campaigns, and Saez and Zucman are doing so at the moment. While this is not inherently a mark against their scholarly work, it does reveal a clear political angle at play. For example, their department website at Berkeley boasts that the new tax-simulation “website will play a role in the coming presidential election, and especially the primaries.” It also features favorable portrayals of the Warren campaign’s tax plan, and accompanying editorial content that argues for the adoption of a national wealth tax.

Editorial content of this type would be fine, provided it is acknowledged as such and distinguished from the academic iterations of the underlying data. Yet here again, Saez and Zucman seem to be blurring the lines between their scholarship and political electioneering. This development is especially curious, considering that Zucman himself has responded to several challenges to his data by name-calling and accusing his critics (myself included) of having political motives. So as the adage goes, Physician, heal thyself.

Yet we also see several clear signs of Saez and Zucman’s politics spilling over into their data presentation above and beyond the aforementioned methodological adjustments between PSZ-2018 and their new series.

First, as I pointed out last week, the new Saez-Zucman numbers intentionally exclude the Earned Income Tax Credit (EITC) from their estimates of the tax rate on the lowest earners. Just as the new corporate-tax-incidence adjustments caused the rates on the ultra-wealthy to pivot downward over time, the exclusion of the EITC has a cumulative effect of raising the depicted tax rate on the lowest earning brackets. Since the EITC is intentionally designed to increase the progressivity of the tax system, its exclusion from the Saez-Zucman numbers results in a highly misleading overstatement of the tax rates that the lowest-income earners actually pay.

As I noted the other day, excluding the EITC breaks from multiple standard tax-data reporting conventions including the treatment that the CBO has been using for the past 40 years. Zucman’s defenses of making this change amount to a tendentious argument that the credit — as a transfer — cannot be differentiated from other forms of public spending such as defense and health care. He therefore claims it is necessary to remove the EITC from consideration as a feature of the tax system

Yet on their new website, Saez and Zucman are all too eager to incorporate different aspects of health care into their total “tax” estimates — provided it further augments the patterns in their new data.

This practice may be seen through their bizarre treatment of private health insurance premiums as a component of taxation. A PowerPoint slideshow on the new website includes an Orwellian rebranding of private insurance payments as a “health insurance poll tax,” and Zucman has deployed similar language while defending this designation.

Now a reasonable argument can in fact be made that health insurance premiums have regressive effects, and are closely intertwined with the incentives and regulations of the tax code. But Saez and Zucman step well beyond that argument, offering an additional prescriptive version of their series that adds in insurance premiums and treats them as if they were an additional form of taxation.

It is not difficult to see the inconsistency in these practices. They exclude the EITC, which is a direct and internal feature of the tax code, yet they also defend adding private health care premiums by redefining them as a “tax” with the stroke of a pen. The effect of both is to augment their reported numbers for the current tax burden on the lowest income earners.

To be clear, the Saez-Zucman treatment of health insurance premiums is offered in addition to their newly adjusted series. It constitutes a prescriptive political extension of the data contained in their book. But it is also the default setting on their new website.

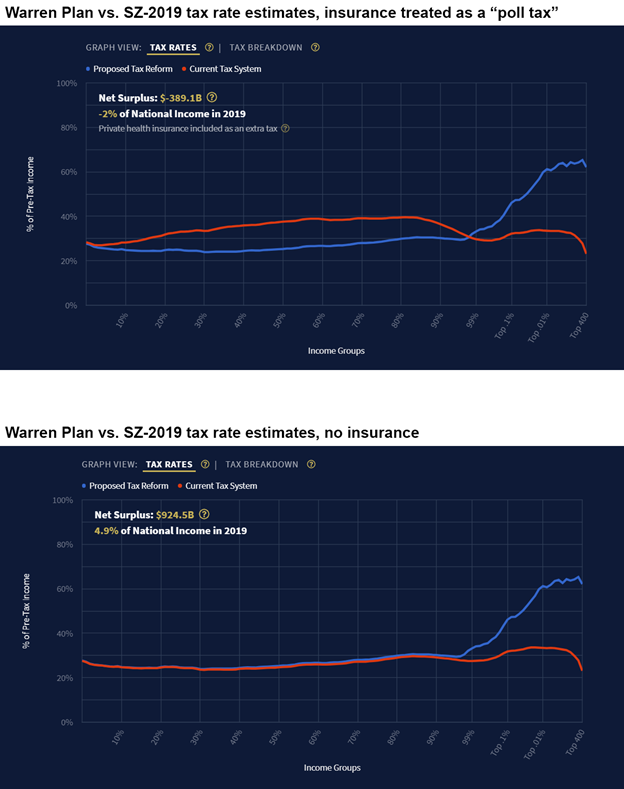

We may see the direct effects from an example on the front page of that website. In the figure below, Elizabeth Warren’s “tax plan” (blue line) is depicted to reduce the overall rate paid by the lowest earners when compared to the current rates, as estimated by Saez and Zucman (red line). These cuts are allegedly offset by sharp increases to tax rates on the top 1 percent and higher.

Yet if we remove the private-health-insurance treatment, the difference between the Saez-Zucman estimates for the current system and the Warren plan almost entirely disappears up until just short of the 99th percentile. Far from showing a “tax cut” on lower incomes under Warren’s proposal, Saez and Zucman actually appear to be using their tax estimates to bring Warren’s separate and massively expensive Medicare for All proposal in to their calculations through the back door. Since Medicare for All would replace private health insurance, the observed change actually comes from Saez and Zucman’s extremely suspect decision to reclassify insurance as a “poll tax” and use it to augment the political website version of their new numbers.

In light of these data discrepancies, it is becoming increasingly apparent that the primary driver of Saez and Zucman’s claims about the tax rates on the wealthy do not reflect a regressive shift over time. They arise almost entirely out of unconventional and contested adjustments to their previous numbers, and from even more suspect accounting tricks that augment their political salience to the current Democratic presidential contenders.