Wars and the pre-Fed economy

Many economists assume that the Fed has improved U.S. economic performance relative to the pre-Fed periods. As I discussed in a previous blog post, however, the Fed has been better on some margins and worse on others. Most improvements under the Fed have only come since about 1985 during the Great Moderation.

Another aspect that biases this comparative analysis in favor of the Fed is that most studies only analyze the post-World War II period under the Fed. They argue that the early Fed was poorly managed or not well-informed, and that the postwar period is more representative of the Fed’s current behavior. However, omitting the years up to and including World War II presents challenges when comparing the Fed’s performance to the pre-Fed period since there were major wars in the pre-Fed periods but no major wars since World War II.

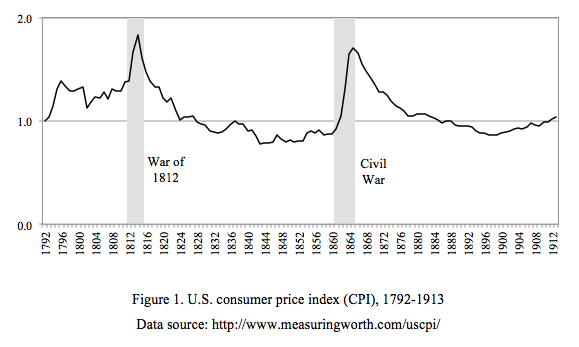

Figure 1 shows the consumer price index (CPI) from 1792 through 1913. There are two important things to note: First, the long-run price level was roughly constant over 120 years of the pre-Fed period. Second, there are two events that caused major spikes in the price level: the War of 1812 and the American Civil War. Just looking at Figure 1, it’s pretty obvious that most of the volatility in the pre-Fed period was caused by these two events.

In a recent working paper, Dan Smith and I compare economic performance in the Fed and pre-Fed periods after accounting for the effects of war. We measure economic performance based on the rates and volatilities of inflation and real GDP growth. Most results are as expected: The volatility of inflation has been lower (better) under the Fed, but the average rates of inflation have been higher (worse), and rates of GDP growth have been lower (worse).

Although supporters of the Fed claim that GDP volatility has been lower under the Fed, this claim is only true when comparing the Fed to the national banking period following the Civil War. In the period before the Civil War, the volatility of GDP growth is actually the same or lower than under the Fed, even during the Great Moderation!

These results provide further evidence that the Fed has not improved economic performance. We hope other economists will consider this evidence in discussions of Fed reform and future monetary policy.