What Travel Agents Can Teach Us About Blockchain

What can important technological innovations of the past tell us about today’s emerging technologies, such as cryptocurrencies and blockchain?

I recently looked at a centuries-old example—the emergence of the printing press and its impact on monks, the incumbent scribes of the day. I found parallels to blockchain technology today, such as initial skepticism and a steep learning curve that slowed the overall transition from old to new technology.

Today’s example comes from far more recent history—the impact of the internet on incumbent brick-and-mortar travel agents. These businesses were in theory some of the most vulnerable to new competition online, and they definitely took a hit.

But the truly interesting lesson comes from travel agents’ surprising resiliency. By specializing and finding market niches, as well as adopting the technology that was threatening them, small agencies redefined the business and continue to coexist with online giants like Travelocity and Expedia.

A One-Way Ticket?

Our younger readers may have never contemplated a world where they don’t book their own airline ticket. But until the late 1990s, unless you wanted to spend hours on the phone with multiple airlines, the only way to compare prices and flight times was to visit your local travel agent. Agents had access to a database of flights and prices and could book directly, and air travel was the bread and butter of their business.

In the heady early days of the internet, we heard bold predictions that brick-and-mortar retail’s days were done. The handful of large travel sites we know today put the flight database online, and suddenly agent fees and trips to their offices were a thing of the past. If any incumbent business was going to die a quick death at the hands of the internet, it was surely travel agents.

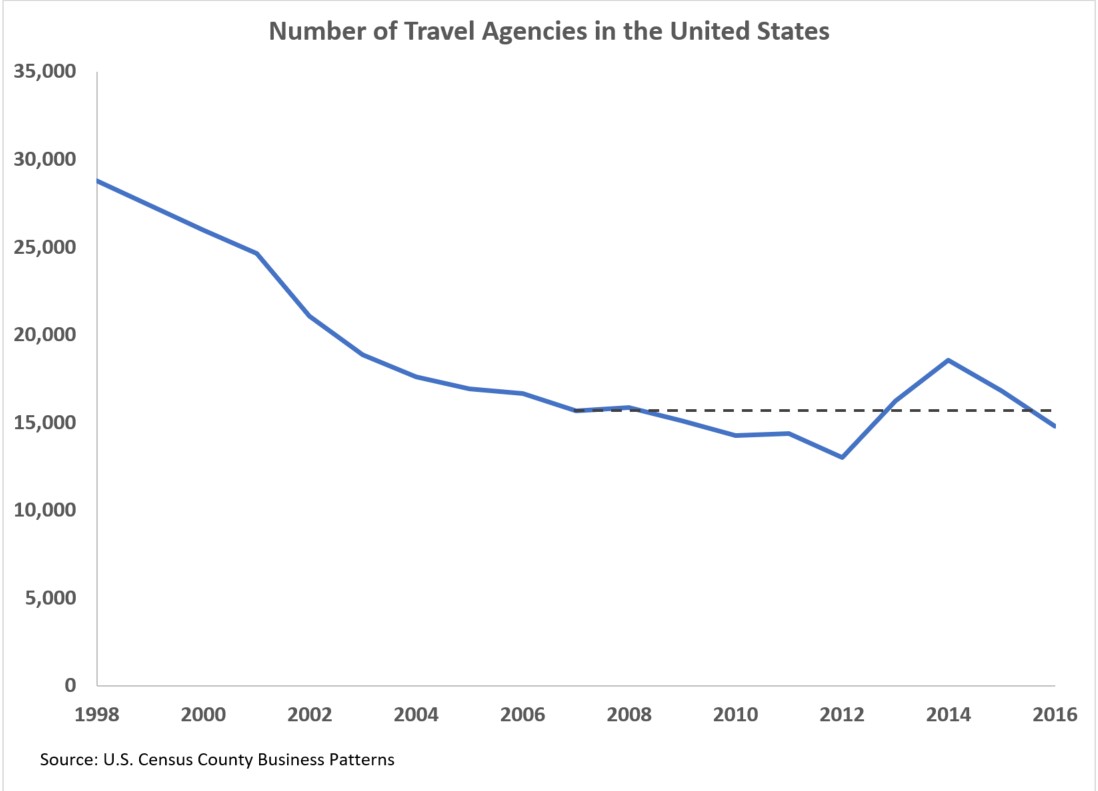

The chart below documents the shakeout that ensued. The number of travel agencies operating in the U.S. fell by almost 50 percent between 1998 and 2007.

The impact of the internet is undeniable, but what happened in the following decade is even more interesting. While there is a good deal of year-to-year volatility, the overall trend is essentially flat. What have the remaining half of agencies done to survive?

Don’t Die, Specialize

I first studied this industry in graduate school, right around 2007. I wanted to stress test the neat-and-tidy narrative that brick-and-mortar agents were on their way to being obsolete. Breaking the national data apart into the 3,000+ U.S. counties, I compared over time on the number and size of travel agencies, rates of internet adoption, and measures of demand for multiple travel services.

The most important variables turned out to be the ones determining demand for more complex travel services, such as packaged tours and cruises. In counties where air travel demand was high relative to more complex travel, internet adoption over time drove the exit of agencies from the market. But in counties where the opposite was true, agencies appeared far more resilient.

Simply put, brick-and-mortar agents are better than websites at helping people when travel gets more complex. We know what we’re going to get when we book an air-travel ticket online, but if we’ve never been on a cruise, there’s no substitute for a live conversation with an expert.

Though I didn’t know when the downward trend would flatten, I made the cautious prediction that a significant number of traditional agencies would be able to coexist alongside the big online players. That flattening appears to have begun right around the time of my original project.

The discussion around cryptocurrencies often centers on whether they will become everyone’s money or nobody’s money. The experience of travel agents suggests a different path, where multiple kinds of money coexist, each having advantages with respect to different transactions. Crypto-evangelists and opponents of government fiat currency may not want that to happen, but that’s the outcome on which I’d put my money.

Adopt to Adapt

Another lesson from the travel industry is that incumbents are not static entities—they often remain relevant by adopting the same technology that fuels their newer rivals. Increasingly, brick-and-mortar agents have become home-based agents, operating independently at home rather than as part of a small business downtown.

This trend reflects the way internet technology has changed many lines of work, from Uber drivers to hobbyists selling crafts online. Home-based agents are more likely to have multiple sources of income and adjust their hours according to demand. This may help explain some of the volatility in the number of agents the Census reports in recent years.

While it’s fun to write articles declaring the death of bankers or lawyers at the hands of blockchain, it’s also silly. These professionals are smart enough to not only find the niches in which they outperform new technology, as described above, but also to use blockchain technology to their advantage. Incumbents may prosper by realizing blockchain technology’s potential to improve record-keeping or trading platforms, for example.

When we discuss cryptocurrencies and blockchain technology in black-and-white terms, we’re forgetting the lessons of very recent history. Disruptive technologies are rarely superior to incumbents in every single product or service the latter provides. And incumbents are rarely passive enough not to adapt and adopt in response to technological change.