What’s the Right Inflation Rate?

In 2012, the Federal Reserve adopted a “longer run” inflation target of 2%. The European Central Bank (ECB) similarly “aims at inflation rates of below, but close to, 2% over the medium term.” Indeed, all around the world, central banks have adopted positive but low inflation targets, with many—including Canada, Japan, New Zealand, Norway, Peru, South Korea, Sweden, United Kingdom, and West African States—settling on 2%.

What’s the right—or, optimal—inflation rate? And how does it compare to the consensus view among central bankers?

For starters, it should be clear that we are considering the optimal inflation rate over the medium-to-long run. In the short run, an unexpected reduction in nominal spending might warrant a temporary increase in the rate of inflation in order to keep the price level from remaining below the level anticipated when long-term employment and borrowing contracts were signed, since failing to increase the rate of inflation in response to such a shock would result in a temporary period of underproduction. Likewise, an unexpected surge in nominal spending might warrant a temporary decrease in the rate of inflation.

Neither one of these scenarios prevents the central bank from hitting its medium-to-long run inflation target. Indeed, to the extent that medium-to-long run inflation targets have been adopted to anchor expectations about future purchasing power, short run variations in the rate of inflation to make up for past mistakes help advance the broader policy goal.

When considering the optimal inflation rate over the medium-to-long run, we are essentially asking what rate of inflation over that period makes us the most productive. We are not asking what rate causes us to produce the most. Monetary mischief might fool us into over-producing. But over-production is unproductive, as it wastes valuable resources. Rather, we are interested in promoting genuinely productive ventures.

Economists who have considered the issue can be divided into three broad camps. Some believe that the optimal rate of inflation is zero. Others maintain that a slightly positive rate of inflation is desirable. Still others hold that a slightly negative rate of inflation is best.

The first view maintains that the productivity-maximizing rate of inflation is zero. Advocates of such a position, including the late Allan Meltzer, usually maintain that the general price level is a numeraire and, hence, any costs incurred to change the numeraire are unwarranted. Some also note that, since nominal capital gains are subject to tax, inflation results in costly distortions in saving and investment. Still others stress the salience of zero inflation, which might reduce uncertainty (and, hence, boost productivity) about price level drift.

The second view maintains that some low, but positive amount of inflation is desirable. This view, as put forward by George Akerlof and others, is usually justified on the grounds of lubricating labor markets—that is, enabling employees to accept a lower real wage without enduring the psychic costs of seeing the amount on their paychecks decrease; enabling employers to offer lower real wages without reducing morale and, hence, labor productivity; etc. Others more-or-less accept the first view but worry that conventional measures overestimate inflation. In other words, achieving zero percent actual inflation requires a slightly positive rate of measured inflation.

The third view maintains that inflation should be slightly negative. This view, which is usually credited to the late Milton Friedman, is usually justified on the grounds that individuals will hold insufficient cash balances when the real rate of return on currency is lower than the real rate of return on bonds of similar risk and durations. If individuals do not hold enough cash, some transactions (and, hence, the mutual gains from those transactions) will go unrealized. Paying interest on cash is possible, but costly. Far better, proponents of the third view maintain, to generate a mild (and expected) deflation so that currency yields a positive real rate of return comparable to similar financial assets. Then, everyone will hold enough cash to make the desired transactions.

Note that, in all three views, there is some cost to be minimized. In the first view (and the second view, when held on the grounds of mismeasurement), it is the cost of changing prices (commonly referred to as menu cost, since new menus will need to be printed). In the second view, it is transactions and/or psychic costs. In the third view, it is the cost of managing smaller cash balances (commonly referred to as shoe leather costs, since holding little cash requires more frequent trips to the ATM).

A more general view would take all of these costs (and potentially others) into account. But the underlying logic is the same. Incurring costs means using scarce resources. If we can reduce costs on net, we free up resources to produce other valuable goods and services, thereby increasing overall productivity.

To say that economists can be divided into these three camps should not be taken to mean they are evenly split. Far from it. And a new working paper from Federal Reserve Board economist Anthony M. Diercks, which surveys “every optimal monetary policy paper made available to the public since the mid-1990s and provides a careful discussion on the most important costs and benefits of inflation,” makes it clear where most work on the subject falls. (HT: John Cochrane)

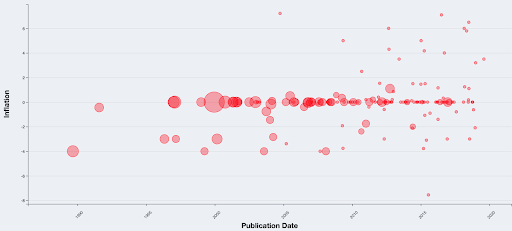

A graph of the optimal inflation rate found in publications over time, which has been taken from the author’s nifty data visualization tool, is presented below. The optimal inflation rate is on the vertical axis. Publication date is on the horizontal axis. Each circle corresponds to a publication, and the size of the circle reflects the number of times it has been cited by other papers.

What’s the consensus view? Most papers—and the most-cited papers—recommend an inflation rate around 0%. The average inflation rate across all 159 papers is 0.03%. Many papers find that a slightly negative rate of inflation is desirable. A few papers, almost all of which have been published in the last ten years, find that a slightly positive rate of inflation is ideal. Ten papers (6.29%) recommend an inflation rate in excess of 4%. One paper (0.63%) recommends an inflation rate below -4%. And, despite its popularity at central banks around the world, zero papers claim a 2% inflation rate is optimal.

Why, then, have so many central banks adopted a 2% inflation target? Former Fed Chair Paul Volcker suggests it is an accident of history. New Zealand did it. It worked reasonably well. Others followed suit. Alex Salter and I point to political selection mechanisms. Fed governors, for example, are appointed by the President and confirmed by the Senate. Those making and confirming appointments are inclined to support candidates whose views on monetary policy have the side effect of yielding a steady stream of seigniorage revenues, which can be spent to bolster re-election odds.

Whatever the reason(s), Diercks’s new working paper makes clear that there is nothing magical about a 2% inflation target. Recognizing that is a much-needed first step toward better Fed policy.