Capturing Shifts in Everyday Prices

Such a difference is not an illusion. It is based on a very real difference in the behavior of prices for everyday goods and services and changes in the overall price level. Our analysis shows that everyday prices and the CPI began to diverge after 2001. This split suggests that everyday prices no longer follow the same trend as the overall price index.

This was perfectly illustrated at a public forum in Queens in 2011 when New York Fed president William Dudley tried to address concerns about rising food and gasoline prices. As reported by Reuters, he pointed out that other prices, such as those for iPads, were falling. The response from an audience member was direct: “I can’t eat an iPad.”

In 2012, AIER developed the Everyday Price Index (EPI) to measure price changes of goods and services that significantly affect short-term household budgets. These goods and services meet two criteria: 1) they are purchased frequently, and 2) there is no way to contractually fix their price for a prolonged period.

These are items such as food, gasoline, or prescription drugs. Their purchase cannot easily be postponed or foregone. If their price rapidly increases, consumers have little choice but to pay it. In contrast, people can plan ahead to purchase some of the items that are included in the CPI, such as appliances. Others, such as mortgages and rent, are contracted and do not provide an unpredictable budget shock.

Periodically we review the methodology of the EPI to make sure it meets our goal of tracking price changes that consumers encounter day-to-day. We made one such revision in 2014. This month we are refining the index again, dropping some items and adding others and more precisely defining what we mean by everyday goods and services.

While the new EPI is not significantly different from earlier versions, it differs greatly from the more widely known CPI. It may be a more relevant index than the CPI for families trying to budget for everyday expenses.

What’s new in the EPI: The updated EPI adds data categories that previously were excluded or unavailable—for domestic services, gardening and lawn care, nonprescription drugs and vitamins, and pet products. It also removes categories previously included– car insurance, club dues and fees for participant sports, and child care/nursery school fees – because it is possible to fix these prices by contract for a period of six months or more.

The EPI is based on the same data the BLS uses in constructing the CPI, and the EPI methodology is identical to that used for the CPI. The EPI is constructed as the weighted average of the prices of the individual components. The weights reflect the shares of household expenditures devoted to each category. The only difference between the EPI and the CPI is the set of products that each index covers. (For more detailed information about the methodology, see AIER Working Paper 004, “Capturing the Inflation that People Experience: The Everyday Price Index versus the Consumer Price Index.”)

An important caution: The EPI should not be interpreted as a better measure of overall inflation than the CPI. Rather, it is a measure that is more relevant to everyday planning and a source of information about trends in everyday prices only.

What we include in everyday prices: Table 1 presents the full list of the goods and services covered by the EPI. Overall, they account for about 37 percent of total household expenditures. Many components of the EPI—for example food, motor fuel, housekeeping supplies, or personal- care products and services—fall easily into everyone’s intuitive definition of everyday products. Some others are less obvious.

For example, many people do not buy tobacco and smoking products. Many may not buy domestic or gardening services. Some people do not have pets and they do not buy any pet products. Capturing the diverse expenditure patterns of various individuals in a single price index is always a challenge and requires compromises. For the EPI, we followed the criteria that if a product is purchased at all, it would be purchased at least once a month. Tobacco products, domestic services, and pet products all meet this standard. Many people do not buy them at all, and that is reflected in the low weight these expenditures receive in the overall EPI.

Table 1 is also notable for what is absent from the EPI. The most prominent absence is the cost of shelter – rent or mortgage payments. These are excluded because they are contractually fixed. Also absent are big-ticket items, such as cars, appliances, furniture and the like, because they are purchased infrequently.

Most items either clearly met our criteria (e.g., food) or clearly did not (e.g., appliances). However, some were more ambiguous (e.g., newspapers or delivery services). To be thorough, we checked, using statistical procedures, whether the trend in the EPI would be significantly affected if we excluded them. No significant difference was found.

EPI and apparel: Is clothing an everyday expense?

Some people may feel that apparel qualifies as an everyday purchase while others would disagree. In some households, apparel may be purchased at least once a month but in others less frequently. It is difficult to make a uniform decision for all households whether apparel, which accounts for a bit over 4 percent of total consumer spending in U.S., should be classified as an everyday good or not.

To accommodate both choices, starting Sept. 16, AIER will publish a special index, “EPI + Apparel,” in addition to the regular EPI. It will include prices of apparel, as well as prices of all other goods and services listed in Table 1. The average inflation rate of “EPI + Apparel” is not significantly different from that of the regular EPI, but it is less volatile. Data for both indexes will be found online at https://www.aier.org/epi.

EPI vs. CPI: Everyday prices are more volatile

We can now compare the Everyday Price Index with the CPI for All Urban Consumers (CPI-U). In all comparisons we use the CPI-U without seasonal adjustment, because the EPI does not undergo seasonal adjustment. Data that have not been seasonally adjusted reflect the prices actually paid by consumers, which is the object of our interest here.

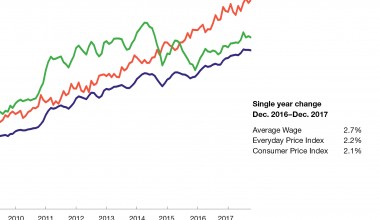

Chart 1 shows the evolution of the CPI and the EPI since January 1987, the earliest data point for the EPI (although the AIER only began publishing the EPI in 2012). Chart 2 shows the corresponding inflation rates, computed as a percent change from 12 months ago.

Chart 1 suggests that the EPI and the CPI moved closely together until sometime in the early 2000s, when their trends diverged. The trend in the CPI became flatter than the EPI, resulting in a substantial cumulative difference between the two indexes today. For illustration, we assume the breakpoint occurred in January 2001; varying this date by a couple of years in either direction does not substantially change the results.

The charts and statistical analysis of the underlying data point to four findings:

1 EPI inflation is more volatile than CPI inflation.

2 Before 2001, the average levels of EPI inflation and CPI inflation were roughly the same.

3 After 2001, average CPI inflation became noticeably slower, while average EPI inflation remained unchanged. As a result, post-2001 EPI inflation, on average, exceeds CPI inflation.

4 Both EPI inflation and CPI inflation became more volatile after 2001.

Chart 2 confirms these findings. Prior to 2001, the average EPI inflation rate, 3.1 percent per year, was virtually indistinguishable from the average CPI inflation rate, 3.3 percent per year. But after 2001, CPI inflation slowed considerably – to 2.1 percent per year on average. EPI inflation, in contrast, hardly slowed at all – it fell only to the average of 2.9 percent per year, which is not significantly different from its earlier value of 3.1 percent.

The divergence of the EPI from the CPI and their increased volatility imply that after 2001 it became more difficult to budget for everyday expenses. This happened for two reasons. First, prices have become more volatile – both everyday prices and general price levels. More volatile prices are more difficult to predict, complicating planning.

Second, the divergence of the two indexes after 2001 means that the trend in general prices ceased to be an accurate guide to changes in everyday expenses. Before 2001, people could use the widely reported CPI data to get a fairly good idea about how to budget for everyday goods and services. After 2001, the CPI was no longer a reasonable guide for this.

The forces behind the trends

Several forces led to the divergence and the increased volatility of prices in the recent years.

Energy price volatility essentially doubled in the post-2001 period compared with earlier decades. This has affected both the CPI and the EPI through categories such as motor fuel, household utilities and fuels, and other energy commodities included in the CPI.

High variability in energy-related prices also explains why the EPI is more volatile than the CPI. Motor fuel is the single most volatile component of either the CPI or the EPI. But because the CPI includes many more goods and services, the weight it assigns to motor fuel is much smaller (fluctuating around 4 percent during the period of our study) than it is for the EPI (around 11 percent). The lower weight means it has less effect on the CPI.

The volatility of gasoline prices, especially in recent years, is so high that it overtakes all other price fluctuations. The EPI very noticeably moves with gasoline prices, possibly giving rise to a criticism that the EPI is essentially a gasoline price index with a few things added in. But this extreme sensitivity to gasoline prices is not a shortcoming of the index. The components of the EPI receive their weights from the Consumer Expenditure Survey, as do components of the CPI. The apparent “overweighting” of the gasoline price in the EPI simply reflects gasoline’s impact on everyday budgets. This is also why gasoline price increases receive so much public attention.

The difference between the EPI and the CPI after 2001 reveals deeper processes in the economy. It came about because CPI inflation slowed down, not because EPI inflation sped up. Two forces likely contributed to this – quality improvement (mostly for durable goods) and international competition.

The quality of many products, especially of the high-tech variety, can change significantly in a short time. When a new computer is twice as powerful as last year’s model but sells for the same price, the price per unit of computing power has dropped. When the BLS constructs the price index for the computers category, it takes such quality improvements into account by essentially entering a lower price for the more powerful, improved computer. This results in a slowdown or an outright decrease in recorded prices in the CPI.

Such quality adjustments apply mostly to durable goods, which are not included in the EPI. As shown in Chart 3, the durable goods price trend in recent decades was quite different from trends for services or nondurable goods, some of which are included in the EPI. Since durable goods account for about 10 percent of the CPI, it is no wonder that the index’s upward trend has slowed in the past 15 years or so.

Another trend of recent decades—the decline in international trade restrictions—may also have contributed to the slowdown in prices for certain categories of goods. For example, the North American Free Trade Agreement (NAFTA) came into effect in 1994 and resulted in more goods imported from Mexico, ranging from cars to T-shirts. In addition, between 1995 and 2004 the system of import quotas for textiles and apparel that existed for decades was phased out, resulting in more importing of these goods from Asia. All this put downward pressure on the prices of goods but usually not services.

This downward pressure is felt more keenly in the CPI than the EPI because many of the goods whose prices are affected by import competition (durables, apparel, home furnishings, etc.) are excluded from the EPI. To the extent that freer trade and increased competition from imports restrained price growth for goods (but not for services, since those are harder to import), the effect was larger for the CPI than the EPI.

The forces that led to the split between everyday prices and the CPI are not likely to go away soon. This is why both the CPI and the EPI are useful. The EPI measures prices of particular interest to the public, and those prices no longer behave in the same fashion as the general price level measured by the CPI.