Economy

Consumers remain key to the expansion, and consumer-related indicators remain broadly positive.

Last month we highlighted the importance of the core economy—private domestic consumption and investment—to the current expansion. Our hypothesis is that growth in these areas could offset weakness from declining exports, rising imports, and the impact of falling commodity prices on commodity-related industries. This month we take a closer look at consumer spending, the largest part of the core economy, and gross domestic product, or GDP. We expect the expansion to continue but recommend extra caution given the weakened growth trends.

Fourth-quarter real GDP growth was revised higher to a 1 percent annualized rate from an initial 0.7 percent estimate. As Senior Research Fellow Polina Vlasenko wrote in AIER’s Daily Economy blog, “GDP growth was revised upwards primarily for two reasons—because business inventories increased more than were originally supposed and because imports posted a decline instead of the increase reported in the earlier estimates. Both changes point to weaker growth in domestic demand than originally believed.” She added, “Both the rise of inventories and a decline in imports suggest that U.S. consumers and businesses purchased fewer goods and services than we thought. And the slower overall demand can be a reason to worry, if it persists.” (https://www.aier.org/blog/beyond-better-gdp-growth-reasons-concern.)

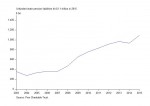

There are reasons to believe that consumer spending weakness won’t persist. First, the job market remains supportive of future spending gains. Initial unemployment insurance claims remain quite low, below 300,000 for the 10th straight month. Job openings in the economy number more than 5.5 million, close to a record (Chart 2). Wages are rising faster, and consumer confidence in the labor market is improving. Second, consumer balance sheets have improved dramatically during this expansion with household net worth at a record high. Third, personal savings rates have increased, though they remain well below average rates in the late 1960s through the late 1970s. Furthermore, consumer-related indicators in our Leaders index continue to expand (see “Economic Outlook”).

Click here to receive email notifications when the latest Business Conditions Monthly is available.

Economic Outlook

The ongoing trend of inconsistent economic performance and mixed data continues to be reflected in our Business-Cycle Conditions model. February marks the 78th consecutive month with our leading indicators at or above 50 percent. Consistent readings above the midpoint suggest a low probability of recession over the next six to 12 months. Conversely, a drop below 50 percent may portend an increased chance of a contraction over the same period.

It should be noted that consumer-related indicators, such as real new orders for consumer goods and real retail sales, remain on an upward trend in the latest reading, supporting our view that the consumer continues to be the key to ongoing economic expansion. Strong favorable trends also continued for housing permits and the interest-rate yield curve.

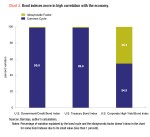

On the negative side, the ratio of manufacturers’ sales to inventories, real new orders for core capital goods, real stock prices, and debit balances in margin accounts at broker/dealers are showing weak trends. As we noted in previous months, the poor performance by core capital goods likely reflects the impact of falling energy and commodity price declines (see Chart 1, January BCM, https://www.aier.org/bcmoverview2016jan).

Overall, with our Leaders right at the neutral 50 percent level, the model confirms our view that the U.S. is on a sustainable but moderate growth path. However, the outlook remains fragile given the strong crosscurrents affecting various parts of the economy.

Click for interactive Indicators at a Glance (on mobile device turn to landscape)

Next/Previous Section:

1. Overview

2. Economy

6. Pulling It All Together/Appendix