Everyday Prices Plunge Again in December

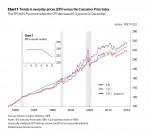

AIER’s Everyday Price Index plunged 0.9 percent in December after dropping 1.0 percent in November. Over the past six months, the EPI has fallen four times at an overall annualized pace of −4.1 percent. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. It excludes prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, fell 0.3 percent in December following a similar 0.3 percent decline in November. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI. Over the past 12 months, the EPI has risen 0.9 percent versus a 1.9 percent gain for the CPI.

The EPI including apparel, a broader measure that includes clothing and shoes, sank 1.2 percent in December after a similar 1.2 percent drop in November. Over the past year, the EPI including apparel is up 0.8 percent. Apparel prices fell 3.5 percent on a not-seasonally-adjusted basis in December and are down 0.1 percent over the past year.

Motor fuel fell 9.7 percent in December, masking sizable increases in other components of the EPI. Admissions prices rose 1.7 percent, domestic services increased 1.4 percent, household fuels and utilities gained 1.1 percent, and housekeeping supplies added 0.6 percent while personal care services, pets and pet products, and food away from home (restaurants) each increased 0.4 percent for the month. In total, 12 of the 24 categories within the EPI were up in December while 11 were down and 1 was unchanged.

The components with the largest weights in the EPI are food at home (20.9 percent), food away from home (17.3 percent), household fuels and utilities (13.3 percent), and motor fuel (12.0 percent). Together, these four categories account for 63.5 percent of the EPI. Among these important components, food at home is up 0.6 percent from a year ago, food away from home is up 2.8 percent, household fuels and utilities are up 2.1 percent, but motor fuel is 1.9 percent lower. Most consumers watch prices, but certain ones, even among everyday purchases, tend to stand out. Food and gasoline prices tend to be volatile and get attention, particularly when prices rise quickly.

With six consecutive months of flat or falling everyday prices, the six-month annualized change in the EPI was −4.1 percent in December. Motor fuel remains the most significant driver of monthly changes. However, labor-intensive areas, especially restaurants, will likely continue to see upward price pressures given the tightness of the labor market and recent acceleration in average hourly earnings. The broadening of upward price changes, as reflected in the slowly rising number of categories with 12-month price changes greater than zero or 12-month increases greater than 2 percent, is consistent with a long economic expansion, a tightening labor market, and rising wages. So far, the pace of increase in consumer prices remains moderate by historical comparison, but careful monitoring is warranted.