Growth in the Money Supply May Lift Everyday Prices

AIER’s monthly Everyday Price Index decreased 0.2 percent in March. A decline in prices of household fuels, utilities, and telephone service offset higher food prices. The EPI measures price changes that people see in everyday purchases such as groceries, gasoline, utilities, and personal-care products. It excludes prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices that are contractually fixed for prolonged periods (such as housing). Over the past 12 months the EPI increased 2.4 percent.

The EPI including apparel, a broader measure, was unchanged in March. Over the past 12 months, the broader index has increased 2.3 percent.

The more widely known price gauge, the Consumer Price Index (reported by the Bureau of Labor Statistics), increased 0.1 percent on a seasonally unadjusted basis in March and increased 2.4 percent over the past 12 months. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI.

Prices of household fuels and utilities fell 0.4 percent in March. Within household fuels and utilities, natural gas utilities declined 1.3 percent, while electricity prices fell 0.3 percent. Prices for telephone service also restrained everyday prices. Prices for telephone service fell 4.9 percent in March. Competition among established carriers and T-Mobile has put downward pressure on prices.

Food-at-home prices increased 0.1 percent in March. A decrease in the price of eggs and dairy products offset increases in other aisles. The price of eggs fell 3.6 percent in March, while prices for dairy products fell 0.9 percent. Prices at the meat counter rose 0.8 percent. Prices of fresh fruits and vegetables rose 0.2 percent. Over the past year grocery store prices have increased 0.5 percent, slower than their average increase in recent decades.

Prices at restaurants increased 0.2 percent in March, and over the past year, 2.4 percent. Prices at full-service restaurants have increased faster than prices at casual restaurants over the past year. Restaurant prices have been supported by restaurant owners’ confidence about future demand. In March, the Restaurant Performance Index, produced by the National Restaurant Association, showed owners were confident that same-store sales would increase in the coming months. Expectations for stronger same-store sale also supported hiring and capital investment plans.

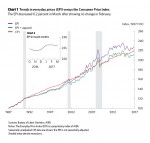

In the short run, many factors can change prices for everyday goods and services. Changes in costs of inputs such as commodities and labor can affect prices, as can swings in the exchange rate and relative changes in supply and demand. However, over the long run the money supply drives inflation. The monetary base surged coming out of the Great Recession but has slowed recently. The monetary base includes currency in circulation and excess reserves. Excess reserves, which are bank reserves held at the Fed, have risen to an unprecedented $2 trillion.

Growth in the monetary base will cause inflation if excess reserves are loaned out. The economy is steady, and households’ finances are in decent shape, so the prospects for new bank loans are favorable. And in fact, private loan growth has already picked up in recent years after a long deleveraging process. Beyond that growth, more people working and spending disposable income is likely to put inflationary pressure on everyday goods and services.