Policy

Monetary Policy

An interest rate hike is expected

this month, but bigger changes may be afoot.

Debate over the Fed’s plan for raising short-term rates seems to have reached a consensus—the central bank will most likely raise its federal funds target range at the Dec. 15–16 meeting of its policy-making Federal Open Market Committee. The market expects that only an extraordinary deterioration in economic conditions would make the Fed stand pat. Given that U.S. gross domestic product growth was recently revised higher for the third quarter and the Labor Department reported a healthy increase in nonfarm jobs last month, we expect the Fed will lift rates for the first time in almost a decade.

If the liftoff occurs, it is expected to be a small move, and the market should be able to absorb it easily. If the Fed raises the target range, say by 0.25 percentage point (to a 0.25 – 0.5 percentage-point range from 0 – 0.25 percent presently), the effective rate may stay below 0.5 percentage points and the spillover effect on longer-term borrowing costs would be very limited.

However, guessing over the Fed’s plan illustrates just how important the central bank can be to market participants and how much uncertainty often surrounds the Fed’s intentions. Legislation that recently passed the House of Representatives takes aim at unknown drivers of the strategy behind decisions that affect the economy.

The Fed Oversight Reform and Modernization act would require the central bank to make public and explain its strategy for the systematic quantitative adjustments of its policy instruments. The bill would let the Fed deviate from its announced strategy, but it would have to tell Congress why it did. Even though the legislation would let the Fed choose its policy instruments, having to publicly explain to Congress its strategy and the reasons for any changes are substantially new requirements. The Fed has not previously had to detail its strategy or explain deviations from it.

The FORM act is far from becoming law, since it is unlikely to pass the Senate. Nevertheless, it already has generated controversy. Federal Reserve Board Chair Janet Yellen sent a letter to House Speaker Paul Ryan warning that the bill, by requiring the Fed to follow a pre-set strategy, could “severely impair the Federal Reserve’s ability to carry out its congressional mandate.” Yet not all economists agree.

Should policy makers have discretion or follow a rules-based strategy?

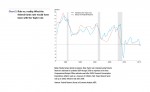

Some advocate for a rules-based strategy for monetary policy. Best known among them is John B. Taylor, professor of economics at Stanford University and a senior fellow at the Hoover Institution. In the 1990s he developed his Taylor rule of monetary policy, which calls for adjusting the fed funds rate in response to two factors: deviation of inflation from its target (taken as 2 percent), and deviation of GDP from potential output. Chart 3 shows what the fed funds rate would have been under the Taylor rule compared with the actual rate. In some periods the two coincide, but they deviate significantly in others.

Taylor’s critics argue that policy makers should have discretion to respond to extraordinary events, such as the 2008–2009 financial crisis. But Taylor says discretion in monetary policy was partly responsible for the severity of the crisis. After 2002, interest rates were kept too low for too long, which spurred excessive risk-taking and helped over-inflate housing prices. According to Taylor, had monetary policy followed a well-formulated rule, the crisis may have been less severe.

A rules-based policy would work well, Taylor argues, by reducing uncertainty and the chances for damaging mistakes. Empirical evidence suggests that when monetary policy was mostly rules based, as in the late 1980s and 1990s, the economy performed well. When the policy was more discretionary, as it was after 2002, economic performance suffered.

Why, then, does the Fed object to the legislation that would compel the central bank to follow a rules-based strategy of its own choosing? It may have more to do with central bank independence than with the rules-based policy debate.

To successfully control inflation, a central bank should be insulated from political pressure. It should not be controlled by those responsible for fiscal policy, or the temptation to use money creation to finance government operations or to channel credit to favored industries would become irresistible. The Fed was designed to be independent.

The FORM act, as proposed, would not limit the Fed’s independence. It would require the central bank to disclose its strategy, but it would not give Congress the power to mandate Fed policy. The choice of strategy would remain solely with the Fed. However, Yellen might justifiably worry that in the future, should lawmakers be dissatisfied with the Fed’s strategy or its reasons for deviating from it, there may be calls for empowering Congress to set monetary policy rules. And that would erode the Fed’s independence and possibly damage the economy. The Fed understandably objects to any movement toward giving Congress more power in overseeing monetary policy decisions.

Next/Previous Section:

1.Overview

4. Policy

6. Pulling It All Together/Appendix