Pulling It All Together/Appendix

The Economy…

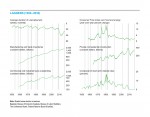

Our Leaders index held at 38 in the latest reading, the second month in a row below the neutral 50 level. Continued readings below 50 suggest an elevated risk of recession, although the underlying economic data in our model remain subject to revision.

Real GDP growth slowed to a crawl in the first quarter, which was completely consistent with the declines in our Leaders index. However, continued gains in services within the GDP data as well as continued strong service-industry job gains offer hope that the economy may rebound rather than tail off into a recession. So we are not ready to forecast a recession in the next six to 12 months but are maintaining a heightened degree of caution.

…Inflation…

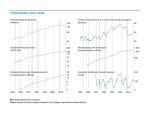

The Consumer Price Index rose 0.1 percent in March from February, the fastest monthly growth since December 2015. Energy was a major contributor. After falling for three straight months, energy prices rebounded for a 0.9 percent gain in March. In April, crude-oil prices continued to rise, suggesting that consumer prices overall would also climb in future months.

The latest AIER Inflationary Pressures Scorecard reveals firm inflation pressure, with 14 indicators out of 23 showing rising pressure, up from 13 in the previous month. Rising inflationary pressures are coming mostly from production costs. Prices of imports and commodities have been growing faster in recent months, as have wages and other labor costs.

…Policy…

The Federal Reserve kept its target range for the federal funds rate unchanged in April. But several factors indicate that a rate increase in June and possibly another in September or December are probable, contingent on new economic data available between now and then.

Tax return statistics provide a look at the distribution of income and tax burdens among Americans. While over 97 percent of 2014 returns reported income of less than $250,000, those filers only accounted for about half of all taxes paid. The other half came from the remaining 3 percent, speaking to issues of both income inequality and relative tax burdens.

…Investing

Markets tend to be forward looking. A range of financial market indicators may be useful in gauging investor sentiment. As we look across several markets—fixed income, commodities, and stocks—recent performance suggests that investors are becoming more optimistic about the future level of economic activity. While that outlook can be wrong, it can also be self-fulfilling. Rebounding markets may provide some extra confidence to consumers and businesses, helping real activity meet expectations.

Japan was once a fast-growing and dynamic economy, second in size only to the U.S. However, since 1990, Japan’s economy has struggled, leading to 25 years of poor equity-market performance. The takeaway is that investors should not assume that stocks will inevitably rise, and they shouldn’t expect that equity returns of the past 25 years will provide an accurate guide for the next 25 years.

Next/Previous Section:

1.Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix