Auto Sales Rebound in May While Factory Orders Fell in April

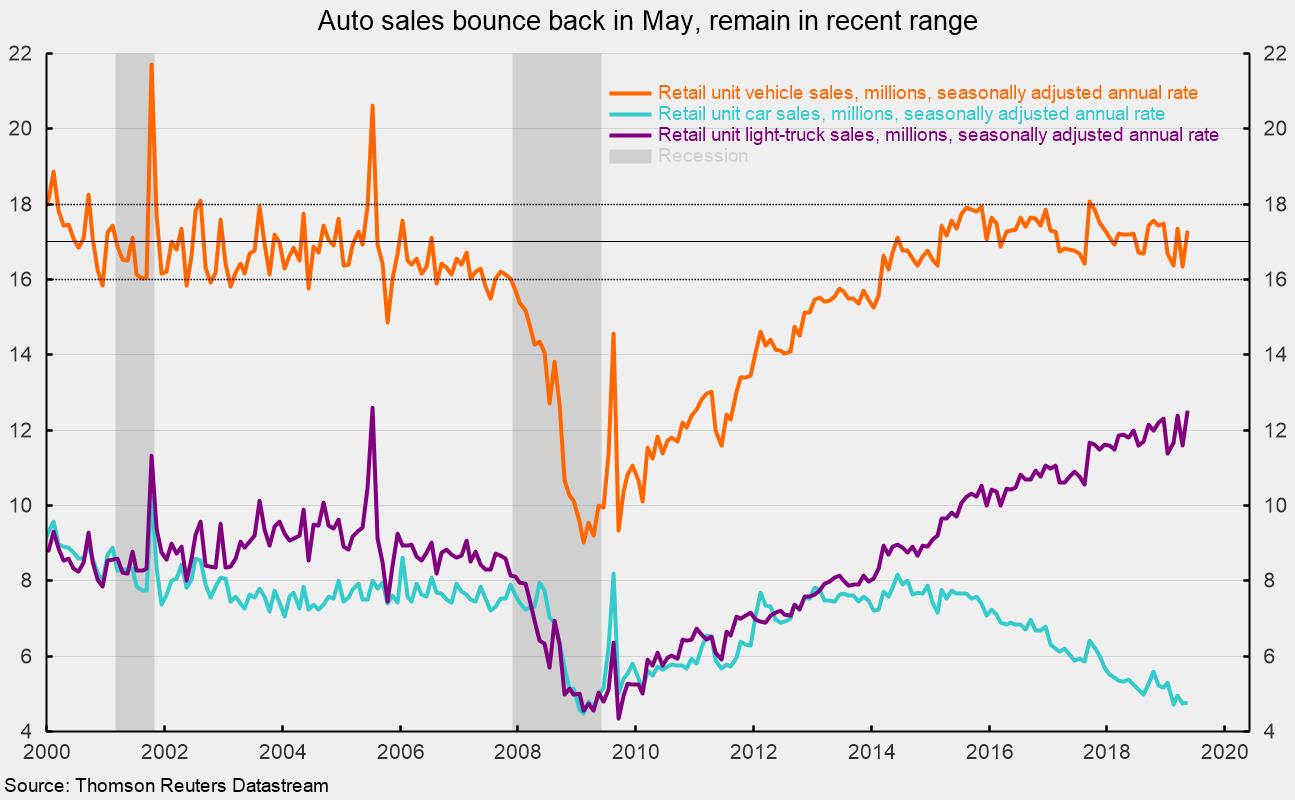

Sales of light vehicles totaled 17.3 million at an annual rate in May, down from a 16.3 million pace in April (see chart). The pace of sales in May remains within the 16 to 18 million-unit range that we have seen for much of the past two decades. Unit vehicle sales fell significantly below the range as the 2008–9 recession began, hitting a low of just 9.0 million in February 2009. Sales began a slow recovery and returned to the 16 to 18 million range in March 2014 and have remained there for 63 consecutive months (see chart).

As of May 2019, light-truck sales totaled 12.5 million at an annual rate while cars managed just 4.8 million. That puts the light-truck share at 72.4 percent, completely dominating the car share of 27.6 percent. The rising share of light trucks continues a trend in place since 2013 (see chart). In February 2013, the split between cars and light trucks (SUVs and pick-up trucks) was about even, with both segments selling about 7.76 million at an annual rate.

Total factory orders fell 0.8 percent in April following a 1.3 percent gain in March. New orders for durable goods decreased 2.1 percent in April, led by a 5.9 percent fall in transportation equipment. Year to date, durable-goods orders are up 2.1 percent to $970.6 billion.

The results for the categories of durable goods shown in the report were mixed in the latest month. Among the industries showing decreases, nondefense aircraft orders fell 25.2 percent while defense aircraft fell 2.4 percent and motor vehicles were down 1.7 percent for the month. Combined, all transportation-equipment orders were off 5.9 percent for the month. Primary-metals orders fell 1.1 percent after a 2.0 percent drop in March. Computers and electronics products were down 0.5 percent following 2.1 percent gain in March.

Categories of durables showing gains for April include electrical equipment and appliances orders, up 0.9 percent in April after a 1.1 percent rise in March; fabricated metal products, up 0.5 percent; and machinery orders, gaining 0.3 percent. Furniture and related products rose 1.3 percent in April after a 1.4 percent rise in March.

Nondurable-goods orders rose 0.5 percent following a 0.9 percent rise in March. Among the major contributors, food products rose 0.8 percent and petroleum products increased 2.0 percent while chemicals fell 0.9 percent and plastics were down 0.8 percent. Paper products were unchanged for April and May.

Measured by product use, orders for consumer goods rose 0.2 percent for the month as consumer-durables orders fell 2.9 percent while consumer-nondurable goods rose 1.0 percent. Total capital-goods orders were off 3.5 percent with defense capital goods gaining 5.4 percent, partially offsetting a 5.1 percent decline in nondefense capital-goods orders. The important nondefense capital goods excluding aircraft category, a proxy for business investment, were down 1.0 percent for April. Year to date, orders for nondefense capital goods excluding aircraft are up 2.6 percent versus 2018.

Finally, Redbook weekly retail sales for the week ended June 1 showed a 5.8 percent increase versus a year ago. Over the last four weeks, the average year-over-year gain is 5.5 percent. This series can give some insight into the upcoming national retail-sales report, due out June 14. The current consensus estimate is a 0.6 percent rise for the month.

Economic data continue to be mixed, with most reports posting erratic gains amid mild positive trends. The labor market remains tight and consumer confidence is holding at favorable levels. While uncertainty around trade is having some impact, there is little hard data to suggest a recession is imminent. The outlook remains cautiously optimistic.