Bitcoin Remains Vastly More Volatile Than Traditional Currencies

Bitcoin investors and enthusiasts cheered this month as the cryptocurrency’s price rose above $10,000 for the first time in over a year. These dramatic swings over the course of months and years, however, mask even-greater price volatility that compromises its use as a practical currency.

AIER has been tracking the day-to-day volatility of Bitcoin since 2016. This is the first of two articles that bring results we reported in 2018 up to the present, comparing Bitcoin’s volatility to that of traditional currencies. The second article will compare Bitcoin’s volatility to other widely traded cryptocurrencies.

In early 2018, we observed that “Bitcoin seems to have experienced something of a regime change, going from periods of great volatility in 2016 to consistently high volatility in 2017.” This uptick in day-to-day volatility turns out not to have been the regime change we predicted. While remaining many times greater than traditional currencies, Bitcoin’s day-to-day volatility for most of 2018 and the first half of 2019 did not stay at quite the frenetic levels seen in late 2017.

Ups and Downs

In our initial study of Bitcoin’s volatility relative to traditional currencies, we wrote:

The future is unpredictable, which can be a huge deterrent to planning and coordination of plans. A medium of exchange that is stable in value and highly liquid, so someone can trade it in a pinch without taking a hit, allows us to better deal with uncertainty and helps us plan and coordinate into the future. Assets that are too volatile are therefore undesirable as currencies.

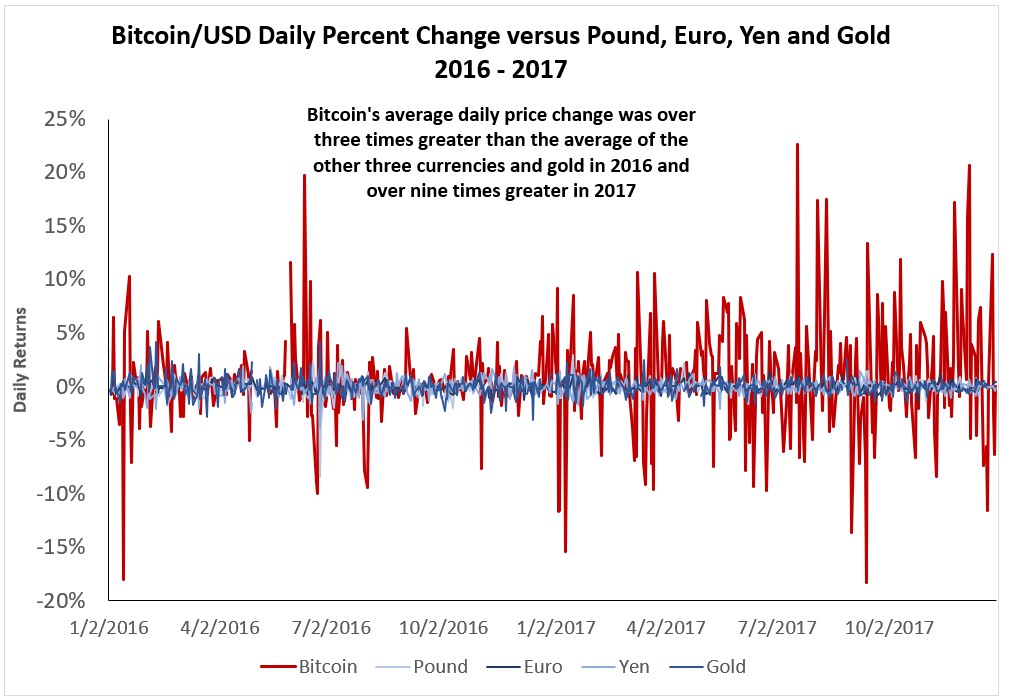

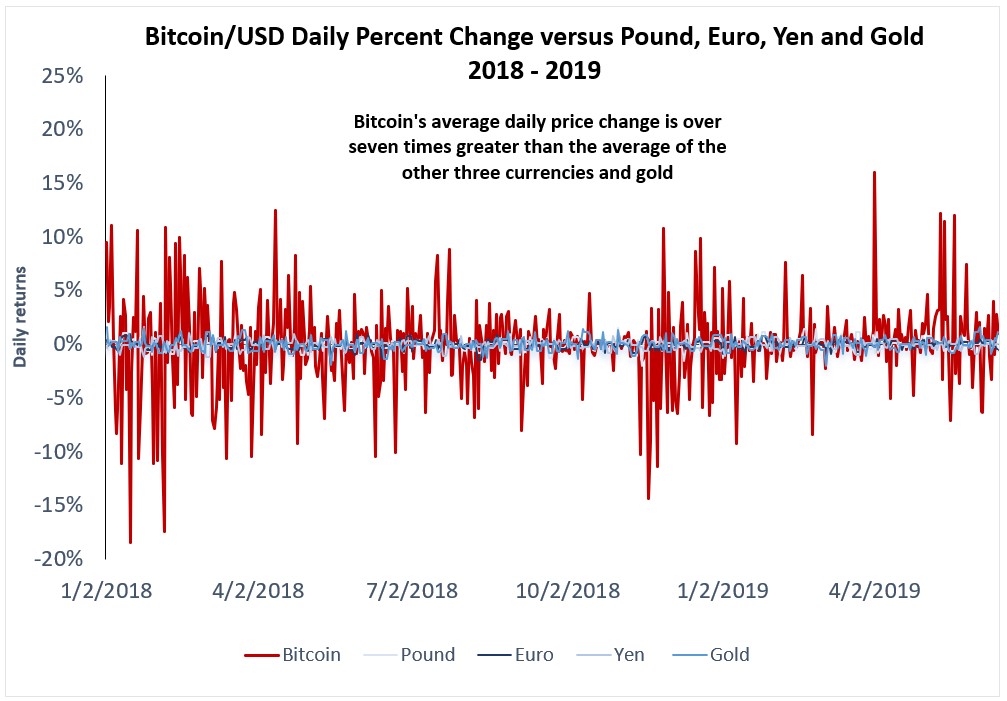

The charts below capture the stark difference between Bitcoin and the exchange rates of the pound, the euro, the yen, and gold against the dollar. We measure each currency’s average daily price change as the absolute value of the percentage change from the day before (so that an increase and decrease of 3 percent, for example, are treated as equally volatile).

Bitcoin’s average daily price change rose from three times greater than that of the traditional currencies in 2016 to nine times greater in 2017, before slightly leveling off to seven times greater in 2018 and the first half of 2019.

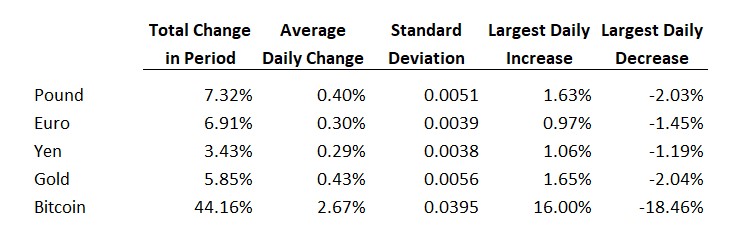

The enormous volatility gap between Bitcoin and traditional currencies is evident across several different measures, including standard deviation and the largest daily changes.

Day-to-Day Volatility: Bitcoin Versus Traditional Currencies (January 2018 – June 2019)

Volatile Volatility

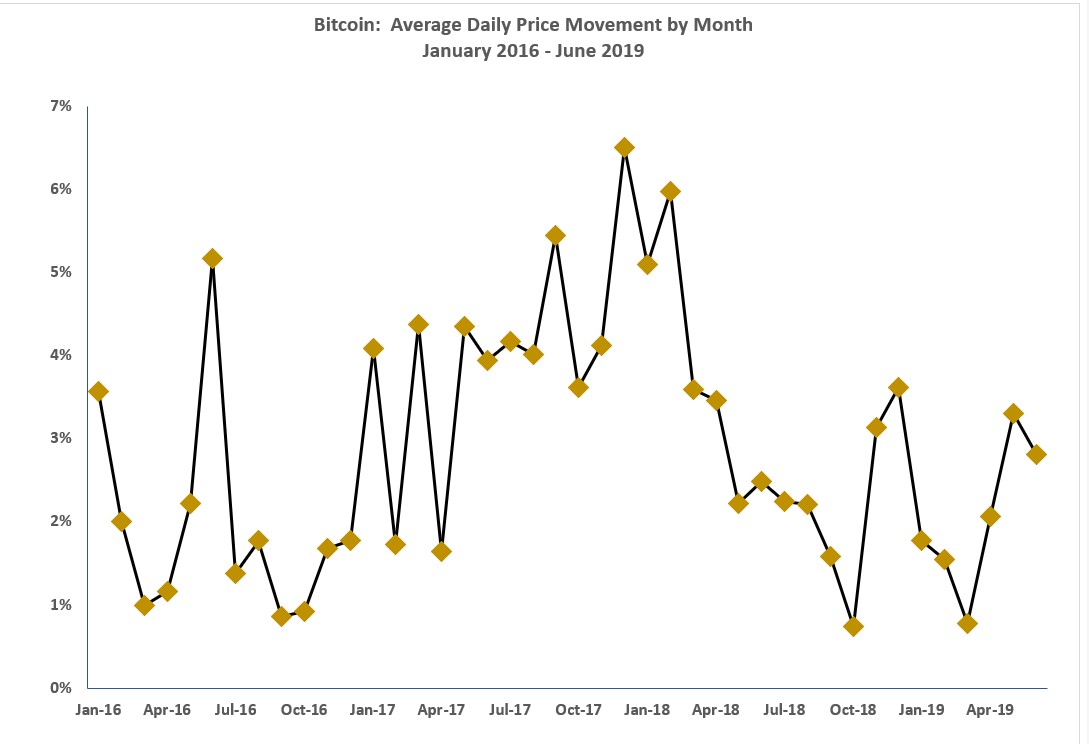

The chart below tracks Bitcoin’s average daily price change for each month from January 2016 through June 2019. Bitcoin’s volatility itself exhibits a great deal of volatility over time. In five months during the sample Bitcoin’s average daily movement in price drops below 1 percent, still larger than the movement of the traditional currencies but much more comparable. But the average daily price movement regularly rises above 3 percent, and rose above 5 percent during four months.

Writing in early 2018, it looked like Bitcoin’s volatility was only increasing, For the12-month period between May 2017 and April 2018, the average daily movement in price never fell below 3 percent, though the pattern in subsequent months looked more like the earlier part of the sample in 2016.

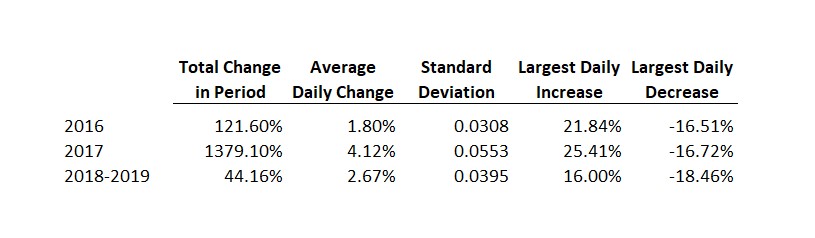

The table below compares the various volatility measures for Bitcoin by year since 2016. While Bitcoin’s penchant for extreme upward and downward swings on individual days remained consistent, 2017 was the cryptocurrency’s most volatile year by multiple measures.

A Long Way to Go

While observers often pay attention to the dramatic long-term movements in the price of Bitcoin, its day-to-day movements may be even more problematic for the cryptocurrency’s dependability as a store of value. These daily changes themselves exhibit fluctuations over time, with the magnitude of the average daily movement in price in some months several times greater than others.

While reading tea leaves based on Bitcoin’s price to predict the cryptocurrency’s ultimate success is tempting, its day-to-day volatility is perhaps more important in determining its practicality as a store of value. By this measure, Bitcoin has a long way to go before it engenders the confidence, at least in the short run, of traditional currencies and gold.

Sources: Pound, Euro, Yen, and gold prices from St. Louis Fed. Bitcoin price from CoinMarketCap.