Suppression of State Banknotes

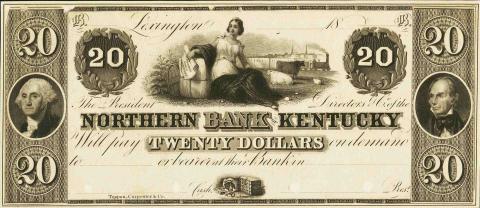

Prior to the Civil War, some 8000 unique banknotes circulated in the United States. The inability of state-chartered banks to branch across state lines (and, in some states, the restriction to unit-banking) meant that there were a lot of banks (far more than those in freer banking systems like Canada or Scotland). Each bank issued its own redeemable notes. And, to make matters worse, only some of these notes traded at par. Others—specifically, those from questionable or distant banks—were only accepted at a discount. It was, by most accounts, a terrible system. So, it is not surprising that conventional wisdom sees the elimination of these state banknotes—by a 10-percent tax levied on their issuance—as a good thing. Was it?

In a very interesting paper, George Selgin (2000, p. 600) reconsiders the desirability of suppressing state banknotes. He asks a simple question: “If state banknotes were clearly inferior to national banknotes, why was a prohibitive tax needed to drive them out of circulation?” State banks could have voluntarily acquired a national bank charter as early as February 25th, 1863, when the National Bank Act of 1863 passed. But, in the nine months that followed, only 169 state banks converted—and none of them were the larger state banks operating at the time. It was only after the Revenue Act passed on March 3, 1865—which levied the 10-percent tax on state banknotes—that conversions soared. By December 1865, some 922 state banks had converted.

How can this be? Selgin considers the case at length. But, for one reason, the discounts discussed above were not as severe as conventional wisdom suggests.

According to Hodge’s Journal of Finance and Bank Note Reporter for October 1863 (the last date for which individual state bank circulation figures are available), discounts on banknotes in New York City tended to be quite modest: With the exception of banks in the Confederacy (the notes of which were no longer saleable in most Northern markets) and three Missouri banks (whose notes suffered discounts of 25%, 30%, and 50%), all other banks had their notes discounted by 2% or less, with one-fifth of 1% being the modal rate for all non-Confederate banks […] Were the entire sum of $154,638,625 in Northern banknotes purchased at par and then sold in the New York market, the loss would have amounted to only $1,501,409, or less than 1% of the notes’ face value, even treating all doubtful or unknown notes as a total loss.

Less than 1 percent. That’s less than standard credit card processing fees today. And it is almost certainly an overestimate. Surely many—if not most—of those notes circulated closer to the bank that issued them where discount rates were even lower.

There were many problems with the state bank era, to be sure. Freer banking systems performed much better. But that does not mean the suppression of state banknotes improved matters. Indeed, the evidence suggests otherwise.