A Border-Adjustment Tax Will Not Help the Economy Grow

Current tax policy allows corporations to deduct the cost of inputs, regardless of their country of origin. For example, General Motors produces tires in Mexico. GM imports the tires into the United States and mounts them on a completed car. It also gets electrical components from a company in Wisconsin. GM can deduct the cost of tires and electrical components when calculating its tax burden. Under a border-adjustment tax, GM could not deduct the cost of imported tires. The BAT would increase the amount of GM’s corporate profits subject to taxation.

Conversely, exports would be exempt from taxation. Under current tax policy, profits earned on the export of goods and services are taxed. This puts U.S. companies at a disadvantage relative to their international competitors. Most other countries do not tax exports.

The BAT would have the same effect as a tariff. It would increase the price of imported goods, which would reduces consumption. On the business side, higher prices would encourage otherwise-unprofitable domestic production. So higher prices would hurt domestic consumers and help domestic producers of import competing goods.

Since the BAT would decrease demand for imported goods, and U.S. residents need foreign currency to import goods, the demand for foreign currency would fall. The border-adjustment tax would exempt from taxation profits earned by exporting. By excluding exports from taxation, U.S. firms would become more competitive. Excluding exports from taxation would boost foreign demand for domestic currency. In a textbook world, both the import and export effects raise the value of the dollar.

The Trump administration argues that the exchange rate would immediately appreciate by the amount of the border tax, which would offset the border tax. An appreciation of the dollar would make imports cheaper and reduce demand for exports.

In practice, the exchange rate adjustment would be slow and incomplete for several reasons. Pre-existing contracts between importers and foreign producers would slow the adjustment process. Dollar invoicing of imports would curb some of the appreciation. Finally, the market for assets dwarfs the market for tradable goods. A border-adjustment tax would not put very much pressure on the exchange rate. A slow exchange rate adjustment means that import prices will rise curbing consumption throughout the economy.

Congress should drop the border tax and instead focus on moving from a worldwide tax system to a territorial tax system. The move to a territorial system should be combined with corporate tax cuts. This would make the United States more competitive and encourage economic growth at home.

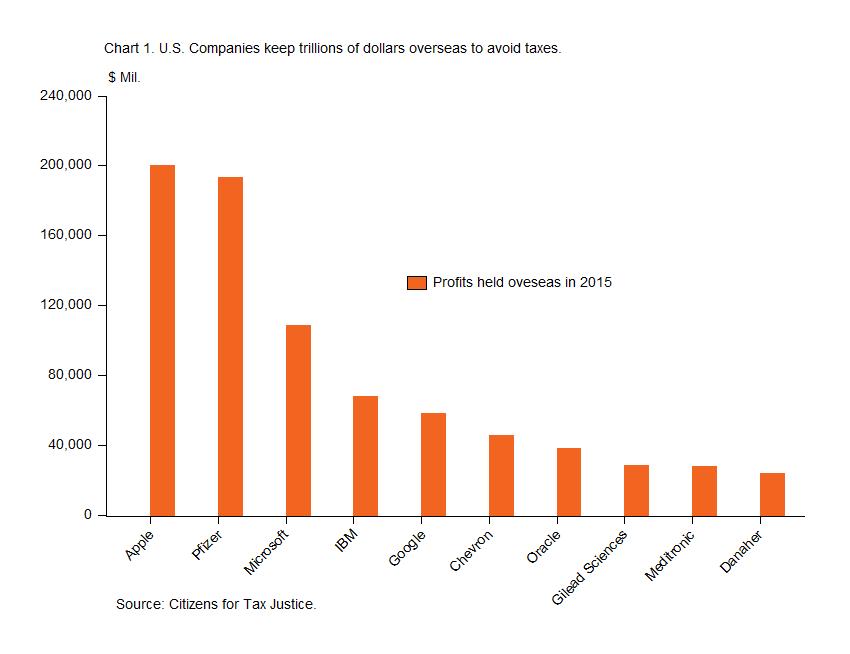

Under the current, worldwide tax policy, profits earned by foreign subsidiaries of U.S. firms are taxed. The firms are given credits for the taxes paid in the foreign country. The IRS sends a bill to the firms for the difference. However, a loophole allows U.S. firms to avoid paying U.S. taxes on profits earned overseas if the firms reinvest the profits overseas.

For example, Dow Chemical earns $1 million in a foreign country. If the foreign tax rate is 10 percent, Dow pays $100,000 to the foreign government and has $900,000 in profit. If Dow wanted to bring the remaining profit back to the United States, it would have to pay U.S. taxes. Rounding off the U.S. corporate tax rate to 40 percent, Dow would owe $300,000. If Dow keeps the profits overseas, it would pay no U.S. taxes. It is clear that the tax code encourages firms to move overseas.

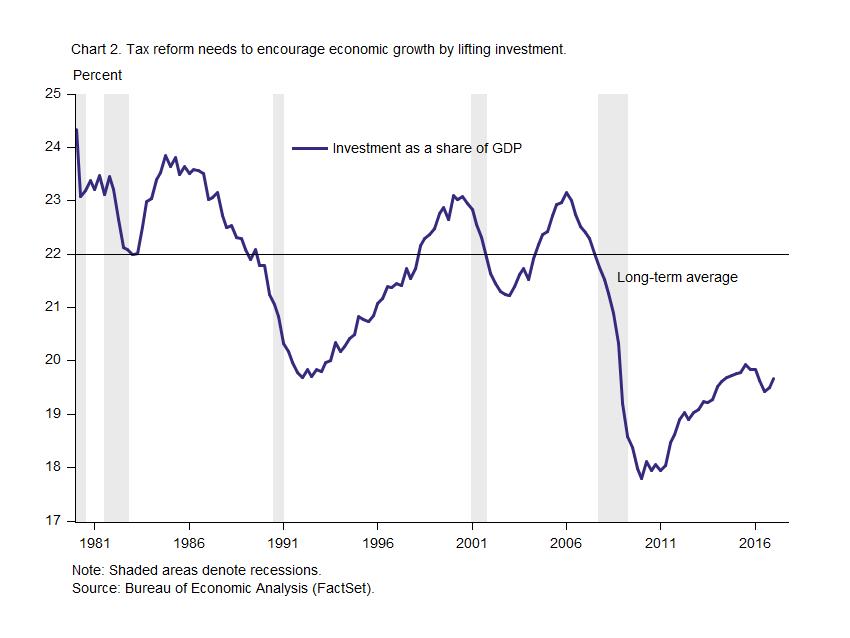

In contrast to a worldwide tax system, a territorial system would only tax profits earned within U.S. borders. A switch to a territorial system combined with a tax cut would make U.S. firms more competitive. The territorial system would also push firms to repatriate trillions of dollars of profits. The profits would be used for hiring and investment. Hiring would build human capital, while investment would create physical capital. Taken together, the additional human and physical capital would lead to technological innovation. New technology makes workers more productive, in turn boosting economic growth, wages, and standards of living.

Tax simplicity is a virtue with similar positive effects. Taxpayers must navigate a labyrinth of laws and regulations to comply with the tax code. According to the Tax Foundation, each year Americans spend over 9 billion labor hours and $400 billion to comply with the tax code. For small businesses, lacking armies of lawyers, compliance is particularly difficult. Each year small businesses spend $46 billion on compliance. This translates to $12,000 per small business.

The government needs to simplify the tax code to promote economic growth. More broadly, a pro-growth tax code would boost the economy by encouraging growth in the labor force and capital formation. Lower taxes on personal income would likely encourage workers to supply more labor. A pro-growth tax policy, like lower corporate tax rates and a territorial system, would boost investment in human and physical capital. Additional capital formation would lead to technological innovation. In turn, technological innovation would lift productivity, wages, and living standards.