Everyday Prices Unchanged for the Second Month in a Row

AIER’s Everyday Price Index was unchanged for the second month in a row in September. The EPI measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. It excludes prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.1 percent in September, the second consecutive month with a 0.1 percent rise. The EPI is not seasonally adjusted, so we compare it with the unadjusted CPI. Over the past 12 months, the EPI has risen 2.3 percent, the same 12-month gain as the CPI.

The EPI including apparel, a broader measure that includes clothing and shoes, rose 0.3 percent in September and is up 2.0 percent over the past year. Apparel prices jumped 4.1 percent on a not-seasonally-adjusted basis in September, though over the past 12 months apparel prices are down 0.6 percent.

The performance of the index in September was largely driven by a decline in fuel and utilities prices (down 0.9 percent), which subtracted 0.12 percentage points. That decline was offset by higher prices for restaurants (up 0.2 percent, adding 0.04 percentage points), motor fuels (up 1.6 percent, adding 0.04 percentage points), alcoholic beverages (up 0.6 percent, adding 0.02 percentage points), cable and satellite TV and radio services (up 0.5 percent, adding 0.02 percentage points), and groceries (up 0.05 percentage points, adding 0.01 percentage points). In total, 15 of the 24 categories within the EPI were up in September while 9 were down.

Over the past year, 21 of 24 categories show higher prices compared to a year ago while 3 show price declines. However, 12 of the 21 categories with increases have 12-month gains between 0 and 2 percent, leaving just 9 with gains above 2 percent. The category with the largest increase by far is motor fuel, for which prices are up 9.2 percent from a year ago. Categories with significant decreases over the past year include nonprescription drugs (down 1.1 percent) and audio discs, tapes, and other media (off 4.6 percent).

The components with the largest weights in the EPI are food at home (20.7 percent), food away from home (17.1 percent), household fuels and utilities (13.5 percent), and motor fuel (12.6 percent). Together, these four categories account for 63.9 percent of the EPI. Among these important components, food at home is up just 0.4 percent from a year ago, food away from home is up 2.6 percent, household fuels and utilities are up 0.5 percent, and motor fuel is 9.2 percent higher. Most consumers watch prices, but certain ones, even among everyday purchases, tend to stand out. Food and gasoline prices tend to be volatile and get attention, particularly when prices rise quickly.

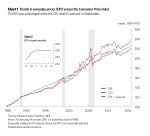

Price increases have accelerated over the past year as the 12-month change in the EPI has risen from 0.9 percent in June 2017 to the 2.3 percent pace last month. Over that same period, increases in the CPI have gone from 1.6 to 2.3 percent. Still, annualized price increases remain generally mild by historical comparison with the 20-year annualized gain in the EPI coming in at 2.6 percent through September 2018.