Pulling It All Together/Appendix

The Economy…

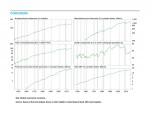

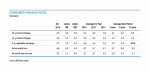

Steady improvements in consumer fundamentals combined with still-solid consumer expectations provide a positive outlook for holiday spending, which can make or break retailer earnings. The strength of fourth-quarter consumer spending is likely to play a critical role in sustaining overall economic growth. However, our Leaders index fell back to a neutral 50 in the latest reading, adding a note of caution to the outlook. Despite that decline, our cyclical score remains solidly positive, suggesting a relatively low risk of recession ahead.

…Inflation…

The CPI fell this month, the second back-to-back monthly decline this year. The latest AIER inflation Scorecard points to further downward pressure on inflation for the months ahead. Only seven out of 23 Scorecard indicators support rising inflationary pressure, while 14 suggest falling pressure. The decliners reflect many forces: demand and supply, money, banking and credit, and costs and productivity.

…Policy…

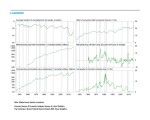

The Federal Reserve held off raising short-term interest rates at its October meeting. Yet, its follow-up public statement indicated that consideration of a hike will be on the table at the next meeting in December. Markets expect an increase, but some disappointing economic data have left room for doubt.

The CPI fell this month, the second back-to-back monthly decline this year. The latest AIER inflation Scorecard points to further downward pressure on inflation for the months ahead. Only seven out of 23 Scorecard indicators support rising inflationary pressure, while 14 suggest falling pressure. The decliners reflect many forces: demand and supply, money, banking and credit, and costs and productivity.

…Policy…

The Federal Reserve held off raising short-term interest rates at its October meeting. Yet, its follow-up public statement indicated that consideration of a hike will be on the table at the next meeting in December. Markets expect an increase, but some disappointing economic data have left room for doubt.

Congress adopted a budget bill that resolves immediate budget challenges. These include suspending the debt limit and setting parameters for government spending through September 2017. The measure also saves the Social Security disability program from collapse and limits for many Medicare participants an increase in Part B premiums that would have been the largest in history. But long-term fiscal challenges remain.

…Investing

Investors are favoring stocks over bonds as the prospect of interest rate increases tempers the outlook for returns on fixed-income securities.

While the plunge in crude oil prices has begun to affect U.S. production, current rates of refining and high gasoline inventory levels are still helping to push pump prices lower.

Retail stocks have been strong performers throughout the current cycle, and our economic outlook suggests continued support for fundamentals, but valuations may raise concerns.

New cash inflows into equities are tilted heavily toward foreign markets. Reallocation by both strategic (passive) and tactical (active) investors may be a primary cause.

Next/Previous Section:

1.Overview

6. Pulling It All Together/Appendix