Alexander W. Salter

Money and the Market Process

A market economy without money would not be able to achieve a division of labor sufficient to make it worthwhile.

Money as a Social Institution

If the language of commerce is quid pro quo, money is its grammar.

Case Study: The 2007-8 Financial Crisis

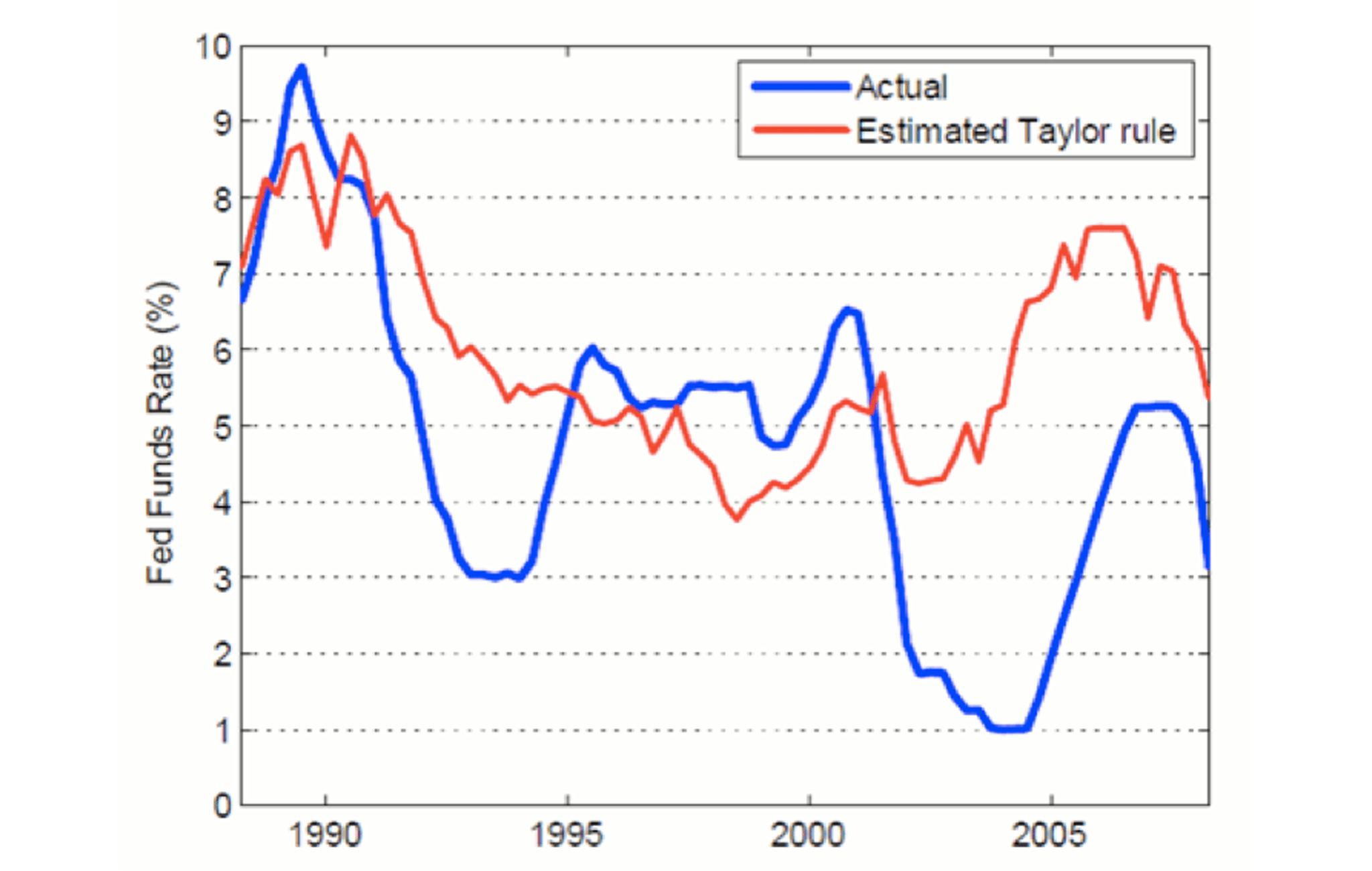

Through incentive and information problems, the Fed–rather than free markets–caused the 2007-8 financial crisis.

Discretionary Central Banking Is Information Incompatible

Discretionary central banking places immense information burdens on central bankers.

Discretionary Central Banking Is Incentive Incompatible

Central banking is the institutionalization of irresponsibility in monetary policy.

Modern Central Banking as Technocracy

The chief problem with modern central banking is that it’s discretionary.

Coinage and Fiscal Finagling

Coinage provided an easy-to-assess standard. It also presented a significant temptation for the fiscal authority.

Ancient Human Activity and the Necessary Conditions for Indirect Exchange

Chartalists are right: debt preceded money. But that fact doesn’t do the work they think it does.

Do the Origins of Money Matter?

A whirlwind tour through alternative theories would seem to suggest one fits much more comfortably with a pro-liberty worldview than another.

Money in Illiberalism

A liberal society is governed by the principles of private property and freedom of contract, under the aegis of a nondiscriminatory rule of law. In such a society, money enables […]