Inflation

|

The Fed is Responsible for Great Inflations

“It’s time the Fed accepts responsibility and moves decisively to curb inflation before the problem gets even worse. Volcker’s Fed whipped inflation, and Powell’s Fed can, too.” ~ Nicholas Curott & Tyler A. Watts

|

Prices Continue to Rise, Exceeding Fed Projections

“The Fed seems resolved to see inflation climb further. I expect FOMC members will revise up their projections of inflation again in June. They should revise their course of action, to bring inflation down as planned, instead.” ~ William J. Luther

|

Lessons From America’s First Great Inflations

“Today, the Federal Reserve and federal government serve as America’s Rhode Island, the money pump that keeps the money supply rising faster than money demand.” ~ Robert E. Wright

|

Supply Disturbances Do Not Explain High Inflation

“Unfortunately for the administration, their politically-convenient supply-side stories explain far too little. Today’s inflation is primarily the result of excessive nominal spending, which the Fed could have and should have offset.” ~ William J. Luther

|

Yes, the High Inflation Rates Will Continue in 2022

“A shift to a more restrictive monetary policy to control inflation is likely to result in a recession. One can only hope that the Fed is able to handle this transition better than it has handled the monetary policy of the recent past.” ~ James D. Gwartney & David Macpherson

|

Understanding the CPI

“Regardless of substitution, businesses have to use some commodities for production. With PPI inflation for all commodities at 24 percent, though that does not necessarily forecast a future CPI increase that high, it strongly suggests CPI inflation will continue to rise.” ~ Robert F. Mulligan

|

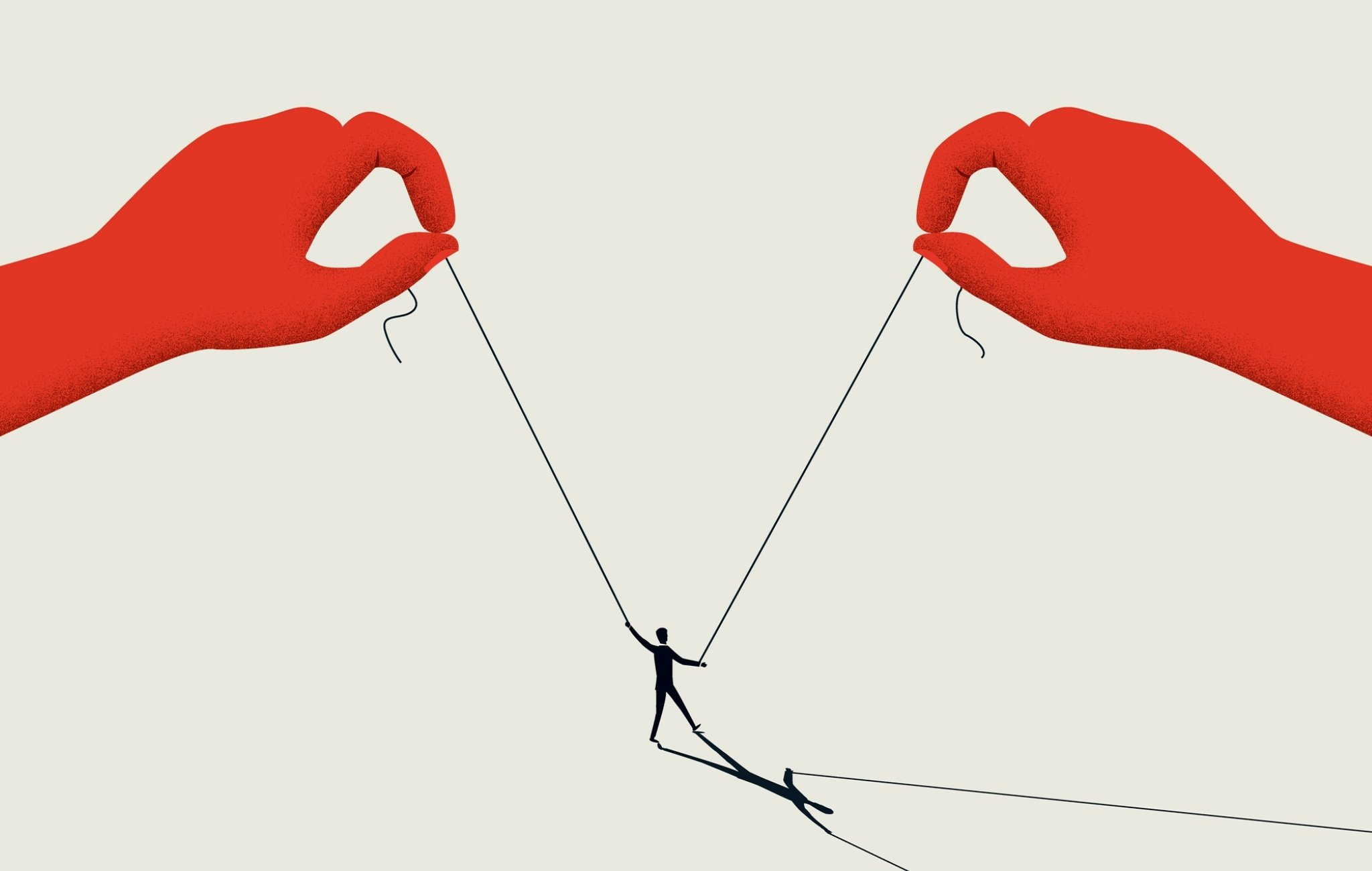

Inflation and the Meaning of Anything

“With the real actors and mechanisms of inflation hidden from public view by language, those who truly fuel it are free to carry on the same policies in relative obscurity and little-noted infamy.” ~ Laura Williams

|

Liberty Gardens

“Maybe America has hit rock bottom and the current travails will induce a return to limited government. Until then, though, I suggest that you remove the rocks from your own garden, and plant yourself some Liberty this spring, summer, and fall.” ~ Robert E. Wright

|

Wild Meat Markets

“Sensible deregulation worked for the airlines and their customers, is working for sex workers, and can work for America’s meat lovers too.” ~ Robert E. Wright

|

Has the Fed Abandoned Its Average Inflation Target?

“Despite affirmations to the contrary, the Fed appears to have abandoned its average inflation target. Excessive nominal spending has pushed prices well above the level consistent with the Fed’s average inflation target.” ~ William J. Luther

|

Government Debt and Inflation: Reality Intrudes

“Sooner or later, absent substantially lowering government spending or raising taxes, interest payments will overwhelm the government’s budget. The situation might even be termed a sovereign debt crisis.” ~ Gerald P. Dwyer

|

Americans Need a COLA, not a Coke

“With inflation now high and trending higher, with no end in sight, American workers, and their employers, need to bring COLAs back, arguably out of fairness to workers but really out of efficiency.” ~ Robert E. Wright