Summary

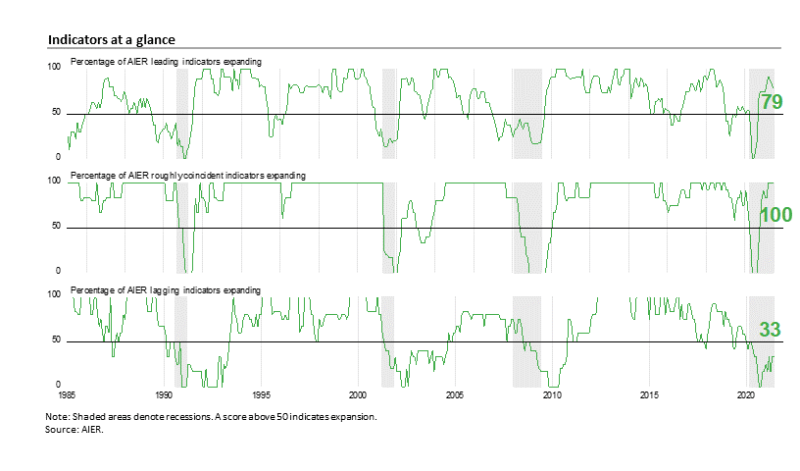

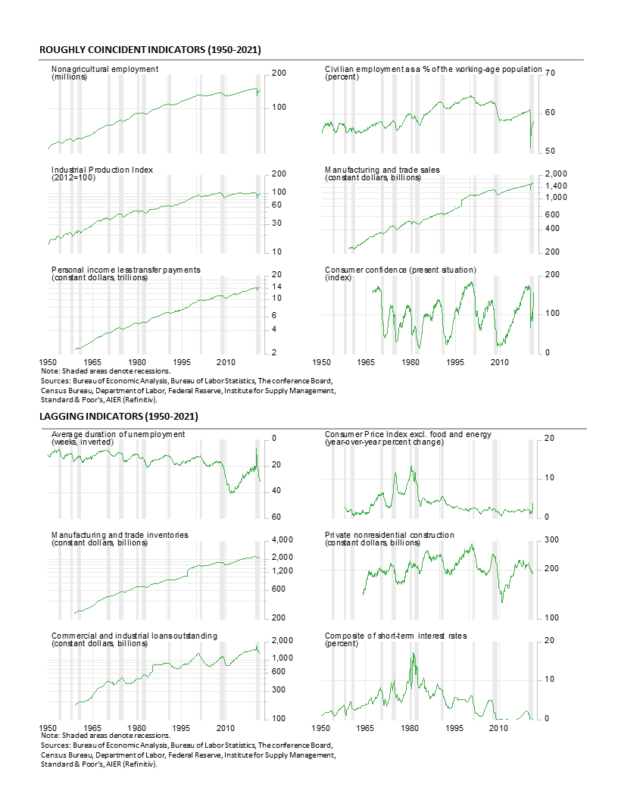

AIER’s Leading Indicators Index posted a third consecutive small decline in June, coming in at 79 versus 83 in May. Despite the pullbacks, the June result remains at a level consistent with solid economic growth and marks the tenth consecutive month above the neutral 50 level. The Roughly Coincident Indicators index held at 100 for a fourth consecutive month in June while the Lagging Indicators Index held at 33 for the second consecutive month (see chart). Overall, the latest results for the business cycle indicator indexes suggest continued economic expansion in the months ahead.

The cessation of restrictive government lockdown policies and reopening of the economy remain the driving forces behind the economic recovery. As restrictions are eased, economic activity increases.

Primary risks in the short term include difficult labor conditions, shortages of materials, lingering logistical issues, and rising prices. Furthermore, outbreaks of the Delta variant of the Coronavirus could worsen the supply issues and result in reinstatement of government restrictions or some retrenchment by some consumers. Despite the risks, the economic outlook remains tilted to the upside, but heightened awareness is recommended.

Leading Indicators Index Suggests Continued Economic Expansion

The AIER Leading Indicators index posted a third consecutive decline in June, decreasing to 79 from 83 in May, 88 in April, and 92 in March. The June result remains solidly above the neutral 50 threshold and suggests continued economic expansion in the months ahead.

Among the 12 leading indicators, nine were in a positive trend in June versus two trending unfavorably while one was trending flat or neutral. Just one leading indicator changed direction in June; total heavy truck unit sales, a measure of capital investment, fell from a positive trend to a neutral trend. However, real new orders for core capital goods, a broader measure of capital investment, remained in a positive trend.

The two unfavorable trends were in real new orders for consumer goods and the Treasury yield spread. The Treasury yield spread has been unfavorable for 18 months while the real new orders for consumer goods indicator has been unfavorable for just two months.

Overall, the Leading Indicators index remained above the neutral 50 level for the tenth consecutive month, suggesting continued expansion is likely. Over the last ten months, the leading indicators index has averaged 79.2, the highest level since January 2019. Government policies restricting consumers and businesses continue to be removed, supporting a recovery in economic activity. However, ripple effects from the lockdowns continue to disrupt labor supply, production, and logistics and transportation, resulting in scattered shortages of input materials and rising pressure on prices. These issues are likely to be resolved over time and unlikely to result in a 1970s-style price spiral.

The Roughly Coincident Indicators index held at a perfect 100 reading in June with all six individual Roughly Coincident indicators continuing to trend higher. The fourth consecutive month of perfect results follow four months of readings in the 83 to 92 range and are the first four-month string of perfect scores since 2017. The Roughly Coincident Indicators index has been above the neutral 50 level for nine consecutive months, posting an average reading of 88.9, the highest since May 2019.

AIER’s Lagging Indicators index held a reading of 33 in June and is the eighth consecutive month in the 17 to 33 range. Those eight months follow back-to-back readings of zero in September and October 2020 and mark the 14th consecutive month below 50. The average over the last 13 months is 22.7. Overall, four indicators were still trending lower, while two indicators were trending higher, and none were in a neutral trend.

Manufacturing Sector Sees Strong Demand but Struggles with Labor and Materials Shortages and Rising Input Prices

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index fell to 60.6 in June, a drop of 0.6 points over the 61.2 percent result in May. June is the 13th consecutive reading above the neutral 50 threshold and fifth consecutive month above 60. Over the past 12 months, the Purchasing Managers’ Index has averaged 59.1, the highest since November 2018. The survey results suggest that the manufacturing sector continues to expand at a robust pace.

Among the key components of the Institute for Supply Management’s most recent survey, the New Orders Index came in at 66.0 percent, down 1.0 percentage point from 67.0 percent in May. The New Orders Index has been above 50 for 13 consecutive months and above 60 for 12 consecutive months. The 12-month average is 64.9, the highest since September 2004. The new export orders index, a separate measure from new orders, rose to 56.2 versus 55.4 in May. The new export orders index has been above 50 for 12 consecutive months.

The Production Index registered a 60.8 percent result in June, up from 58.5 percent in May. The index has been above 60 for 11 of the last 12 months. The 12-month average is 62.4, the highest since December 2004.

The Employment Index fell in June, losing 1.0 percentage points to 49.9 percent in June. The employment index had been one of the weaker components during the recovery from government-imposed lockdowns but had posted six consecutive months above 50 before the June result. Many of the respondents in the survey noted labor difficulties with worker absenteeism, and difficulty attracting and retaining workers.

The Backlog-of-Orders Index eased back from the record-high 70.6 percent in May, coming in at a still-high 64.5 percent for the month. The results suggest manufacturer’s backlogs continue to rise but at a somewhat slower pace compared to May.

Customer inventories in June are still considered too low, with the index coming in at 30.8 percent versus 28.0 percent in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 57 consecutive months. Insufficient inventory may be a positive sign for future production.

The net percentage of manufacturers saying that prices for input materials are increasing rose in June, coming in at 84.1 versus 75.9 in May. Rising input costs reflect shortages of materials, often related to production issues as well as logistical and delivery problems. The sharp rise in input costs may squeeze profits at some manufacturers while others may be forced to pass along price increases to customers.

Supplier deliveries slowed again in June, though the pace slowing was less than in May as the index declined to 75.1 from 78.8. The Supplier Deliveries Index has been driven higher by difficulties hiring new workers, longer delivery times for raw materials, higher prices for inputs, product shortages, and logistical challenges relating to transportation.

Overall, demand for the manufacturing sector remains robust but labor difficulties and logistical problems have restrained the ability to meet that demand. It may take some time for supply to catch up with demand.

Services-Sector Survey Points to Continued Expansion in June

The Institute for Supply Management’s composite services index decreased to 60.1 in June, dropping 3.9 points from 64.0 in the prior month. The index remains solidly above neutral and suggests the 13th consecutive month of expansion for the services sector and the broader economy.

Among the key components of the services index, the business-activity index (comparable to the production index in the ISM manufacturing report) decreased to 60.4 in June, down from 66.2 in May, but still a strong result. This measure has been above 50 for 13 consecutive months and above 60 for the last four months. For June, 16 industries in the services survey reported expansion versus two reporting contraction.

The services new-orders index decreased to 62.1 from 63.9 in May, a drop of 1.8 points from May. Similar to the activity index, new orders have been above 50 for 13 months and above 60 for the past four months – a strong performance overall. For June, 16 industries reported expansion in new orders in June while one reported a drop.

The new-export-orders index, a separate index that measures only orders for export, dropped to 50.7 in June versus 60.0 in May. Six industries reported growth in export orders against eight reporting no change and four reporting declines.

Backlogs of orders in the services sector likely grew as the index increased to 65.8 percent from 61.1 percent. Backlogs of orders have grown for 12 of the past 13 months. Fourteen industries reported higher backlogs in June while four reported a decrease.

The services employment index came in at 49.3 in June, down from 55.3 in May and the first drop below 50 since December. Twelve industries reported growth in employment while two reported a reduction. The report notes that survey respondents are reporting that it is “increasingly difficult to find qualified candidates to fill open positions” and “employees have been somewhat slow to return to work, and there has been turnover as some pursue new opportunities in a hot job market.”

Supplier deliveries, a measure of delivery times for suppliers to nonmanufacturers, came in at 68.5, down from 70.4 in the prior month. It suggests suppliers are falling further behind in delivering supplies to services businesses, but the slippage has decelerated from the prior month. The slower deliveries are a result of labor constraints, production difficulties, and transportation problems. Seventeen industries reported slower deliveries in June.

The prices index continues to reflect labor and logistical issues that are restraining supply as demand surges following the easing of government lockdown restrictions. The prices paid index fell to a still-very-high 79.5, down from 80.6 in May. Seventeen industries reported paying higher prices for inputs in June while just one reported lower prices.

The latest report from the Institute of Supply Management suggests that the services sector and the broader economy expanded again in June. Several respondents to the survey mentioned robust levels of activity but also increased price pressures and materials shortages, particularly related to supply chain, logistics, and transportation issues as well as labor difficulties.

Job Openings Inch Up to Another Record High in May

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the total number of job openings in the economy rose to 9.209 million in May, up from 9.139 million in April. The number of open positions in the private sector increased to 8.305 million in May, up from 8.263 million in April. Both measures are at new highs.

The total job openings rate, openings divided by the sum of jobs plus openings, held at a record 6.0 percent in May while the private-sector job-openings rate remained at a record 6.3 percent.

Four industry categories have more than 1.4 million openings each: education and health care (1.646 million), trade, transportation, and utilities (1.638 million), professional and business services (1.491 million), and leisure and hospitality.

The highest openings rates were in leisure and hospitality (9.0 percent), professional and business services (6.7 percent), education and health care (6.5 percent), manufacturing (6.2 percent), and trade, transportation, and utilities (5.7 percent).

The rise in private job openings was a function of hires, separations and changing labor requirements. Private hires in May totaled 5.619 million versus 5.661 million in April. At the same time, the number of private-sector separations fell to 5.035 million in May, down from April’s 5.478 million. Within separations, private quits were 3.438 million (versus 3.810 million in April) and layoffs were 1.299 million, down from 1.365 million in the prior month.

The total separations rate fell to 3.7 percent from 4.0 percent in the prior month with the private sector experiencing a rate of 4.1 percent, off 0.4 percentage points from 4.5 percent in April.

Labor Market Recovery Continues but Full Recovery Could Be a Year Away

U.S. nonfarm payrolls added 850,000 jobs in June after a gain of 583,000 in May. April and May had net upward revisions of 15,000. The June gain is the sixth in a row and 13th in the last 14 months, bringing the six-month gain to 3.256 million and the 14-month post-plunge recovery to 15.598 million. This is still well below the 22.362 million combined loss from March and April of 2020, leaving nonfarm payrolls 6.764 million below the February 2020 peak. If payrolls continue to grow at the average over the last six months (542,667), it may take another year to fully recoup all of the job losses.

Private payrolls posted a 662,000 jobs gain in June after a 516,000 gain in May. The two prior months had a net upward revision of 31,000. The June rise in private payrolls is also the sixth in a row and 13th in the last 14 months. The June addition brings the six-month gain to 2.872 million and the 14-month recovery to 15.584 million versus a combined loss of 21.353 million in March and April of 2020, leaving private payrolls 5.769 million below the February 2020 peak. If private payrolls continue to grow at the average over the last six months (478,667), it would also take a year to fully recoup all of the job losses.

The breadth of gains for June was positive but still dominated by a few industries. Within the 662,000 gain in private payrolls, private services added 642,000 while goods-producing industries added 20,000. For private service-producing industries, the gains were led by a 343,000 surge in leisure and hospitality (following gains of 306,000 in May, 328,000 in April, 227,000 in March, and 413,000 in February), a 72,000 rise in business and professional services (with 33,000 in temporary help jobs), 67,000 new jobs in retail, and a 59,000 gain in education and health care services.

Within the 20,000 gain in goods-producing industries, construction was down 7,000, durable-goods manufacturing increased by 18,000, nondurable-goods manufacturing fell by 3,000, and mining and logging industries added 12,000.

Despite the ongoing recovery, nearly all private industry groups still have fewer employees than before the government lockdowns. Three industries – Leisure and hospitality (down 2.181 million jobs), education and health services (down 1.028), and professional and business services (off 633,000) – are down more than half a million jobs each.

On a percentage basis, the losses are more evenly distributed. Five of the 14 private industries shown in the report have declines of 4 percent or more since February 2020. Leisure and hospitality leads with a 12.9 percent drop since February 2020, mining and logging comes in second with an 8.7 percent loss followed by information services at 6.1 percent, manufacturing at 4.4 percent, and education and health services at 4.2 percent. For the labor market as a whole, total nonfarm payrolls and private payrolls are down 4.4 percent since February 2020.

The government sector added 188,000 employees in June, with local government payrolls rising by 124,000, state government payrolls up 69,000, and the federal government cutting 5,000 workers.

Average hourly earnings rose 0.3 percent in June, putting the 12-month gain at 3.6 percent. The average hourly earnings data should be interpreted carefully, as the concentration of job losses for lower-paying jobs during the pandemic distorts the aggregate number.

The average workweek fell to 34.7 hours from 34.8 in May. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls gained 0.6 percent in June. The index is up 10.5 percent from a year ago.

The total number of officially unemployed increased by 168,000 in June to 9.484 million. The unemployment rate rose to 5.9 percent while the underemployed rate, referred to as the U-6 rate, fell to 10.2 percent in June. In February 2020, the unemployment rate was 3.5 percent while the underemployment rate was 9.8 percent.

The participation rate was unchanged in June, coming in at 61.6 percent versus a participation rate of 63.3 percent in February 2020. The labor force has shrunk by about 3.5 million people since January 2020.

The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 58.0 for June, unchanged versus May but well below the 61.1 percent in February 2020.

The June jobs report shows another strong gain in private payrolls. There were increases in most industries though most of the total gain came from just three industries. Despite the sixth consecutive monthly gain, the labor market remains well below peak measures from before the pandemic.

Everyday Prices Rise at the Fastest Annual Pace Since 2011

The AIER Everyday Price Index increased by 0.8 percent in May, the sixth consecutive gain following back-to-back decreases in October and November. The most recent rise puts the 12-month gain at 6.5 percent, the fastest pace since September 2011.

The positive contributors to the May rise were led by motor fuels prices, up 4.1 percent and contributing 43 basis points – half of the total gain, followed by household fuels and utilities (up 0.9 percent for the month and contributing 11 basis points), food away from home (up 0.6 percent for the month and contributing 10 basis points), food at home (groceries), up 0.3 percent and adding 7 basis points, and domestic services (up 6.4 percent for the month while contributing 6 basis points).

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 0.7 percent in May, and also the sixth consecutive increase. Over the past year, the Everyday Price Index including apparel is up 6.5 percent, the fastest since September 2011. Apparel prices rose 0.2 percent on a not-seasonally-adjusted basis in May, the fourth increase in the last five months. From a year ago, apparel prices are up 5.6 percent.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.8 percent on a not-seasonally-adjusted basis in May. Over the past year, the Consumer Price Index is up 5.0 percent, the fastest pace since August 2008. The Consumer Price Index excluding food and energy rose 0.7 percent for the month (not seasonally adjusted) while the 12-month change came in at 3.8 percent.

After seasonal adjustment, the CPI rose 0.6 percent in May while the core increased 0.7 percent for the month. Within the core, core goods prices were up 1.8 percent in May and are up 6.5 percent from a year ago while core services prices rose 0.4 percent for the month and are up 2.9 percent from a year ago. Among the notable increases in the core CPI were used car and truck prices, up 7.3 percent for the month, accounting for about a third of the seasonally-adjusted increase in the total CPI. Other gainers include food – at home and at restaurants – as well as car and truck rentals, household furnishings and operations, new vehicles, airline fares, and apparel.

Like many measures of activity within the economy, many prices continue to be distorted by lingering effects from government restrictions on consumers and businesses that are causing shortages, logistical and supply chain problems, and labor problems. As activity returns to normal, supply and demand will adapt and likely lead to slower price increases, but it may take some time before the economy completely returns to normal functioning.

Industrial Output Rose in May on Broad Gains; Capacity Utilization Remains Low

Industrial production rose 0.8 percent in May, the seventh gain in the last eight months. Manufacturing output, which accounts for about 75 percent of total industrial production, increased 0.9 percent, the sixth gain in the last eight months. Over the past year, total industrial output is up 16.3 percent while manufacturing output is up 18.3 percent. Both total industrial output and manufacturing output remain just slightly below their pre-pandemic levels.

Mining output accounts for about 12 percent of total industrial output and posted a 1.2 percent increase in the latest month. Over the last 12 months, mining output is up 16.5 percent.

Utility output, which is typically related to weather patterns, is also about 12 percent of total industrial output, and increased 0.2 percent for the month following a 1.9 percent increase in April. From a year ago, utility output is up 3.6 percent.

Among the key segments of industrial output, energy production (about 25 percent of total output) gained 1.0 percent for the month and is up 11.0 percent from a year ago.

Motor-vehicle production (about 5 percent of total output), one of the hardest-hit industries during the lockdowns and now suffering through a semiconductor chip shortage, jumped 6.7 percent in May following a 5.7 percent drop in April. Motor-vehicle production is up 140.8 percent compared with May 2020. Total vehicle assemblies rose to 9.85 million at a seasonally-adjusted annual rate. That consists of 9.58 million light vehicles and 0.27 million heavy trucks. Within light vehicles, light trucks were 8.00 million while cars were 1.58 million.

High-tech industries output rose 1.5 percent in May and is up 18.1 percent versus a year ago. High-tech industries account for just 2.2 percent of total industrial output.

All other industries combined (total excluding energy, high-tech, and motor vehicles; about 68 percent of total industrial output) gained 0.4 percent in May and are 13.3 percent above May 2020.

Total industrial utilization rose to 75.2 percent in May from 74.6 percent in April. That is still well below the long-term (1972-2020) average utilization of 79.6 percent. Manufacturing utilization rose 0.7 percentage points to 75.6 percent, also still well below the long-term average of 78.2 percent.

Industrial output posted a solid gain in May despite the ongoing difficulties with labor, logistics, and materials shortages. Many of these issues are likely to be resolved in the coming months and quarters, easing some of the upward pressure on prices. Substantial excess capacity is one reassuring factor in the outlook for prices.

Outlook Remains Positive

The U.S economy continues to show significant progress on the path to recovery. The AIER Leading Indicators index posted its tenth consecutive month above the neutral 50 threshold, suggesting continued expansion in coming months. The Roughly Coincident Indicators index posted a fourth consecutive 100 reading, confirming the strengthening economic recovery.

Fading government restrictions are boosting economic activity. However, the rebound in demand continues to outpace the recovery in supply as ongoing labor difficulties including a lack of qualified workers, absenteeism, temporary shutdowns, and inability to retain talent, have led to production shortages and logistical and transportation problems. These shortages are putting upward pressure on prices, but a 1970s-style price spiral remains unlikely.

The emergence of the Delta variant could worsen the supply issues and lead to renewed government restrictions on consumers or businesses. It could also lead to some retrenchment by consumers if the perception is that the Delta variant represents a significant health risk. Careful monitoring is warranted.

Research-Reports-July-cream