Problems of the global economy do rarely result from trade, but mainly come from the existence of state currencies, among which the US dollar has a prominent position. Since the abolishment of the gold standard during the First World War more than a hundred years ago, there is no longer a natural international currency in general use, as it was before with gold and silver.

Many of the evils that the critics attribute to globalization are due to the role which national currencies play in the international economy. The international economic system suffers from the contradiction between private companies and national currencies. Private business must operate in international trade in a monetary environment of currencies that are in the hands of states and under the authority of governments and their agencies.

Currency War

‘Currency war’ denotes an economic policy that uses the exchange rate as a tool to gain a competitive advantage over other countries in the pursuit of national goals. After the gold standard was abandoned, the governments gained a free hand to manipulate their exchange rates. The period between the two world wars experienced the contraction of international trade and the industrialized countries suffered extreme impoverishment. When President Hoover signed the Smoot-Hawley Tariff Act into law in 1930, the fall into a deep and long depression began.

After the end of the second world war, the Bretton Woods global currency system wanted to put an end to currency manipulation and installed a fixed exchange rate system. Yet different from plans to make gold the prime anchor, the Bretton Woods System put the US-dollar into the center. When the United States abused its privilege and swamped the world with dollars, the system broke down. In the early 1970s, the move to flexible exchange rates started. A new period of currency manipulation began.

Although the relative position of the United States in the world economy has declined since the end of the Second World War, around two thirds of the allocated international currency reserves are still held in US dollar. With the US-dollar as the benchmark and the most important reserve currency, the other countries have tried to gain competitive exchange rates by accumulating US-dollars.

In the meantime, almost every country has obtained an exchange rate that is undervalued in terms of the purchasing power to the US-dollar. Whereas the exchange rate manipulation could not bring a steady competitive advantage of a single currency against the other non-US countries, the process of competitive devaluation has led to the general overvaluation of the US-dollar against most of the other currencies in the world.

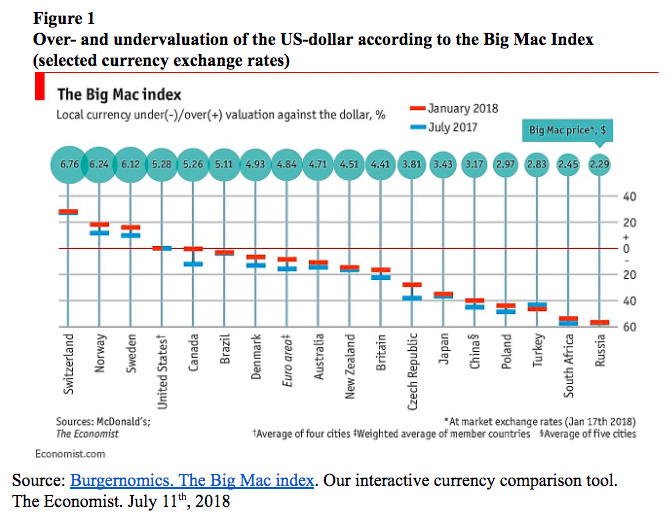

An illustrative example of the situation shows the so-called Big Mac Index of the journal The Economist which uses the price of McDonald’s Big Mac hamburger as a benchmark for a currency’s purchasing power. As shown below (Figure) 1, only Switzerland, Norway, and Sweden have an overvalued exchange rate against the dollars while all other currencies (the whole table lists over fifty countries) have undervalued exchange rates against the US-dollar.

Beyond those shown in the graph (Figure 1), other extreme cases of undervaluation according the Big Mac Index are Egypt (-68.2 %), Taiwan (-58.8 %), Mexico (53.3 %), Argentina (50.9 %).

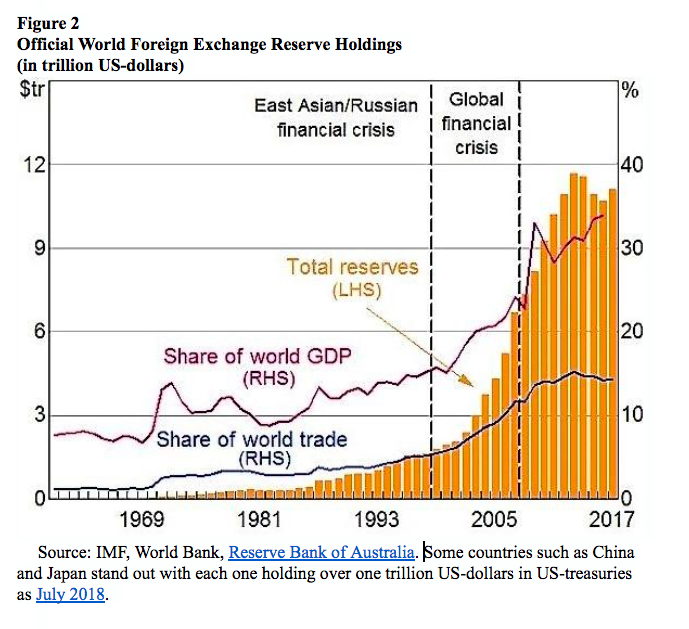

To keep the exchange rate undervalued, the monetary authority must intervene in the currency markets. To make its currency cheap, the country’s central bank or its treasury must buy up the foreign currencies that enter through the country’s exports. If the payment is in US-dollars, the treasury or central bank can use the money and buy the American government bonds right away. These acquisitions then show up as this country’s international reserves and for the United States they constitute a foreign debt.

In the case that the country’s exporters earn foreign exchange other than the US-dollar, the monetary authority that wants to hold the country’s exchange rate competitive will change the foreign currency into US-dollars and then buy American treasury bonds and accumulate foreign exchange reserves.

This means, for example, that when the Chinese exporter should be paid in a foreign currency other than the U.S. dollar (let’s say in Australian dollars), the Chinese central bank will exchange the Australian dollars into American dollars and thereby contribute to the dollar’s overvaluation and to the undervaluation of the Australian dollar.

Likewise, if a Brazilian exporter gets paid in Argentinean pesos, the Brazilian central bank will exchange the Argentinean pesos in the international currency markets against US-dollar and thereby contribute to the undervaluation of the Argentinean peso against the US-dollar. By this procedure, the overall amount of international reserve holdings rose from one trillion in the 1980s to over ten trillion in 2017 (see figure 2).

Economic Nationalism

International trade is the natural extension of local and national trade. Yet economic nationalism wants to stop the extension of trade at the border. This doctrine holds that the benefits of more trade only happen within the country’s borders and that external trade is more harmful than beneficial. In its extreme form, the doctrine of economic nationalism calls for a closed economy. Under complete autarky, the nation would produce all the goods it consumes within the country and has no commercial relations with the rest of the world.

While generally the negative effects of economic nationalism are less pronounced in a large country, no country is so large that its abstention from international trade would not have detrimental effects for the wellbeing of its citizens. Trade barriers mean that the national companies are less exposed to foreign competition. For the consumers, protectionism means higher prices, lower diversity of products, and less innovation. The loss of productivity that comes with protectionism implies a lower wage level.

Managed trade means that the government intervenes into the free market with the aim of warding off specific imports and to favor the export of specific goods. Sometimes, managed trade forms part of a development strategy as it the case with the project of ‘import substitution’ and the ‘export-led growth’ strategy.

Managed trade and currency manipulation go often hand in hand. Such a government that wants to discriminate against imports and favors the country’s exports does not only intervene in the goods markets but also in the foreign exchange market. When such a country devalues its currency, its exports become cheaper on the international market while the imports from abroad become dearer on the national market. In addition to that, trade policy targets specific goods or types of goods for imports and exports.

Most of these trade policy measures are ineffective as they are difficult to implement as intended, lead to unforeseen consequences and provoke retaliation. Instead of gaining specific benefits of an individual nation, all countries lose.

How To End the Currency War

Not countries trade but individual companies. International trade does not mean that the countries trade with each other but that companies that are in different countries exchange goods across their borders. Not Germany or the United States export and import, but companies that reside in Germany or the United States exchange the goods and services.

Production takes place in factories where specialization and productivity gains happen. The more a company forms part of the global economy and the more business gets involved in international competition, the better the companies can specialize and thus increase their productivity. More world trade allows more specialization. More specialization leads to rising productivity. Higher productivity leads to an increase in income.

Yet this market-based exchange of goods that knows no frontiers, takes place in an environment of national currencies under the authority of states. Money as the legal tender is linked to a state. In this sense, the euro is also a national currency. These states or regions have their own agenda and interests. In the hands of these entities, the currency is an instrument not for global trade but in the battle for dominance and hegemony. The same way that a government uses trade policy to sanction an adversary, governments use their currencies in the international political arena.

By doing so, governments damage the global system of the division of labor. In as much as commerce increases the level of wealth, governments destroy the potential of wealth creation. Instead of mutual benefit, international trade and the exchange rate become an instrument of conflict.

The way out of the dilemma and to resolve the problem that is posed by the existence of national currencies under state authority, is to use private money at a global scale. Gold once served this purpose and could again. Further, the new electronic monies, like Bitcoin for example, are not bound to a specific state or nation.