Electricity is among the most-regulated sectors of the U.S. economy. A century of public-utility regulation of entry and rates has given way to new suites of government intervention. Wholesale electricity is centrally planned in most states, creating a contrived retail market. At the same time, government policies have increasingly displaced thermal generation (natural gas, oil, coal, and nuclear) with intermittent wind and solar power, requiring costly battery storage.

Today, a growing number of regions are subject to rising power rates, conservation appeals, and service interruptions. The Great Texas Blackout of February 2021 caused hundreds of deaths from a lack of heating and other services, not to mention a hundred billion dollars in damages. California, which in 2000–2001 suffered shortages that closed businesses and schools, endures “green” electricity rates at double the national average. Other states and regions are pursuing policies that portend similar results.

Economic discoordination can inconvenience, disrupt, and even kill. But this threat to reliable, affordable electricity is not the result of market failure but government failure, abetted by expert error from the knowledge problem and by politicization.

Regulated Electricity

For more than a century, electricity has been regulated as a “natural monopoly.” In recent decades, the interconnected network for delivering electricity (“the grid”) has been regulated as a “commons.”1 A forced transition to wind and solar, driven by Big Green, has created a perfect storm of cost increases and service instability. This statist tsunami begs for a nongovernmental alternative.

§ § §

Natural monopoly theory postulates situations where one firm exhausts economies of scale, buying competitors to achieve a dominant, least-cost position. The natural progression from inefficient duplication to singular control leaves one firm able to “exploit” consumers.

“It is everywhere acknowledged that the multiplication of wires overhead is a crying evil and danger,” one reformer wrote in 1889. “Can there be any doubt that it is the height of folly to continue, and that the only rational way of entrusting electric service to incorporated companies is to permit but a single company to operate in a district and control prices by some other means than competition?”2

Some 80 years later, economist Alfred Kahn described “acceptable performance” for the “regulated monopoly” as entailing “control of entry, price fixing, prescription of quality and conditions of service, and the imposition of an obligation to serve all applicants under reasonable conditions.”3 The quid pro quo of franchise protection for the firm in return for rate maxima authorized by a central authority became known as the regulatory compact.

§ § §

Traditional public-utility regulation of electricity has been joined in recent decades by a more comprehensive regulatory regime: a centrally planned wholesale power market predicated on mandatory open access (MOA) in transmission, from which “competition” in both generation and distribution could emerge. To get the power to homes and businesses, interstate regulation by the Federal Energy Regulatory Commission (FERC) in the mid-1990s has been joined by intrastate MOA, beginning in California (1996) and Texas (1999).4

Under so-called retail wheeling, the franchised utility retained its transmission monopoly with “unbundled” rates capped at cost plus a reasonable return (per public utility regulation). But the utility has had to allow outside generators and retailers access to its wires, creating rivalry to the (former) vertically integrated, franchised utility.

This regime is neither deregulation nor a waystation to deregulation. Mandatory access violates private property rights by taking away control from (utility) owners. “What’s Yours is Mine,” two free market critics of this “infrastructure socialism” wrote.5

Second, the vital link of transmission remained under strict public utility regulation.

Third, a government entity is required to plan and coordinate the de facto socialized grid. What was done before by the utility—buying, transporting, and selling power under “the obligation to serve”—is coordinated by employees of the Independent System Operator or Regional Transmission Organization over multiple utility areas. ISO/RTOs go far beyond the engineering control of grid operations; they determine takes, pricing, and release.6

The seven central agencies are shown in Figure 1, with traditional regulation governing in the Northwest, Southwest, and Southeast (approximately all or part of 17 states).

Source: Federal Energy Regulatory Commission

The vaunted “competition” under MOA is artificial, contrived, raising the problem of over-entry and wasted resources compared to what would emerge in a real free-market discovery process.

§ § §

“But nothing is so permanent as a temporary government program,” Milton and Rose Friedman wrote in 1983.7 The government-led push for wind and solar power to compete as grid electricity demonstrates this insight.

Operationally proven in New York as far back as the 1880s, wind turbines and solar panels are not infant industries. Being dilute and intermittent (the sun does not always shine, nor the wind perpetually blow), both were uneconomic and undesired to generate electricity, when compared to more reliable, dispatchable electricity, beginning with coal and hydro, and continuing much later with oil and natural gas.

Today’s wind-power boom can be traced to the Energy Policy Act of 1992, which introduced a sizeable tax credit for each kilowatt-hour generated. Set to expire in 1999, the credit has been extended 14 times. The tax benefit has even allowed wind producers to offer negative prices, paying people to take electricity. Such inverted economics has caused the premature retirement of reliable means of power production and an absence of new entry into the field, setting up the grid for reliability issues at times of peak demand or unforeseen events.

Federal solar subsidies date from 1978 with 15 extensions. The boom dates to the EPAct of 1992, which tripled the Investment Tax Credit (ITC) to cover 30 percent of solar installation costs.

Duplicating the grid with higher-cost, unreliable generation is a successful lobbying story explained by the phenomenon of concentrated benefits, diffused cost, and by the politics of Baptists (environmentalists) and Bootleggers (wind and solar firms). Government policy in these instances has created major industries that would have had only niche applications, such as solar off the grid.

Grid control by ISO/RTOs has simplified the entry of wind and solar over large regions. Outsized tax preferences, federal must-take provisions, and the low marginal cost ensured rapid entry of the very electricity that was more expensive and less reliable. The climate politics of decarbonization is prominent in the seven control regions.

A Free Market, Regulatory Takeover

A free market in electricity is defined as the absence of government ownership, control, or regulation. Electricity and government are separate, apart from legal protection against force or fraud. Government neutrally upholds the enforceability of private contracts and other market norms under the rule of law.

Private ownership and control direct each industry phase, from generation to transmission to final delivery and usage. Entry, exit, pricing, and other terms of service are not state-prescribed in a free-market setting. Industrial organization (such as vertical or horizontal integration) is not restricted. Trade-group coordination and interfirm cooperation are free from antitrust scrutiny. Beyond that, a market discovery process would determine the particulars of the industry.

Classical liberalism cautions against government direction and control, from outright socialism (municipal ownership); to franchise protection and cost-based rate ceilings (public-utility regulation); to mandatory open access for outside parties (an uncompensated taking); to renewable requirements (the forced energy substitution of wind and solar).8

§ § §

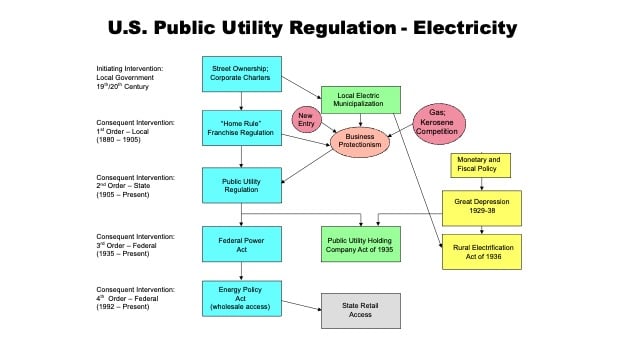

History offers strong evidence in favor of free markets versus governmental control of electricity. The problems of regulating and planning in a political hotbox has resulted in a century of expanding intervention, from local to state to federal (see Figure 2).

The free-market electricity era — the result of human action but not of human design — dates from the industry’s inception until the advent of public-utility regulation. “Regulation by competition” lasted decades: in New York from 1882 to 1905; in Illinois from 1881 to 1914; and in California from 1879 to 1911.9

The market era was characterized by declining rates, expanding usage, and reliable service.10 “Sell your product at a price [that] will enable you to get a monopoly,” intoned the father of modern integrated electricity service (and Thomas Edison’s protégé), Samuel Insull, prior to public-utility regulation in his state.11

Insull’s “cut-and-try” and “ridiculously low” rate policy consolidated and expanded Chicago’s market, a model that he took to the suburbs and then the countryside.12 His territory secured, this so-called natural monopolist sought to “do everything to bring down the cost of production … to serve the public as to obtain and retain its good will.”13

The market process was never over after a firm consolidated an area by replacing small, inefficient “dynamos” with large central-station generators and erecting downstream transmission to reach varied and distant users. Competition for the market was a process, not an endpoint.

Insull exploited economies of scale, from “massed production” to the “gospel of consumption.” The all-important load factor — the average utilization of generation and transmission equipment — required filling the valleys of usage between the peaks. Central-station profitability, not to mention reliability, was guided by two-part pricing whereby users paid a special surcharge for the machinery to stand ready for their surge in demand. Utilities interconnected their grids (the “superutility”) to improve load factors with less investment.14 All this as if led by an invisible hand.

The physics of electricity guided market entrepreneurs. Vertical and horizontal integration reflected economies of scale and scope with a commodity that had to be consumed the moment it was generated. Reliability had to be unfailing. Electrified homes and wired offices could not go dark and silent. Elevators and streetcars could not be stranded. Emergency battery storage entered the mix in the mid-1890s, however expensive, to avoid the human and financial costs of blackouts.15

Market-directed integrated operations resulted in unprecedented affordability and continuous, coordinated service. Responsibility was under one roof with the capital of that (large) firm at risk from blackouts. True, few-to-no independents in generation, transmission, or distribution could compete against the “natural monopoly.” Yet highly coordinated multiphase operation, evident in petroleum and natural gas (in a free market), was required by the uniqueness of electricity. Governmental franchise protection was not necessary.

Grid electricity was never considered a common-pool resource at odds with definable private property rights and efficient operation. The “commons” theory of governmental organization arose only with the government-mandated open-access transmission, itself a clear violation of private property rights. During the market era of electricity, large control or balancing areas (from scale economies) were within the firm, not outside it.

Utility-Led Regulation: Unnatural Monopoly

Scale economies and consolidation greatly diminished firm-on-firm rivalry. But “exploitation,” in which a natural monopolist withheld supply or increased prices for its captive customers, was not documented. “The economic theory of natural monopoly is exceedingly brief and… exceedingly unclear,” economist Harold Demsetz would later note. It “fails to reveal the logical steps that carry it from scale economies in production to monopoly price in the marketplace.”16

In fact, the “natural monopolists” turned to unnatural monopoly via statewide public-utility regulation. In a landmark 1898 address before the National Electric Light Association (now, Edison Electric Institute), Samuel Insull of Chicago Edison Company called for a middle way between “municipal socialism” and “acute competition.”

The competitive franchise, he complained, “frightens the investor, and compels corporations to pay a very high price for capital.” An “inevitable” consolidation ends the economic waste of duplicate facilities. The solution was the quid pro quo of exclusive franchises for rate regulation.

The best service at the lowest possible price can only be obtained [via] exclusive franchises … coupled with the condition of public control requiring all charges for services fixed by public bodies to be based on cost, plus a reasonable profit…. The more certain [franchise] protection is made, the lower the rate of interest and the lower the total cost of operation will be, and, consequently, the lower the price of the service to public and private users.17

Rates were declining and service rapidly expanding without such regulation. There was no “market failure,” much less notable ratepayer discontent. Industry leaders had to manufacture the demand for regulation with public relations campaigns and lobbying efforts.18

Insull and fellow industry leaders desired to block new entrants and secure better profit under cost-of-service regulation. But a primary concern was averting potentially punitive local regulation and the threat of municipalization.19 The political economy of prior regulation leading to new regulation was in evidence.

Regulatory Failure and Expansion

Statewide commissions regulating electricity as a public utility began in Massachusetts (1887), New York (1905), and Wisconsin (1907). The intellectual and industry fervor for such control resulted in 35 more states joining by the early 1920s.20

Adopted as a Progressivist ideal, impartial experts set out to implement “scientific” regulation based on determinable data. But subjectivity intervened, and the legal monopolists “learned how to regulate regulation.”21 The utilities gamed cost-of-service regulation by maximizing (inflating) the rate base. And they escaped the jurisdiction of state commissions via intercompany or interstate transactions.

“The early proponents of state regulation,” noted economist John Bauer, “thought that they had found the way to harness private monopoly to the public advantage.” Instead,

regulation has been discouragingly ineffectual. It has not furnished the extent and regularity of protection to consumers as expected…. Worst of all, it permitted the perversions of organization and management in the electric power industry during the 1920s which created further barriers to satisfactory regulation.22

A widely recognized breakdown of regulation led to ever-widening intervention.23 Two major New Deal laws were enacted in 1935. The Federal Power Act expanded public-utility regulation to interstate commerce, empowering the Federal Power Commission (now the Federal Energy Regulatory Commission). The Public Utility Holding Company Act barred electric (and gas) holding companies from owning separate properties in different states. Horizontal integration was limited to one contiguous property. Major divestments of gas and electric companies followed.24

Plugging regulatory gaps with widening intervention (local to state to federal) was the order of the day (see Figure 2). Reliance on “regulation by competition” was politically forgotten.25

Source: Author graphic

Classical Liberal Retort

Utility regulation was scarcely challenged until the 1960s when free-market economists re-examined the case for market failure and “corrective” government intervention.

In Capitalism and Freedom, Milton Friedman advocated “private unregulated monopoly wherever this is tolerable.”26 George Stigler sided with imperfect markets, comparing theory to practice. “The merits of laissez-faire rest less upon its famous theoretical foundations than upon its advantages over the actual performance of rival forms of economic organization,” he concluded.27

Harvey Averch and Leland Johnson explained gold-plating, a process by which firms under public-utility regulation are incentivized to artificially (uneconomically) enlarge the rate-base upon which their regulated rate of return is calculated.28 More capital investment, greater profit. With a depreciating rate base upon which to apply the allowed rate of return, over-investment was encouraged to maintain profitability. Retaining obsolete equipment on the books was one strategy; contracting for nuclear plants despite the risk of construction delays and inflated costs proved to be another.

Harold Demsetz’s “Why Regulate Utilities?” (1968) provided a signpost for free market competition. He argued that rivalry for one franchise provided competition for the field. Multiple firms, in other words, could bid to win monopoly rights where the benefits of scale economies would be reflected in rates and other terms of service.

Buyers, along this line of reasoning, could organize as a monopsony to contract against a singular firm already in operation. Sans regulation, third-party entrepreneurs could sign-up ratepayer blocs to counter a single-seller utility and to avoid “exploitation.” Lawyers and consultants would have a niche, free-market style, to effectuate self-regulation, the government demoted.

“[T]he rivalry of the open marketplace disciplines more effectively than do the regulatory processes of the commission.” Demsetz ended: “If the managements of utility companies doubt this belief, I suggest that they re-examine the history of their industry to discover just who it was that provided most of the force behind the regulatory movement.”29 Indeed, it was not consumers but the to-be-regulated, with experts in tow, that lobbied for and received the regulatory compact.

Not only Chicago School economists questioned natural monopoly as a pretext for public utility regulation.30 Business economist Walter Primeaux Jr. documented firm-on-firm rivalry, defined as “situations where two electric companies serve the same city and consumers have a choice of being served by one firm or the other.”31 Almost 50 cities were identified as being in the not-so-natural-monopoly situation. Otherwise, interfuel competition for different energy services existed between natural gas, propane, electricity, and oil.

Austrian-school economics also dissented against market failure and public-utility regulation. “A ‘public utility’ industry does not differ conceptually from any other, and there is no nonarbitrary method by which we can designate certain industries to be ‘clothed in the public interest,’ while others are not,” wrote Murray Rothbard in 1962.32 Competition itself was not about the number of firms (even if there were only one) but about the conditions of legal entry and exit and of unhampered operation otherwise.

A classical liberal view explained the inherently competitive market process. Competition could entail direct rivalry with duplicate facilities, or it could be a single firm maintaining a market against potential rivals. Either way, the private and public costs of government intervention could be bypassed and market signals established.

This tradition was popularized in a book of essays edited by Robert Poole Jr., Unnatural Monopolies: The Case for Deregulating Public Utilities (1985). Capital over-investment and regulatory lag were just two problems impeding “modernization and more responsible service,” the introduction explained.33

Infrastructure Socialism: Mandatory Open Access

Rate-base malincentives (higher profits from overcapitalization) reached their apogee with the delays and cost overruns associated with nuclear power plants, itself a government-enabled industry.34 Large commitments for nuclear by utilities in the 1960s resulted in unprecedented problems in the 1970s, even in-construction cancellations. Meanwhile, rapidly improving natural-gas-fired generation created a large disparity between the marginal cost of power generated by the new plants versus the utility’s inflated, average cost of power.

With federal legislation in the Public Utility Regulatory Policies Act of 1978 (PURPA) subsidizing independent power producers, particularly gas-fired cogeneration, customer groups lobbied for cheaper electricity that could be transported by the utility under cost-capped rates. This sparked enthusiasm among economists and regulators for the aforementioned mandatory open access, whereby utilities were mandated to open their (rate-regulated) wires to third parties between the generating plant and the consumer. The Energy Policy Act of 1992 prescribed such interstate “wheeling,” as did subsequent state-level initiatives for last-mile (retail) access.35

MOA demoted utility planning and service to the authority of government regarding the who, what, where, and how much of power—and over multiple utility areas. ISO/RTO centralized power pools allowed nouveau firms to buy and sell the commodity. Continued public utility regulation of transmission-distribution (“quarantining the monopoly”) solidified franchise protection, while taking away the incentive of pure profits for improvement.

Economic calculation has bedeviled ISO/RTOs. For the firm, two-part pricing (demand charge and volumetric charge) enabled meeting peak demand profitably. But for central planners entrusted with system-wide reliability, different options have proven difficult, and even destructive. Some regions have implemented “capacity charges” to reward generators for standby capacity. Others have banked on “energy only” prices, betting that ample capacity would be incited by periodic price windfalls. Each one-size-fits-all replaced a tailored, less centralized customer charge.

Consumer welfare and “the obligation to serve” have been lost in the transition to central planning, as well as in the governmental quest for decarbonization. Worse, agency errors (such as Texas’s panicked increase in energy-only pricing in February 2021) have been protected by sovereign immunity.

Free-Market Reform

A free market in electricity would terminate the current provisions of landmark federal statutes, such as the Power Act of 1935, Public Utility Holding Company Act of 1935, Public Utility Regulatory Policies Act of 1978, Energy Policy Act of 1992, Energy Policy Act of 1995, and Inflation Reduction Act of 2022. Repeal of public utility regulation would be required on the state level, including Texas’s Public Utility Regulatory Act of 1975, Public Utility Regulatory Act of 1995, and Electric Restructuring Act of 1999.

The above reforms would remove the electricity functions of the Federal Energy Regulatory Commission (née Federal Power Commission) and the Securities and Exchange Commission, as well as, in Texas, the Public Utility Commission and the Electric Reliability Council. Quasi-governmental bodies such as the North American Electric Reliability Corporation and the National Association of Regulatory Utility Commissioners would be reorganized along private lines—or terminated.

Explained another way, a free-market reform agenda would remove:

- Franchise protection, rate regulation, and entry or exit rules

- Transmission edicts on the federal and state level

- Industry-structure limitations

- Tax subsidies and other preferences for nuclear, wind, solar, batteries, etc.

- Restrictions on voluntary arrangements between firms (antitrust law)

A true free market based on private property rights puts profit-seeking entrepreneurs, not regulators and planners, in charge of the production, transmission, and distribution of electricity. Firms would be contractually subject to consumers or their representatives. Malincentives increasing rates, as well as the expenses associated with third-party government, would cease.

Of the army of experts and planners under political electricity, some would become employees or consultants for the market-empowered firms or represent consumer blocs negotiating with these firms. With central planning and regulatory minutiae demoted, freed resources and expanded entrepreneurship would propel the process of creative destruction in search of improved rates and other terms of service.

Conclusion

The free market did not fail to deliver its benefits in the opening decades of commercial electricity. Entrepreneurs, although hampered by government, successfully served homes, businesses, and industries. The overall result was an undesigned order, rewarding providers and consumers alike.

The turn to public-utility regulation was political, not economic. A naïve belief in effectual control gifted new powers to state government, but solutions proved illusory as intervention created new problems. Regulators were not impartial, and complicated questions about “prudent” costs and “reasonable” profits became flash points. When statewide efforts were stymied, federal regulation was resorted to, itself leading to questions about the forgone alternative of free-market provision.

Inflated utility rate-bases created a large cost discrepancy that mandatory open access purported to deliver to consumers. But central planning, coupled with government-enabled integration of wind and solar generation, has left ratepayers and the economy with the worst of all worlds.

Free-market electricity rests on time-honored theoretical and evidential foundations. Yet the classical-liberal alternative to heavy-handed regulation has been ignored (not refuted) for more than a century. A fundamental rethink and subsequent policy reform promises to lower rates, ensure reliability, and free resources for the rest of the economy—a win for virtually everyone but a political constituency that would, deservedly, melt away.

[1] The common-pool resource (CPR) argument for government planning is put forward by L. Lynne Kiesling, Deregulation, Innovation and Market Liberalization: Electricity Regulation in a Continually Evolving Environment (New York: Routledge, 2009), chapter 8.

[2] Charles Whiting Baker, Monopolies and the People (New York: G. P. Putnam’s Sons, 1889), pp. 66–67. By the 1920s, the question was how best to regulate. See, for example, Charles Stillman Morgan, Regulation and the Management of Public Utilities (Boston, MA: Houghton Mifflin, 1923).

[3] Alfred Kahn, The Economics of Regulation: Principles and Institutions (Cambridge, MA: The MIT Press, 1970, 1995), vol. 1, pp. 3, 11.

[4] This intervention was predated by nineteenth-century common-purchaser and common-carrier laws enacted on the political strength of crude oil producers at the expense of pipelines. Robert L. Bradley Jr., Oil, Gas, and Government: The U.S. Experience (Lanham, MD: Rowman & Littlefield, 1996), pp. 118–119, 609–18. MOA with interstate natural gas pipelines also predated that for electricity. Robert L. Bradley Jr., “The Distortions and Dynamics of Gas Regulation,” in New Horizons in Natural Gas Deregulation, ed. Jerry Ellig and Joseph Kalt (Westport, CT: Praeger, 1996), pp. 16–19.

[5] Adam D. Thierer and Clyde Wayne Crews Jr., What’s Yours Is Mine: Open Access and the Rise of Infrastructure Socialism (Washington, DC: Cato Institute, 2003).

[6] In terms of political economy, these agencies perform “noncomprehensive planning,” as opposed to full government ownership and control. Don Lavoie, National Economic Planning: What Is Left? (Cambridge, MA: Ballinger Publishing, 1985), pp. 3–4.

[7] Milton and Rose Friedman, Tyranny of the Status Quo (New York: Harcourt Brace Jovanovich, 1983), p. 115.

[8] End-use mandates and conservation regulation would be another intrusion outside of self-interested market actions in the electricity sector. Demand would be regulated by price and contracts, not government policy.

[9] Before statewide regulation, municipalities issued franchises and often prescribed maximum rates. But not all did, and utilities generally had room to work under the rate constraints. Legal challenges and meager enforcement also defined, relatively speaking, the free-market era of electricity.

[10] Robert Bradley, Jr. “The Origins of Political Electricity: Market Failure or Political Opportunism?” Energy Law Journal 17, no. 1 (1996), pp. 60–61, 70.

[11] Samuel Insull, “Sell Your Product at a Price Which Will Enable You to Get a Monopoly,” in Central-Station Electric Service: Selected Speeches, 1897–1914 (Chicago, IL: Privately Printed, 1915), p. 116.

[12] An Insull biographer described the strategy as “one part quality service, two parts hard selling, and three parts rate cuts.” Forrest McDonald, Insull (Chicago, IL: University of Chicago Press, 1962), p. 104. See Robert L. Bradley Jr., Edison to Enron: Energy Markets and Political Strategies (Hoboken, NJ: John Wiley & Sons; and Salem, MA: Scrivener Publishing, 2011), pp. 71–72.

[13] Samuel Insull, “The Obligations of Monopoly Must Be Accepted,” in Central-Station Electric Service, p. 122.

[14] Bradley, Edison to Enron, pp. 71–77.

[15] Bradley, Edison to Enron, p. 90.

[16] Harold Demsetz, “Why Regulate Utilities?” The Journal of Law and Economics 11, no. 1 (April 1968), p. 56.

[17] Insull, “Standardization, Cost System of Rates, and Public Control,” June 7, 1898. Reprinted in Insull, Central-Station Electric Service, p. 45.

[18] The effort of Insull (and Theodore Vail on the telephone side) to sway public opinion toward regulation involved “editorial boilerplate services, the dispatching of mangers to become leaders of community groups, the production of ghostwritten articles, and the alteration of school textbooks.” See Marvin N. Olasky, Corporate Public Relations: A New Historical Perspective (Hillsdale, NJ: Lawrence Erlbaum Associates, 1987), chapter 4.

[19] Bradley, Edison to Enron, pp. 86–88.

[20] Robert L. Bradley Jr. “The Origins of Political Electricity,” pp. 65–66.

[21] William E. Mosher et al., Electrical Utilities: The Crisis in Public Control, ed. Mosher (New York: Harper & Bros., 1929), p. 1.

[22] John Bauer and Peter Costello, Public Organization of Electric Power: Conditions, Policies, and Programs (New York: Harper & Brothers, 1949), pp. 37–38.

[23] See Bradley, “The Origins of Political Electricity,” pp. 81–82.

[24] Douglas W. Hawes, Utility Holding Companies: A Modern View of the Business, Financial, SEC, Corporate Law, Tax, and Accounting Aspects of Their Establishment, Operation, Regulation, and Role in Diversification (New York: Clark Boardman Co., 1987), at 2-18.

[25] Bradley, “The Origins of Political Electricity,” pp. 75–76, 77–78, 78–82.

[26] Milton Friedman, Capitalism and Freedom (Chicago, IL: University of Chicago Press, 1962), p. 155.

[27] George J. Stigler, “Monopoly,” in The Fortune Encyclopedia of Economics, ed.David R. Henderson (New York: Warner Books, 1993), p. 409.

[28] Harvey Averch and Leland L. Johnson, “Behavior of the Firm Under Regulatory Constraint,” American Economic Review 52, no. 5 (1962): 1052–69.

[29] Demsetz, “Why Regulate Utilities?”, p. 65.

[30] Demsetz, “Why Regulate Utilities?”, p. 55. Richard A. Posner, Natural Monopoly and Its Regulation (Preface of the 30th Anniversary Edition. Washington, DC: Cato Institute, [1969], 1999), p. vi.

[31] Walter J. Primeaux Jr., Direct Electric Utility Competition: The Natural Monopoly Myth (New York: Praeger, 1986), p. ix.

[32] Murray Rothbard, Man, Economy and State: A Treatise on Economic Principles (Los Angeles, CA: Nash Publishing, 1962), pp. 619–20.

[33] Robert W. Poole Jr., editor. Unnatural Monopolies: The Case for Deregulating Public Utilities (Lexington, MA: Lexington Books, 1985). One chapter was by Primeaux, who had been introduced to Poole by Gordon Tullock, a founder of the Public Choice school.

[34] In the 1950s, commercial nuclear plants required liability caps (the Price Anderson Act of 1957); five years of free enriched uranium from the Atomic Energy Commission; and a push by state and federal officials for utilities to enter nuclear contracts under the protection of public-utility regulation (for cost passthrough and a profit).

[35] See Paul L. Joskow, “The Difficult Transition to Competitive Electricity Markets in the United States,” in Electricity Deregulation: Choices and Challenges, ed. James M. Griffin and Steven L. Puller (Chicago, IL: University of Chicago Press, 2005), pp. 31–97. For the original 2003 version of Joskow’s paper, see here.