Growing Pains

Robert Lucas won the Nobel Prize in economics in 1995 for his pioneering work in developing the New Classical theory of the business cycle. But despite his success in writing on business cycle theory, Lucas himself was not convinced that he was directing his efforts to their highest-valued use. In his article “On the Mechanics of Economic Development,” Lucas (1988) argued that economists should focus their energy on answering the question: how can we raise the economy’s growth rate?

Avoiding or mitigating recessions is certainly a worthy goal. But, as anyone familiar with the logic of exponential growth knows, raising the economy’s annual growth rate has a far greater impact on long-run growth than ironing out the business cycle. As Lucas famously summarized it: “The consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about [growth], it is hard to think about anything else” (Lucas 1988, p. 5).

After being fixated on business cycle theory for much of the past decade, however, many macroeconomists have shifted their focus back to economic growth. In particular, they’ve focused on perhaps the most important issue macroeconomists today have to grapple with: why has economic growth been so stagnant since the Great Recession, and why are most forecasts of future growth in the developed world so dim relative to their pre-crisis projections?

Paul Krugman addressed this “Great Shortfall” in a recent blog post: “The Economic Future Isn’t What It Used to Be.” “It’s true that U.S. unemployment is back below what it was before the crisis,” he wrote. “But … we’ve returned to sort-of full employment at a much lower level of real GDP than informed people projected we’d reach before the crisis struck.” Krugman concludes that much of the blame for the “hysteresis” — the idea that severe recessions and extensive periods of high unemployment have a long-lasting impact on labor markets and worker productivity, which in turn depresses future growth — the economy has endured since 2009 is the result of policy makers’ unwillingness to embrace even-higher deficits and more-expansionary fiscal policies. He refers to the mindset that governments are still subject to budget constraints and hence cannot continue to rack on ever-escalating deficits even in the midst of a recession as the “Austerity Delusion.”

Other economists have taken their turn at explaining the causes of these depressed projections of future growth in the wake of the global financial crises. In a widely cited NBER paper entitled “The Permanent Effects of Fiscal Consolidation,” Larry Summers and Antonio Fatas (2016) laid much of the blame for our dim economic outlook at the feet of “self-defeating fiscal consolidations” — namely, the fiscal tightening that many nations engaged in starting around 2010. Ball (2014, p. 7) provided empirical evidence suggesting that there were “strong hysteresis effects,” particularly in nations that adopted austerity measures. Conversely, nations like Australia that embraced strong fiscal stimulus, he argued, emerged from the crisis “almost unscathed.” Like Krugman, then, these economists pin the lion’s share of the blame on the alleged outbreak of fiscal austerity.

Was fiscal austerity really the primary culprit for our depressed economic outlook?

In short, no. In most cases, to borrow from Mark Twain, the report of the demise of expansive fiscal policy was “greatly exaggerated.” .

Take Britain, for example. Krugman and others spent years lashing out against “savage” budget cuts. Perception and reality, however, have proved to be two different things. The British government did, in fact, reduce spending. But as Tom Clougherty at the Adam Smith Institute rightly noted, these cuts weren’t spending cuts in the way that you or I might think of them. They were only “cuts” relative to the baseline models of future spending growth. In other words, they were reductions in projected future spending, not cuts in present spending.

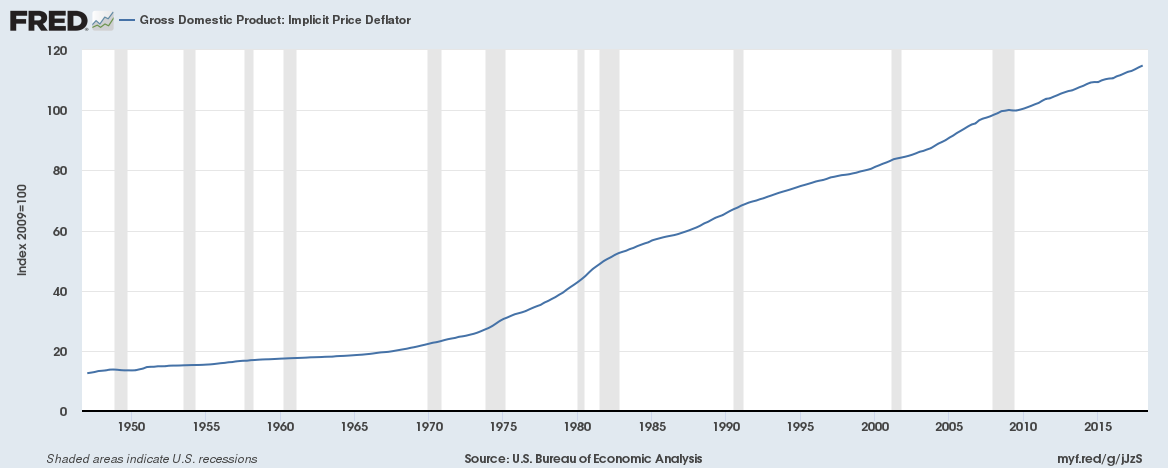

Moreover, the magnitude of these cuts was fairly trivial. Indeed, even when measured in real (i.e., inflation-adjusted) terms, British government spending rose each year during the alleged Dark Ages of “self-defeating fiscal consolidation.” To be fair, deficit doves would contend that cuts in current and future spending relative to expected spending growth do indeed have a contractionary impact in the present. This is why Krugman was quick to predict economic doom in Britain and the United States when relatively conservative parties were ushered back into power under the mantra of reining in deficits.

Did the British or U.S. economy founder due to fiscal austerity? Far from it. As Scott Sumner rightly pointed out at the time, any negative impact these austerity measures might have had on aggregate demand could (and should) have been offset by expansionary monetary policy. Of course, Krugman could respond that this “monetary offset” (the idea that fiscal policy is relatively impotent when monetary policy is potent) doesn’t apply if the economy is stuck in a “liquidity trap.” In that case, monetary policy is supposedly impotent because the central bank has already pushed interest rates to the zero lower bound. But as Sumner and others argued (including Ben Bernanke prior to his time as Fed chairman), monetary policy is still potent even when interest rates are driven near zero. Besides, the economy was hardly in a liquidity trap in 2011–12.

Elsewhere I have written about monetary offset. As I point out in that piece, Krugman seems perfectly willing to accept the logic of the monetary offset when it comes to trade wars, but not so much when it comes to his go-to of expansionary fiscal policy.

Did the limited fiscal constraint that nations like the United States and Britain engaged in translate into the sort of disaster Krugman predicted? Not at all. In fact, the British and U.S. economies grew at a faster pace than most other OECD nations — particularly ones in the Eurozone, where expansionary monetary policy wasn’t maintained. The same storyline holds in many other nations that Krugman and others allege engaged in “savage” cuts.

Did nations that engaged in large-scale fiscal expansion perform better? Again, the evidence appears to be somewhere between weak and nonexistent. Take Australia, for instance, the nation that Ball (2014, p. 7) highlighted as an example of how more-aggressive fiscal expansion could counter anemic growth. Even in the depths of the Great Recession, Australia’s budget deficit never exceeded 4.2 percent of GDP. In the United States, the budget deficit exceeded 10 percent of GDP in 2009–10. It seems, then, that the reasons for Australia’s relative success had to do with heavier trade with Asia than with the United States and Europe, and weak financial ties with the latter two, not extraordinarily aggressive deficit spending.

The sluggish recovery and bleak outlook of economic growth have little to do with fiscal austerity. They are more likely the result of the bad monetary and fiscal policies that created the mess in the first place.