Is Demand to Hold Money Stable?

The equation of exchange tells us that the value of money expenditures must equal the value of goods purchased with these expenditures. More specifically, it tells us that the quantity of money in circulation (M) times the average number of times each unit of money is spent (V) is equal to the quantity of actual products purchased (y) times their average price (P): MV = Py.

As an accounting identity, the truth of the equation of exchange is indisputable. What has come under dispute is the stability of V, which is the inverse of demand to hold money on reserve. John Maynard Keynes issued the challenge to the assumption of stable velocity in his General Theory. He went so far as to say that under conditions of high uncertainty, individuals have an infinite demand to hold money. If new money is issued by the central bank, Keynes claimed, it would not be spent under these conditions. This is equivalent to saying that V will collapse unless some party can be found to spend new money on productive activities.

Keynes’s claim struck against traditional assumptions of monetary theory. If V is not stable, in particular if it is subject to collapse absent intervention, then the traditional assumption of monetary theory that money creation tends to be inflationary is fallacious. However, a long history of inflations that result from money printing — such as under John Law in early 18th-century France, the colonial government in the United States during the American Revolution, the revolutionary government in France (which devalued the assignat), the belligerent nations that left the gold standard and began printing money during World War I, and many regimes in developing countries that have turned to money creation as a means of funding state activity — suggests that Keynes’s prediction was incorrect, if not also his theory of money demand.

Interpretation of monetary conditions has been hampered by difficulties inherent in measuring the money stock and its velocity. As I have pointed out before, schemes of sterilization in recent years as well as under the gold standard have weakened the link between the level of prices and the size of the monetary base. Sterilization is a policy specifically aimed at taking base money out of circulation — in other words, reducing the average velocity of money.

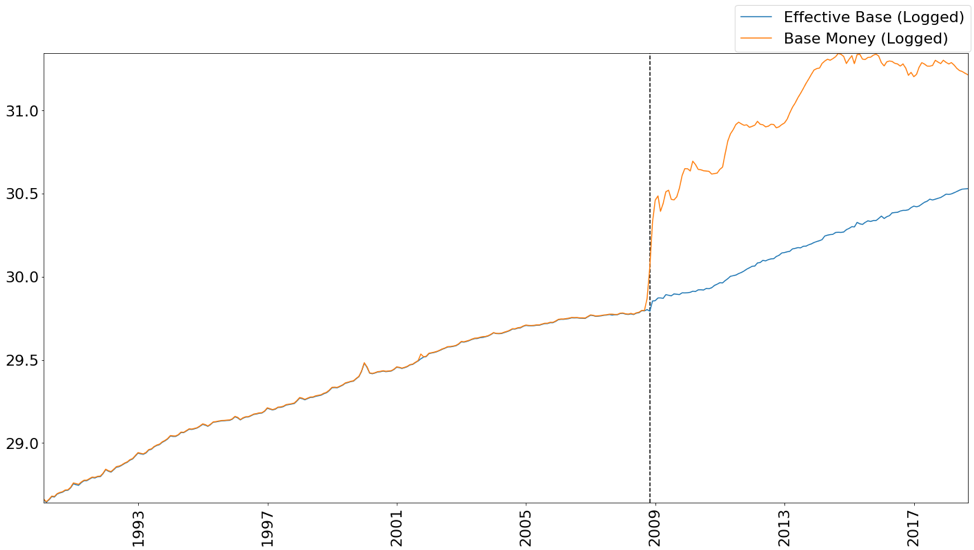

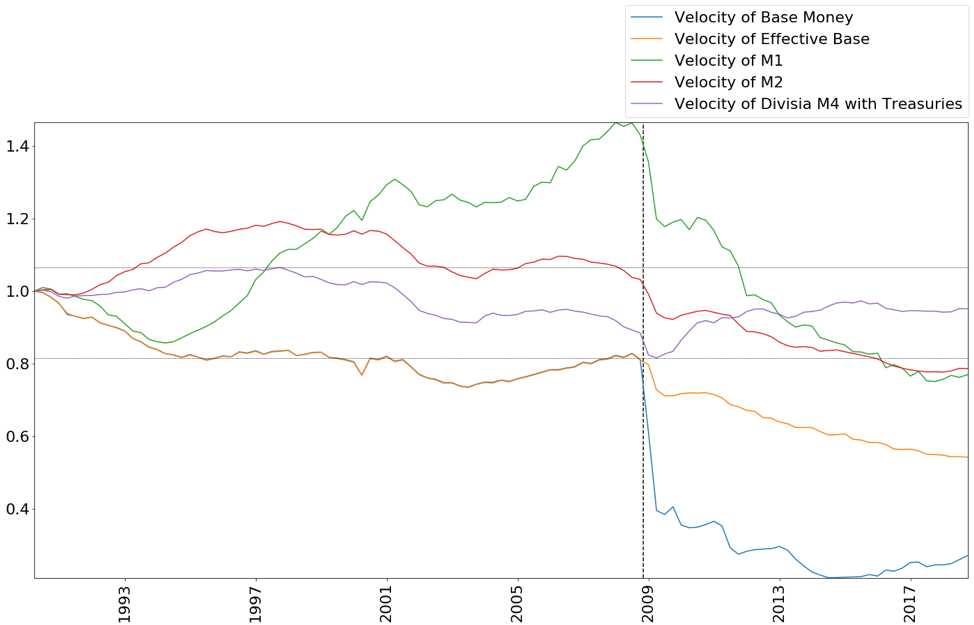

The velocity of the base was falling moderately before the crisis in 2008 and collapsed afterward. The collapse was due to the decision by the Bernanke-led Federal Reserve to begin paying interest on excess reserves, which prevented the massive expansion of the base money stock from entering circulation. Even aside from that sterilization, the rising reserve requirements stipulated by Basel III, which started to be enacted during the crisis, also lowered the velocity of the effective base, defined as the portion of the monetary base that remained in circulation. For these reasons, use of the monetary base is inadequate for observing the stability of velocity.

The graph below shows the distinction between the stock of base money and the stock of effective base money, with the difference between the two representing the quantity of funds removed from circulation as they collect interest from the Federal Reserve.

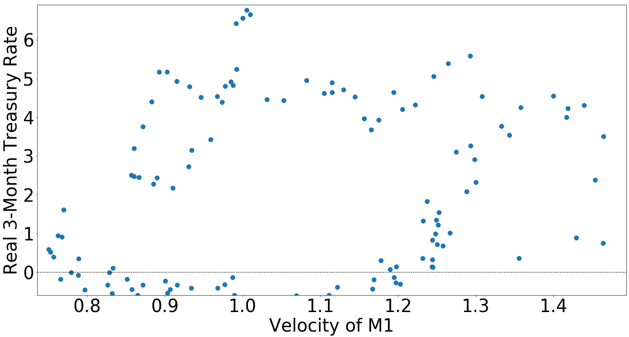

Even velocities of M1 and M2, traditional monetary aggregates that include different forms of savings (largely in fractional-reserve banks and money market mutual funds), lack a history of constrained and normally distributed values. The velocity of M1 fluctuates wildly while M2 shows a downward trend similar to the effective base. Economic theory suggests that velocity is a function of the interest rate: demand to hold money falls as the return on other assets rises. We can check correlations between these aggregates and the rate paid on three-month Treasuries to find support for a theory of stable velocity. If velocity is a function of the interest rate, then the velocity of money should be randomly distributed about a mean that increases as interest rates rise. The plot of M1 is not randomly distributed about a mean that changes in sync with the interest rate. Either velocity is not stable or M1 is a poor approximation of the total stock of money (see chart below). A similar plot of M2 would show the same sort of structure.

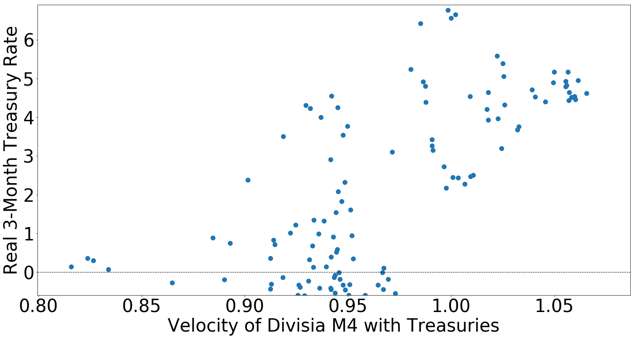

As a comparison, I checked the velocity of the Divisia monetary aggregates, which attempt to measure the total weighted value of the money stock using a cost basis, against the real interest rate. Estimates from the Divisia aggregates show both stability and a significant amount of randomness when plotted against the real interest rate (see below chart).

In spite of Basel III and interventions by the Federal Reserve, the Divisia aggregates suggest a highly stable velocity of money, as indicated in the plot of the data against time by the horizontal dotted lines (see chart below). These lines represent the range of velocity for this money stock. A comparison of Divisia velocity and the real interest rate shows that observations of the value of velocity are randomly distributed around a relatively stable mean as the real interest rate increases.

Claims that velocity is unstable do not hold up when one controls for changes in conditions driven by monetary policy and when one observes an accurate approximation of the total money stock. Without stable demand for base money, due largely to policy manipulation, the outcomes predicted by the equation of exchange are difficult to observe. The Divisia monetary aggregates suggest that the equation of exchange is still a reliable guide to monetary theory and a useful apparatus for interpreting monetary policy.