I just read Ben Bernanke’s “The Federal Reserve and the Financial Crisis.” The book was actually published in 2013, and it contains his 2012 lectures at George Washington University. It contains four well written lectures that cover the history of the U.S. Federal Reserve and the 2008 financial crisis. Some of the complexities of the 2008 are clearly exposed.

However, what called my attention was the strength that monetary policy and theory blinders can have. Some of the blinder’s effects are not new. One example: to depict the gold standard as a system that fixes the price of gold and consists of an international fixed exchange rate regime. This is very common misrepresentation of the gold standard. First, in this monetary regime gold, not the dollar, is money. The dollar, as a convertible banknote is a gold substitute. Therefore there is no fixing of the price of gold. This is similar to arguing that writing a check is fixing the price of the dollar. For a similar reason there is no fixed exchange rates. This is to confuse what is money and what is a substitute under gold standard. All countries in the gold standard network use the same currency, gold. There is no pegging of the exchange rate in gold standard just as there is no pegging of the Euro in the Euro area. Different would be the case of fixing the exchange rate between gold and silver (two different currencies.) Using again the check example, to argue that the gold exchange means an international fixed exchange rate regime is like arguing that there is a fixed exchange rate between two checks convertible to dollars that were issued by different banks. This is to confuse a price (exchange rate) with a parity or conversion relation.

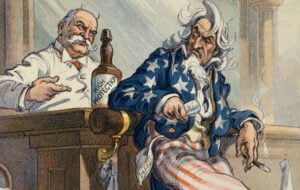

These issues are not new. But the blinder that caught my attention the most was an unobserved tension between the first two lectures and the last two. The first describe how financial instability (and gold standard instability as well) requires the presence of a central bank to smooth the economy, avoid crisis, etc. This depiction is in the borderline of being a Nirvana Fallacy, where the real world limitations of a market institutions compete with the unreal an ideal perfect central bank. The other lectures, however, show all the limitations, problems, and unawareness that the Federal Reserve has traditionally faced. And it also shows all the costly mistakes that the Federal Reserve has committed more than once. As an example, in the 2008 crisis the Fed allowed nominal income to fall in a similar fashion that it did in the Great Depression. Not even the big mistakes were avoided.

Monetary blinders can make us see problems that are not there, and remain blind to serious issues that are actually there.