Bryan Cutsinger

Rethinking the Fed’s Framework: Lessons from the Post-Pandemic Inflation

The paper evaluates alternative frameworks and argues that the Fed should adopt either a nominal spending target or a symmetrical average inflation target.

Fed Holds Rates Steady Amid Economic Uncertainty

Yesterday, the Federal Reserve’s monetary policy committee kept the target range for its policy interest rate at 4.25 to 4.5 percent, unchanged since December 2024. The decision came as no […]

Waller Isn’t Flinching at Tariff Inflation — Here’s Why

In a recent speech delivered in Seoul, South Korea, Federal Reserve Governor Waller offered unique insights into how monetary policymakers should think about the effects of tariffs on both inflation […]

Fed Holds Steady as Tariff Storm Looms

The Federal Reserve’s monetary policy committee left the target range for its policy rate unchanged at 4.25 to 4.50 percent at its May 7 meeting, maintaining the level set in […]

Despite Uncertainty, Fed Holds Rates Steady

The Federal Reserve’s monetary policy committee left the target range of its policy rate unchanged at its March meeting on Wednesday. It has remained at 4.25 percent to 4.50 percent […]

Powell’s Revisionist History of Inflation Targeting

At a recent press conference, Federal Reserve Chair Jerome Powell claimed that the Fed’s flexible average inflation targeting (FAIT) framework did not contribute to the post-pandemic inflation surge. There was […]

Powell’s Revisionist History of Inflation Targeting

At a recent press conference, Federal Reserve Chair Jerome Powell claimed that the Fed’s flexible average inflation targeting (FAIT) framework did not contribute to the post-pandemic inflation surge. There was […]

Stop Blaming Algorithms: Political Scapegoats Won’t Fix Housing Problems

According to an issue brief recently released by the Council of Economic Advisers, dynamic pricing algorithms are reducing competition in the housing market. The brief’s authors contend that landlords who […]

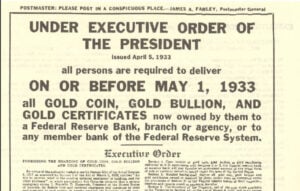

The Fed’s Gold Standard Confusion

Why did the United States abandon the gold standard? In an article published recently by the Federal Reserve Bank of St. Louis, Maria Hasenstab cites the international gold shortage during […]

Is The Fed Manipulating the Market?

“We cannot just look at the Fed’s target rate to determine whether it is manipulating the market. We must consider its target rate relative to the natural rate.” ~Bryan Cutsinger