Economy

Tumbling crude oil prices tripped up business investment.

Business investment fell 2.2 percent in the second quarter of 2016, the third quarterly decline in a row. On a year-over-year basis, it was down 1.3 percent in the second quarter. Its recent poor performance stands in stark contrast to generally strong consumer spending, which exceeded 4 percent for the quarter. Over the past seven quarters, business investment has dropped an average of 0.5 percent a quarter, while consumer spending has averaged 3 percent growth.

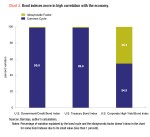

The causes of this divergence are continued gains in jobs and income for consumers versus collapsing energy and commodity prices that have arrested investment in the energy and mining industries. The mid-2014 tumble in crude oil prices resulted in plummeting investment in mining and extraction structures, down to just $50 billion in the second quarter of 2016 from $140 billion at an annual rate in the first quarter of 2015. Other equipment, including equipment related to mining and energy extraction, slid to $218 billion in the second quarter of 2016 from a peak of $265 billion in the third quarter of 2014.

Overall, business investment excluding mining structures and other equipment has slowed a bit, rising at a 3.3 percent pace over the past four quarters compared with gains in the 6-to-8- percent range over the past three years. Conversely, the combined mining structures and other equipment categories plunged 23.8 percent in the second quarter of 2016, its sixth consecutive quarterly drop (Chart 2).

For the second half of 2016, GDP growth may show some improvement. The sharp drops in mining structures and other equipment may have bottomed, and slowing declines would result in better GDP growth. Likewise, the sharp drop in inventories that weighed on second-quarter growth is unlikely to be sustained, leading to stronger GDP growth. Though consumer fundamentals remain solid, consumer spending is unlikely to continue growing at the 4 percent-plus pace.

Economic Outlook

The Leaders index of our Business-Cycle Conditions model registered a small decline for the second month in a row, falling to 42 percent in July from 46 in June and 50 in May. Overall, our Leaders have been in the 38-to-50 range for six consecutive months. A prolonged period of results ranging slightly below the neutral 50 mark is unusual but may be interpreted as consistent with a slow-growth economy.

Some of our consumer-related leading indicators, such as initial claims for unemployment insurance and real retail sales, are trending upward in the latest reading, supporting our view that the consumer continues to be the key to ongoing economic expansion.

The percentage of expanding coincident indicators was unchanged in the latest month at 75 percent. Our Coinciders index has held steady at 75 for six consecutive months and seven of the past eight. Among the Coinciders, labor market indicators, economy-wide sales, and personal income excluding transfers remain on upward trends, while consumer confidence in current economic conditions is stable and industrial production is trending lower. These results may be considered consistent with the Leaders index, suggesting slow, consumer-led growth in the economy and weakness in the business-investment sector. The proportion of lagging indicators that are expanding held at a perfect 100 percent reading in July (Chart 3).

Overall the Leaders index suggests that the U.S. is likely on a sustainable, moderate growth path. However, the outlook remains fragile and the risk of recession remains slightly elevated.

Click for interactive Indicators at a Glance (on mobile device turn to landscape)

Next/Previous Section:

1.Overview

2. Economy

3. Policy

4. Investing

5. Appendix