Pulling It All Together/Appendix

The Economy…

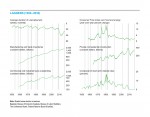

Our Leaders index rebounded to a neutral 50 percent in the latest reading, following two months at 38 percent. The rebound suggests the risk of recession has receded but remains slightly elevated.

We maintain our view that continued gains in the labor market are likely to provide a solid foundation for economic growth in coming quarters. In the second half of the year, four items to watch are: the Fed, the dollar, crude-oil prices, and corporate profits and profit margins.

…Inflation…

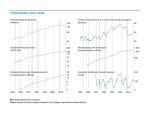

The AIER Inflationary Pressures Scorecard shows falling pressure for months ahead, with 10 indicators supporting rising pressure and 13 suggesting falling pressure. Consumer demand and supply and costs and productivity show nearly balanced effects on inflation. But rising interest rates and money creation slowed by monetary policy suggest falling inflationary pressure.

Despite the falling inflationary outlook, a rebound in energy and food prices in April took the Consumer Price Index to its highest monthly growth in over three years. Within the core CPI, prices of services continue to advance, while goods prices have stalled, mainly due to falling prices for apparel, household furnishings and supplies, and new vehicles.

…Policy…

The minutes of the April 27 Federal Open Market Committee meeting revealed a more upbeat tone and a more favorable evaluation of economic conditions by Fed officials. This created an expectation that the next interest rate increase could happen soon. The markets are pricing in a possible increase in June but see a September rate hike as much likelier. Whenever it comes, experience tells us that small and well-anticipated federal funds rate increases tend to produce correspondingly small changes, if any, in long-term interest rates and financial markets.

…Investing

Basic, fundamental economic forces suggest that interest rates in the U.S. are likely to rise in the months ahead. However, potentially offsetting forces could restrain yields increases. Rising crude-oil prices, if they continue, may lead to higher investment in the energy sector.

Basic, fundamental economic forces suggest that interest rates in the U.S. are likely to rise in the months ahead. However, potentially offsetting forces could restrain yields increases. Rising crude-oil prices, if they continue, may lead to higher investment in the energy sector.

U.S. equites are close to their all-time high, boosted by optimism about the outlook for earnings growth. Better topline growth prospects and the ability to manage and protect margins will be keys to sustaining price increases, both in the U.S. and abroad.

Next/Previous Section:

1.Overview

2. Economy

3. Inflation

4. Policy

5. Investing

6. Pulling It All Together/Appendix