Monetary Policy

|

Rethinking the Fed’s Framework: Lessons from the Post-Pandemic Inflation

The paper evaluates alternative frameworks and argues that the Fed should adopt either a nominal spending target or a symmetrical average inflation target.

|

How Currency Shapes Global Trade: Exchange Rates, Investment, and Stability

Free trade and free markets promote sound money, as countries compete for business and investment.

|

CBDCs Undermine Financial Privacy

“Financial privacy is very important for a free society. What we do reveals much more about who we are than what we say.” ~William J. Luther

|

Stay Put or Pay Up: Why Can’t Your Mortgage Move With You?

“Once ‘locked in,’ a comparatively low mortgage rate functions as an emotional and economic anchor.” ~Laura Williams

|

Inflation Remained Below Target in August

“More cuts are projected for 2025, but not enough to return the stance of monetary policy to neutral.” ~William J. Luther

|

Fed Rate Cuts: Better Late than Never

“A 50 basis point cut in its federal funds rate target on Wednesday marks a reversal at the Fed.” ~William J. Luther

|

Moderate Inflation Affirms Fed’s Path to Easing

“The Fed should ignore the political noise and follow the data. Central bankers failed to curb inflation, but that doesn’t mean they should deliberately make the opposite mistake now.” ~Alexander W. Salter

|

Inflation Slightly Below Target in July

“The federal funds rate target range is likely to be at least a full percentage point lower by the end of the year. That would significantly reduce the distance the Fed needs to travel in order to return monetary policy to neutral.” ~William J. Luther

|

The Federal Reserve and Pandora’s Box

“In the name of preventing a second Great Depression, then-Fed Chairman Ben Bernanke opened a Pandora’s Box of monetary ills in 2008. And like the Greek myth, there may be no way of putting these ills back in the box.” ~Paul Mueller

|

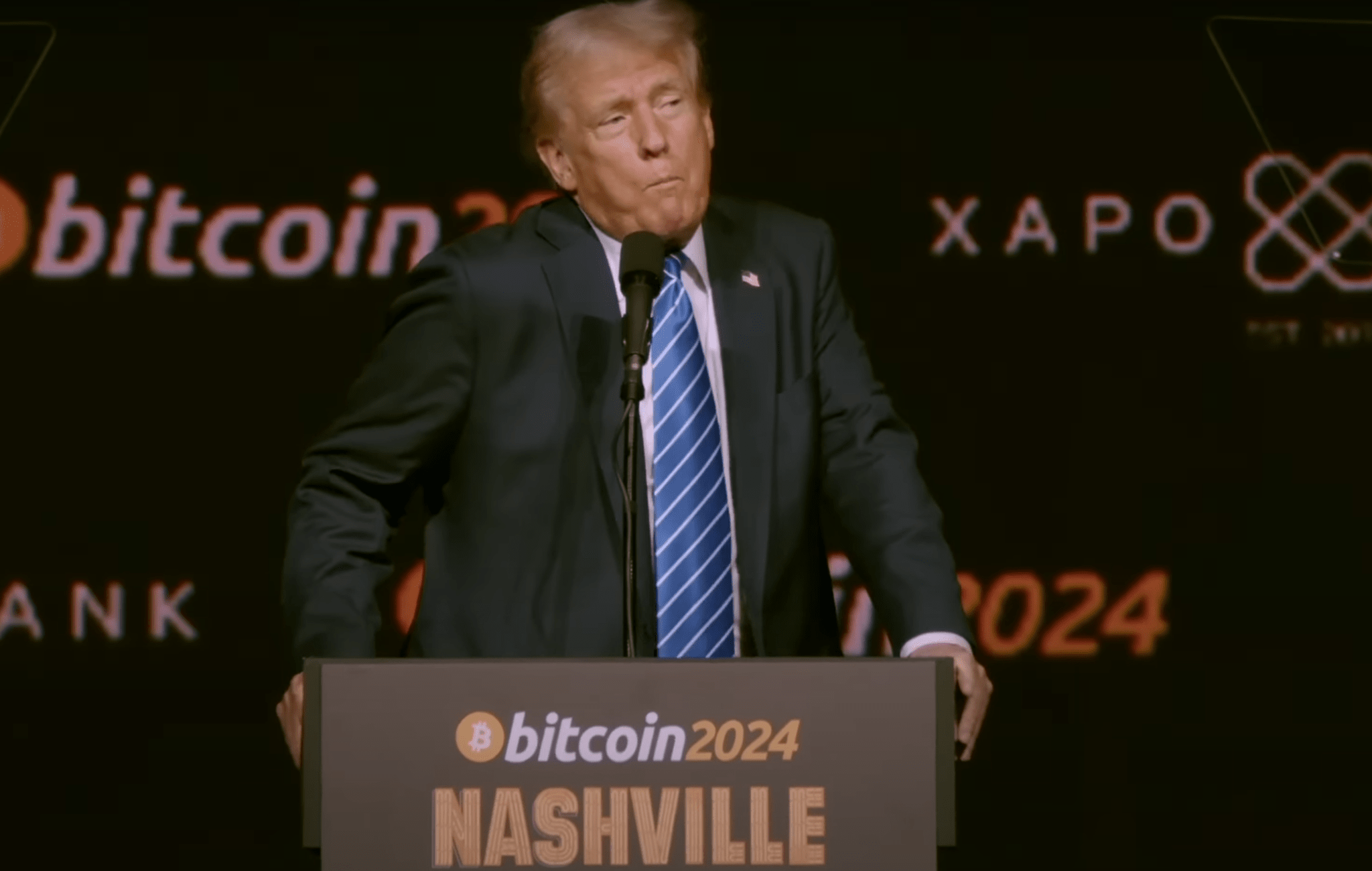

Should Taxpayers Fund a Strategic Bitcoin Reserve?

“Given that the reserve of gold can be viewed only as the federal government holding it for investment purposes, there is no particular reason to focus only on gold and not include other assets, including cryptoassets such as bitcoin.” ~Gerald P. Dwyer

|

There’s Nothing Conservative about Deficits and Debt

“Interest payments now suck up more of the federal budget, leaving less to spend on important political priorities. Since Republicans and Democrats disagree about what those priorities are, the resulting fiscal strain amplifies partisan divisions.” ~Alexander W. Salter

|

Should the Fed Get Credit for Lower Inflation?

“Labor market developments cannot explain the decline in nominal spending growth. Tighter monetary policy can… Given the lags of monetary policy, the Fed may have already undershot its target.” ~William J. Luther