Sound Money Project

The Sound Money Project was founded in January 2009 to conduct research and promote awareness about monetary stability and financial privacy. The project is comprised of leading academics and practitioners in money, banking, and macroeconomics.

It offers regular commentary and in-depth analysis on monetary policy, alternative monetary systems, financial markets regulation, cryptocurrencies, and the history of monetary and macroeconomic thought.

For the latest on sound money issues, subscribe to our working paper series and follow along on Twitter or Facebook.

Advisory Board: Steve H. Hanke, Jerry L. Jordan, Lawrence H. White

Director: William J. Luther

Senior Fellows: Nicolás Cachanosky, Gerald P. Dwyer, Joshua R. Hendrickson, Thomas L. Hogan, Gerald P. O’Driscoll, Jr., Alexander W. Salter

Fellows: J.P. Koning

|

CBDCs Undermine Financial Privacy

“Financial privacy is very important for a free society. What we do reveals much more about who we are than what we say.” ~William J. Luther

|

Inflation Remained Below Target in August

“More cuts are projected for 2025, but not enough to return the stance of monetary policy to neutral.” ~William J. Luther

|

Fed Rate Cuts: Better Late than Never

“A 50 basis point cut in its federal funds rate target on Wednesday marks a reversal at the Fed.” ~William J. Luther

|

Moderate Inflation Affirms Fed’s Path to Easing

“The Fed should ignore the political noise and follow the data. Central bankers failed to curb inflation, but that doesn’t mean they should deliberately make the opposite mistake now.” ~Alexander W. Salter

|

Tax Cryptocurrencies as Money, Not Property

“Treating cryptocurrencies like property for tax purposes discourages people from using them like monies.” ~Gerald Dwyer

|

Inflation Slightly Below Target in July

“The federal funds rate target range is likely to be at least a full percentage point lower by the end of the year. That would significantly reduce the distance the Fed needs to travel in order to return monetary policy to neutral.” ~William J. Luther

|

Moderate Inflation Returns in July

“To judge whether monetary policy is loose, it is not enough to show that monetary aggregates are growing at historically low rates. What matters is whether the money supply is growing faster than money demand.” ~Alexander W. Salter

|

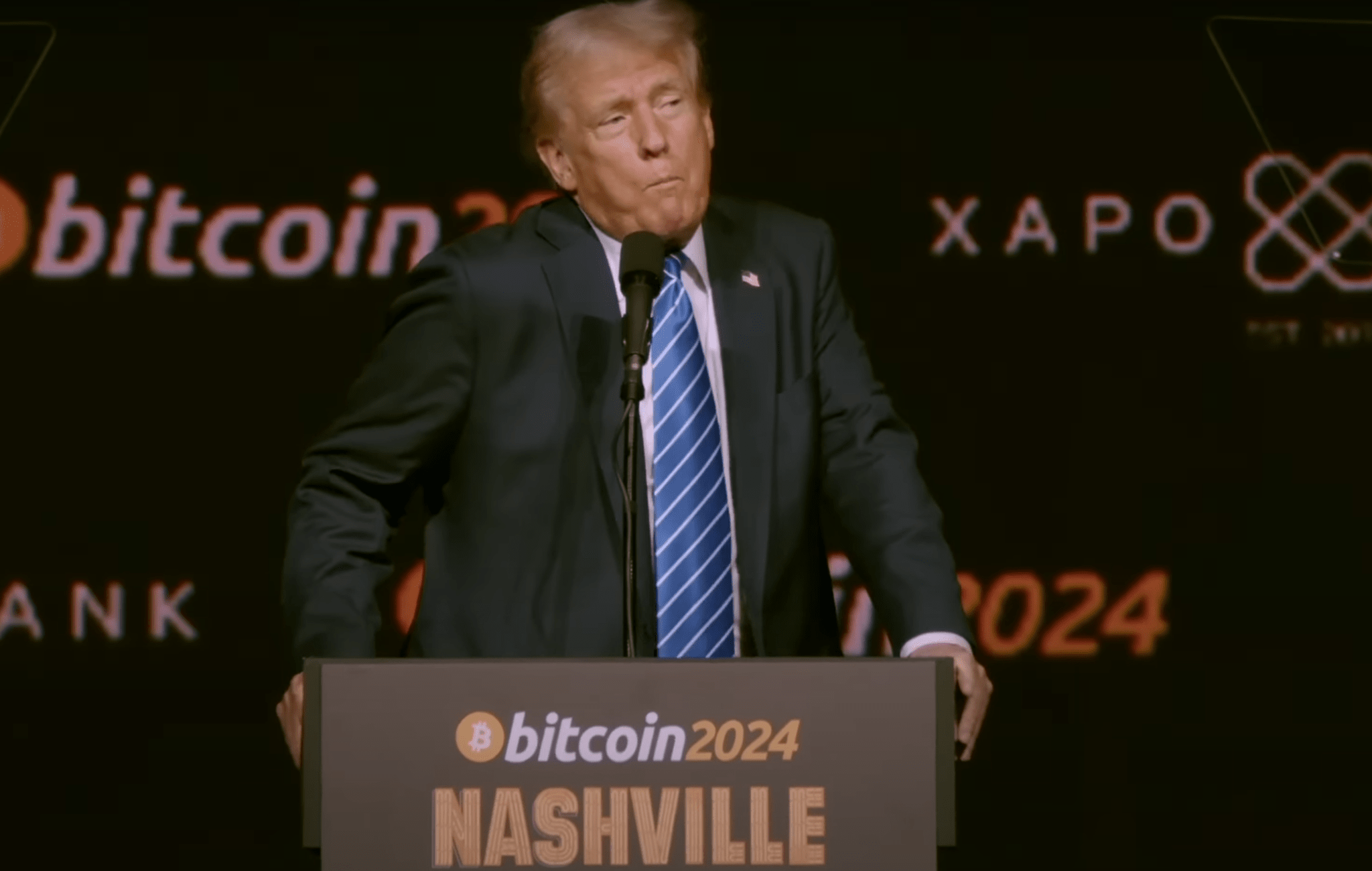

Should Taxpayers Fund a Strategic Bitcoin Reserve?

“Given that the reserve of gold can be viewed only as the federal government holding it for investment purposes, there is no particular reason to focus only on gold and not include other assets, including cryptoassets such as bitcoin.” ~Gerald P. Dwyer

|

Should the Fed Get Credit for Lower Inflation?

“Labor market developments cannot explain the decline in nominal spending growth. Tighter monetary policy can… Given the lags of monetary policy, the Fed may have already undershot its target.” ~William J. Luther

|

Inflation Remained Low in June

“Despite the progress made on inflation over the last three months, and the risk of overtightening noted by Waller and Powell, the FOMC is unlikely to cut its federal funds rate target next week.” ~William J. Luther

|

Beware of Conflict Theories of Inflation

“This perspective emphasizes that social conflicts are the central cause of inflationary pressures. The Marxist undertones of CTIs suggest that inflation results from social injustice, implying a moral imperative for government intervention to right the supposed wrongs.” ~Nicolás Cachanosky

|

Milei’s New Monetary Regime for Argentina

“Despite its controversial nature, full dollarization remains the monetary regime with the most potential for long-term stability in Argentina. It offers a credible pathway to restore confidence and put the country back on a sustainable economic trajectory.” ~Nicolás Cachanosky