Here is an interesting article about the effect of inflation on your pain at the pump. The linked article by Mark Brandly, professor of economics at Ferris State University and an adjunct scholar of the Ludwig von Mises Institute, shows the effects of the Federal Reserve’s monetary expansion on domestic gas prices. With gas now over $4 a gallon on average, it’s worth noting that it’s not necessarily only the oil companies that are posting record profits (though at least they have to compete for those extra dollars…); the counterfeiters at the Fed are doing quite nicely as well. As Brandly points out:

“If the dollar had held steady relative to the euro at the exchange rate of 1.18 euros per dollar, then the US spot price for oil at the end of March would have been $62.42 per barrel.

Consider the impact that this has had on gasoline prices. To make the calculations easy, let’s say that the current price of gasoline is $4 per gallon. Oil costs are 68 percent of the price of gasoline. That means that oil costs make up $2.72 of the $4 gasoline price. The dollar’s depreciation relative to the euro in the last decade was 40 percent; and 40 percent of $2.72 is $1.09.

Therefore, if the dollar had held steady with the euro, we would be paying roughly $2.91 for a gallon of gasoline that now costs us $4. Gasoline prices would be 27 percent lower today if the dollar had held its value relative to the euro over the last decade.”

Think about it. If the Fed could “print” oil, then is there any argument that the price of oil would go down? Of course not; this is not even debatable. If the Fed could create oil “out of thin air,” then it could conceivable create enough to reduce the price of oil on the market all the way down to zero. But then imagine if you had barrels of oil and you wanted to trade them for, say, food or rent. You would be able to trade them for less food and rent. This is what people understand about commodities on the market instinctively, because everyone buys and sells commodities everyday.

People don’t, however, buy and sell dollars. Or do they? In fact, any time you buy groceries, you’ve sold dollars. And any time you’ve worked for a paycheck, you’ve bought dollars. It is actually this simple. What is obvious about, say, the impact on the price of oil of “magically” creating virtually unlimited amounts of new oil goes the same for the value of money. In fact, to avoid confusion, let’s call it the “price” of money. The price of money is what you have to give in return for it, or what you get in return. This is money’s “purchasing power”, and that is the true measure of its value, not the nominal amount marked next to some dead president’s head.

Where is all of this lost purchasing power going? Well, unless you’ve been getting fresh $100 bills mailed to you in proportion to what has been “created,” it’s been taken from you and given to those who do get them i.e. the government, their cronies, and the banks.

Theodore Phalan is an economics student at George Mason University and a previous Sound Money essay contest winner.

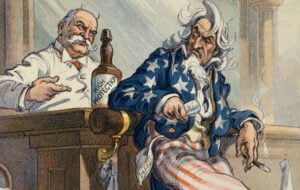

Image by gruar razvan ionut / FreeDigitalPhotos.net.