In an earlier post, I discussed the monetary offset—the idea that, so long as the central bank is hitting its inflation target (or, ideally, maintaining a steady flow of nominal spending), fiscal policy is either ineffective or unnecessary. More recently, President Trump has proposed a 25 percent tariff on steel and a 10 percent tariff on aluminum. When considering the effects of such proposals, we must keep the monetary offset in mind.

A nation’s trade policy is often viewed as a component of its fiscal policy. Politicians often rationalize tariffs and other trade interventions by claiming that they will help boost exports and reduce our trade deficit. Since net exports are a core component of GDP, any policy that reduces the trade deficit should, other things equal, serve to boost economic growth.

Of course, not all things can be held equal. One of the greatest insights of international-trade theory dating back to Adam Smith and David Ricardo is that free trade—which can sometimes lead to larger trade deficits—increases economic growth. The law of comparative advantage says that nations are made wealthier when they specialize in producing items they can produce at a lower cost and trade them for items they are less efficient at producing. This more efficient allocation of world production increases output and lowers prices, and in doing so makes consumers everywhere better off. These benefits of trade might not be readily apparent if we restrict our focus to crude macroeconomic aggregates like nominal GDP — after all, trade primarily makes us wealthier not by raising total nominal spending but by making more real output available at lower prices.

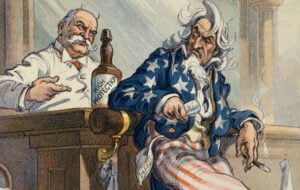

But even if we restrict our focus to crude aggregates like nominal GDP and inflation, the lesson of the monetary offset should disabuse anyone of the myth that we can boost spending by restricting trade.

The logic is largely the same as we saw in my previous post on the monetary offset. If the Fed targets inflation, the inevitable rise in prices that would be sparked by a trade war would trigger it to contract the money supply, sending aggregate demand on a downward spiral. (The crippling effect of the Fed’s response to this negative supply shock is precisely why the Fed shouldn’t focus solely on inflation.) And if the Fed targets nominal GDP, any alleged boost to total spending would be effectively offset by contractionary monetary policy. Real GDP would decline, and inflation would rise.

Even Paul Krugman, who has rarely seen a fiscal stimulus he doesn’t like, recognizes that restricting trade as a way of raising aggregate demand is a fool’s errand.

“What would happen instead,” Krugman writes, “is that the Fed would raise rates sharply to head off inflationary pressures (especially because a 20 percent tariff would directly raise prices by something like 3 percent.). The rise in interest rates would have two big effects. First, it would squeeze interest-sensitive sectors. Second, it would drive up the dollar, inflicting severe harm on U.S. export sectors.”

No matter how you slice it, trade wars are a foolish and negative-sum endeavor. When economists across the ideological spectrum are so strongly united against something, policy makers should take note — though, admittedly, economic consensus is no guarantee of good policy. Unfortunately, policy decisions are mostly made based not on what is economically sound but on what is politically expedient. But economists still can and should fight the good fight against bad trade policies.