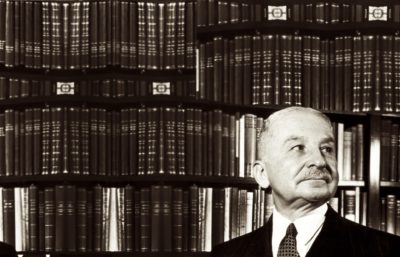

Had he not passed away at the tender age of 92 in 1973, Ludwig von Mises would have turned 131 years old today. In my humble opinion, he was the greatest social thinker of the twentieth century. In a series of breakthrough contributions like The Theory of Money and Credit, Socialism: An Economic And Sociological Analysis, Human Action (his magnum opus), and Theory and History–to say nothing of a series of smaller and no-less-insightful works like Bureaucracy and Omnipotent Government–Mises developed theories of economic growth and business cycles that are relevant today. One of the wonders of the modern world is that his major contributions are available to be perused or downloaded from the institute bearing his name or from the Liberty Fund. Today, anyone with access to an internet connection can access his works with little or no trouble. Anyone with a USB drive can carry his greatest works on a keychain.

The progress that made this possible wasn’t an accident, and it wasn’t random. Indeed, this brings us to Mises’s greatest contribution: his demonstration that socialism cannot function as a rational economic system and that private ownership of the means of production is necessary if value is going to be maximized and waste is going to be minimized in the production process.

Mises started–and in my humble opinion, ended–the debate over whether an economic system based on common or social ownership of the means of production could function with his essay “Economic Calculation in the Socialist Commonwealth.” He demonstrated that it was impossible to know whether a particular production process was wise (resource-optimizing) or unwise (resource-wasting) in the absence of prices for the means of production. His socialist critics accepted this, and Oskar Lange suggested that a statue of Mises be given a place of honor by the socialist Central Planning Board (here is Murray Rothbard with more).

Mises carried his argument step further, though: he argued that these prices cannot emerge without exchange, and exchange in turn cannot happen without private ownership of the means of production. Many economists laud the market for its efficiency properties as free markets generally direct resources to their highest-valued ends while minimizing costs of production. In the Misesian tradition, however, the market plays a much more essential role. It is not merely one of a number of possible allocative mechanisms. Exchange in a free market is an information- and knowledge-generating process. To adapt the title of one of Hayek’s essays, competition in the free market is “a discovery procedure.” This emphasis on the coordinating and knowledge-generating properties of exchange in a free market with secure private property rights is one of the distinctive features of the modern Misesian tradition, which is discussed in a three-part series by my occasional co-author Steven Horwitz (1, 2, 3).

Mises’s arguments, and the arguments of those who have followed him, do not merely undermine arguments for pure, global socialism. They also undermine arguments for interventionism more generally. Economists take a lot of heat for focusing on market exchange and material prosperity, and it is fashionable in some circles to say that “there is more to life than economic efficiency” as if that decides an argument in favor of intervention. Not so: people respond to incentives, even when you don’t want them to, and the knowledge-destroying and incentive-distorting effects of interventionism all too often bring with them unintended consequences that not only reduce economic efficiency but also harm precisely the intended beneficiaries of the intervention.

It is for this reason that I urge my students to consider the consequences of different interventionist schemes–to count the cost, as it were. In his introduction to the new edition of Socialism from Laissez-Faire Books, Peter J. Boettke makes an important point:

“Critics of economics say that economists know the price of everything but the value of nothing. Nothing, perhaps, is so dangerous intellectually in the policy sciences as an economist who knows only economics, except, I would add, a moral philosopher who knows no economics at all.” Ludwig von Mises can no longer teach us economics in person. His astounding intellectual contributions live on, though, in his writings and in the passion for truth that shines through almost every word. Unfortunately, the people who most need to read Mises probably won’t. In this light, I can close with nothing better than the sober warning Mises offers in the last few sentences of Human Action: “The body of economic knowledge is an essential element in the structure of human civilization; it is the foundation upon which modern industrialism and all the moral, intellectual, technological, and therapeutical achievements of the last centuries have been built. It rests with men whether they will make the proper use of the rich treasure with which this knowledge provides them or whether they will leave it unused. But if they fail to take the best advantage of it and disregard its teachings and warnings, they will not annul economics; they will stamp out society and the human race.” *-Disclosures: I have done (and will do) contract work for the Mises Institute, Laissez-Faire Books, Liberty Fund, and the Foundation for Economic Education, but not in conjunction with this article. I’m grateful to Michael Goldstein for the reminder that today is Mises’s birthday.