Sound Money Project

The Sound Money Project was founded in January 2009 to conduct research and promote awareness about monetary stability and financial privacy. The project is comprised of leading academics and practitioners in money, banking, and macroeconomics.It offers regular commentary and in-depth analysis on monetary policy, alternative monetary systems, financial markets regulation, cryptocurrencies, and the history of monetary and macroeconomic thought.

For the latest on sound money issues, subscribe to our working paper series and follow along on Twitter or Facebook.

Advisory Board: Steve H. Hanke, Jerry L. Jordan, Lawrence H. White

Director: William J. Luther

Senior Fellows: Nicolás Cachanosky, Gerald P. Dwyer, Joshua R. Hendrickson, Thomas L. Hogan, Gerald P. O’Driscoll, Jr., Alexander W. Salter

Fellows: J.P. Koning

Against Central Bank Independence

President Trump’s return to the White House has sparked a resurgence of interest in central bank independence. Federal Reserve Governor Michael Barr said he would step down from his Vice […]

To Whip Inflation, Trump Needs The Courage To Be Unpopular

How much longer will high inflation plague the US economy? Both the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCEPI) have grown faster than 2 percent […]

Forecasts Stable: The Fed Should Take a Breather

Prices still pinch: The Bureau of Labor Statistics announced the Consumer Price Index (CPI) rose 0.4 percent in December and 2.9 percent over the past year. The major cause was […]

What Happened at the 2024 AIER Monetary Conference: Building a Better Fed Framework?

In December, AIER held its inaugural monetary conference, Building a Better Fed Framework, at The George Washington University in Washington, DC. As the Federal Reserve embarks upon its monetary policy […]

The FOMC Should Hold Rates Steady

Another disinflationary hiccup: The Bureau of Labor Statistics (BLS) announced the Consumer Price Index (CPI) rose 0.3 percent in November and 2.7 percent over the last year. Year-over-year prices grew […]

WSJ’s Prof. Blinder Misses Again on Inflation Analysis

Writing in the Wall Street Journal, Alan Blinder argues that President-Elect Donald Trump’s economic agenda will spark inflation. “Almost every economist will tell you — as many did before Nov. […]

Is Inflation in 2024 Fueled by Supply or Demand?

Inflation picked up in October, but remains more or less on track. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at […]

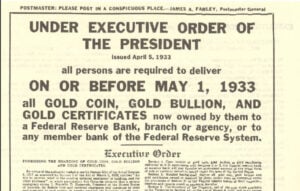

The Fed’s Gold Standard Confusion

Why did the United States abandon the gold standard? In an article published recently by the Federal Reserve Bank of St. Louis, Maria Hasenstab cites the international gold shortage during […]

Don’t Dread Dwindling Disinflation

Inflation ticked up in October. The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) rose 0.2 percent last month. Prices are up 2.6 percent over the last […]

Trump the Inflationist? Probably Not

At the New York Times, Jeanna Smialek reports that economists are worried President-Elect Trump will stoke inflation. Voters returned Trump to office largely because of the economy, especially the high […]