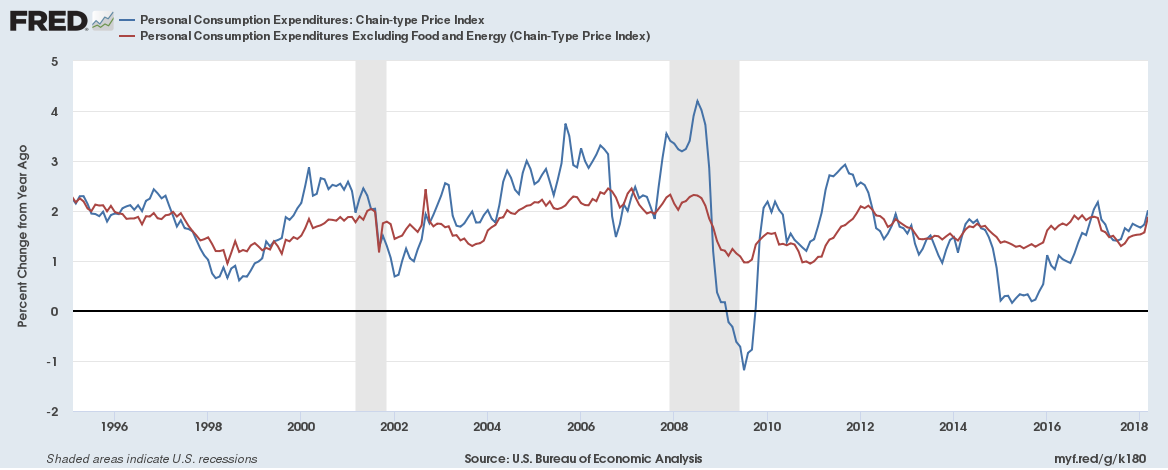

Many economists agree that the monetary authority should focus narrowly on inflation. However, these same economists typically prefer core measures of inflation, which exclude food and energy prices, to headline measures of inflation, which include food and energy prices. If the central bank should keep inflation in check, what sense does it make to ignore changes in food and energy prices?

The standard argument for focusing on core inflation has two components. First, it holds that stable headline inflation is a medium- to long-term policy objective. The monetary authority need not hit its headline inflation target perfectly each period. So long as its errors tend to cancel out, it will create a long-term nominal anchor and thereby facilitate long-term contracting.

Second, it acknowledges that food and energy prices are especially volatile. An increase in the price of wheat or gasoline this quarter is likely to be offset by a decrease in its price next quarter. Given that stable headline inflation is a medium- to long-term policy objective, the monetary authority need not respond to these transitory swings in prices.

I find the standard argument for core inflation targeting unsatisfying. It is not so much that I think the view is misguided (though I offer what I think is a superior target below). Rather, I think the argument is poorly articulated. It requires one to say that headline inflation matters, but not in the short run. And it seems to rest on naïve empiricism.

There is a better argument for targeting core inflation. It also has two components. First, it holds that the monetary authority should respond to nominal shocks and ignore real shocks. It should accommodate changes in money demand to prevent unnecessary periods of over- or underproduction. But it cannot improve matters in the face of genuine changes in productivity, so it should not even try.

Second, it acknowledges that food and energy prices are largely driven by real shocks. When the price of wheat increases relative to other prices, it is most likely because weather or other production issues have rendered wheat more scarce than was anticipated. When the price of gasoline falls relative to other prices, it is most likely because more oil or natural gas was recovered and refined than had been expected. These are relative price changes. They are the result of real shocks. In response to a real shock, the monetary authority cannot improve matters.

Of course, if one accepts this argument for targeting core inflation, one might go one step further and conclude we should dispense with inflation targeting altogether. A nominal income target would also provide a long-term nominal anchor. Changes in productivity growth would affect inflation in the short run. But to the extent that such shocks are transitory, a nominal income target would tend to achieve stable headline inflation over the medium to long term. More importantly, strict adherence to a nominal income target would prevent the monetary authority from responding to any real shock, not just those affecting food or energy markets, while requiring the monetary authority to respond to any changes in food and energy prices that result from nominal shocks.

There are good reasons for favoring core inflation targeting to headline inflation targeting. But the case for nominal income targeting is even stronger.