When financial-markets commentators discuss monetary policy, they are typically considering whether (or how likely it is that) the Federal Open Market Committee (FOMC) will raise or lower or maintain the federal funds rate (FFR). In doing so, they employ a sort of verbal shorthand. As regular readers here are no doubt already aware, the FOMC does not, in fact, set the FFR. The FFR is a range of rates private financial institutions agree to in the process of borrowing and lending balances held at the Fed (i.e., federal funds). The Fed is not a party in these transactions and, hence, does not set the rate. Rather, the Fed sets an FFR target and then uses its policy tools to influence the FFR — that is, to push the FFR in the direction of the target rate.

How does the Fed influence the federal funds rate? The Fed has a lot of policy tools, to be sure. But, traditionally — that is, when the Fed was operating in a corridor system — it exerted influence on the FFR primarily through its open-market operations. A corridor system prevails when the FFR falls below the rate the Fed charges banks to borrow (i.e., the discount rate) and above the rate the Fed pays banks for holding reserves at the Fed. We are not in a corridor system today. We are in a floor system. However, it is useful to consider how the Fed has traditionally conducted monetary policy before turning to its more recent approach, which I will do in a subsequent article.

The Federal Funds Market

For starters, recognize that each bank wants to hold the optimal amount of federal funds. If it holds too few federal funds, it might not be able to honor its obligations to other banks (e.g., when they show up with checks written by its customers) or might fall below the legal amount of reserves it is required to hold. If it holds too many federal funds, it will earn less interest on its assets than it otherwise would. Hence, each bank is trying to hold the optimal amount of reserves, given its unique position and the opportunity cost of holding reserves.

The optimization problem each bank faces is made more complicated by randomness. Depositors do not call ahead to notify their bank when they plan to write a check or swipe their debit card. Of course, banks are used to this. They have a good idea how much will be debited and credited on a typical day. But, on any given day, a bank might receive more (fewer) debits or fewer (more) credits than is typical. And, as a consequence, it will be left holding more (fewer) federal funds than is optimal. Fortunately, for the bank holding too many federal funds, there are other banks in the system with exactly the opposite problem: they are holding too few federal funds. So there is an opportunity for a bank flush with federal funds to lend some of those funds to another bank.

Whereas the total demand for federal funds is determined by the private banking system, the total supply of federal funds is determined by the Fed. The Fed creates federal funds — that is, balances banks hold at the Fed — when it purchases assets or makes loans to these banks. At any given point in time, the supply of federal funds is fixed. The Fed can increase the supply of federal funds by purchasing assets with newly created balances. It can decrease the supply of federal funds by selling assets and destroying the federal funds it receives. Buying and selling assets in this manner is referred to as open-market operations.

The Federal Funds Rate

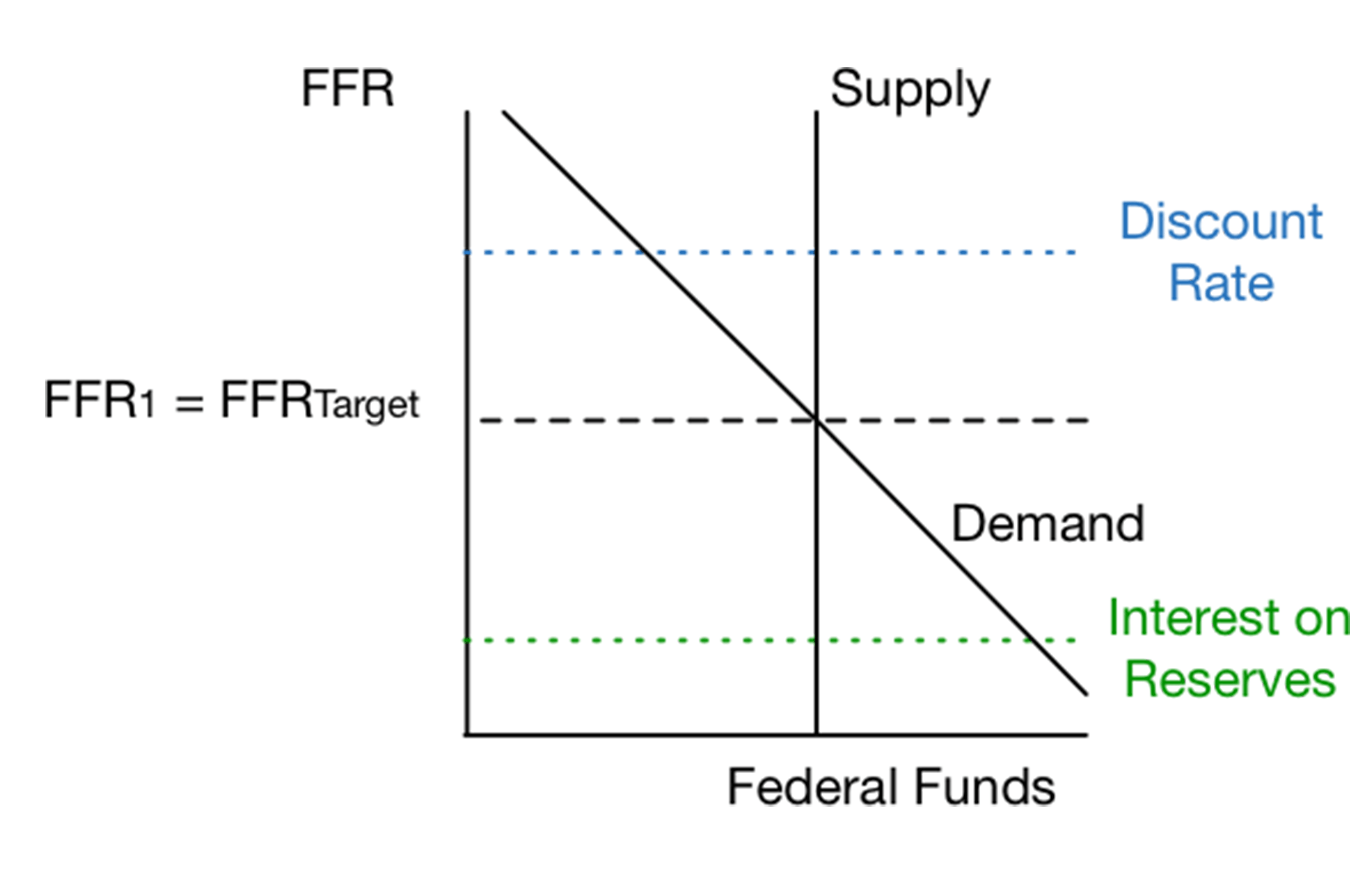

Although the federal funds rate is, in fact, a range of rates private financial institutions agree to in the process of borrowing and lending balances held at the Fed, the Fed can influence the rates being charged by making federal funds more or less scarce through its open-market operations. The following figures illustrate.

Figure 1.

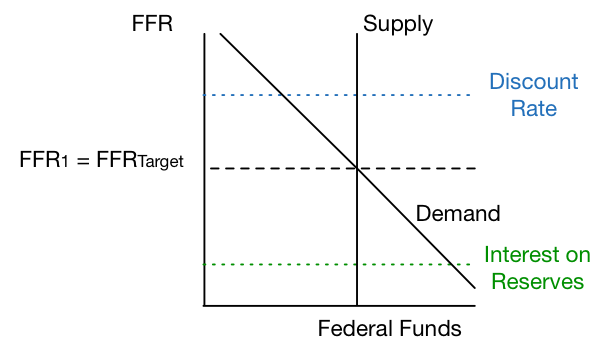

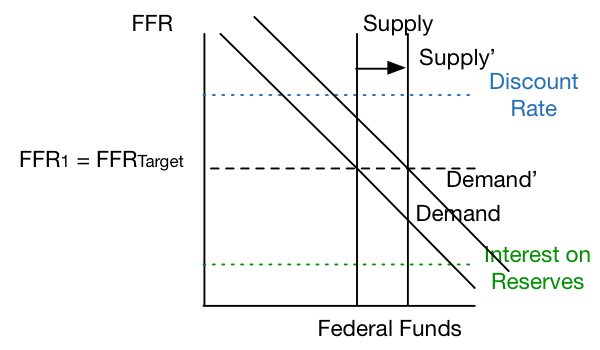

We start with the case in which the Fed is hitting its target (FFRTarget), as in figure 1. Suppose then that demand for federal funds increases to Demand′, as in figure 2. Now the prevailing federal funds rate (FFR1) is greater than FFRTarget.

Figure 2.

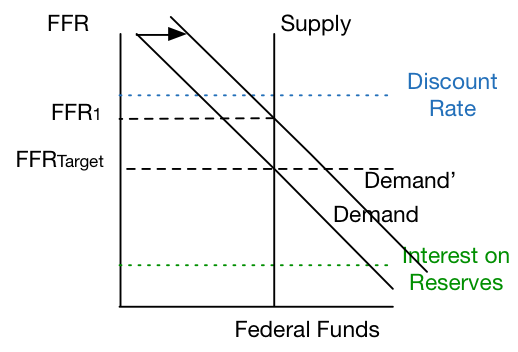

In this case, the Fed would need to buy assets with newly created federal funds, thereby increasing the supply to Supply′, as in figure 3, in order to hit its target.

Figure 3.

Notice that, in these three figures, I have assumed the Fed is operating in a corridor system. The FFR is between the discount rate and the interest the Fed pays on reserves. In my next article, I will explain how Fed policy differs when the FFR is at or below the interest rate paid on reserves.